Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 50-500

Leverage

- 500:1

Regulation

- CySec

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Just2Trade Broker Review

Just2Trade is a well-established international broker that serves clients in more than 130 countries. The company provides a variety of tradable assets, including forex, stocks, futures, options, and bonds. The broker is headquartered in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Just2Trade offers access to a variety of trading platforms, including MetaTrader 4 and 5, CQG, ROX Premium, and Sterling Pro. Their website provides information about the broker's services and terms. This review will look at the unique features and expectations for traders using Just2Trade.

Just2Trade Pros and Cons

Pros

- Low minimum deposit

- Regulated in the European Union

- Established and reputable broker with a proven track record in offering brokerage services since 2016

- Wide range of financial instruments available to trade

- Tight spreads and low commissions

- Fast and straightforward account opening

Cons

- Not available to residents of the U.S, UK, and Canada

Broker Regulation

Lime Trading (CY) Ltd. operates under the brand 'Just2Trade'. The Cyprus Securities and Exchange Commission (CySEC) regulates the broker (license number 281/15). Just2Trade follows the European Securities and Markets Authority's (ESMA) regulatory framework and participates in the Investor Compensation Fund. These regulatory associations provide monitoring and potential protection for traders' funds.

Just2Trade Account Types

Just2Trade's account structure differs from that of other online brokers. They do not use a tiered structure in which account advantages increase with more deposits. Instead, their three account kinds (Standard, Forex ECN, and MetaTrader 5 Global) are distinguished by the markets and assets to which they provide access. Details about these account types are provided below:

Standard Account

- Minimum deposit: $100

- Spreads: Beginning at 0.5 pips

- Commission: None

- Negative Balance Protection: Yes

- Best for Beginners

Forex ECN Account

- Minimum deposit: $200

- Spreads: Beginning at 0 pips

- Commission: $3 per lot

- Negative Balance Protection: No

- Best for Intermediate traders

MetaTrader 5 Global Account

- Minimum deposit: $100

- Spreads: Beginning at 0 pips

- Commission: $2 per lot

- Negative Balance Protection: Yes

- Access all assets (forex, stocks, futures, bonds, options, commodities)

- Access to the U.S. listed stocks and IPOs

- Best for Experienced traders

All Just2Trade account categories let traders choose their preferred leverage (up to 1:500, subject to professional trader recognition) and provide access to trading in currencies, precious metals, oil, and stocks.

Just2Trade offers a forex demo account that allows new traders to experiment and become familiar with the currency market in a risk-free environment. Using a demo account might assist users understand the broker's trading circumstances before committing real funds.

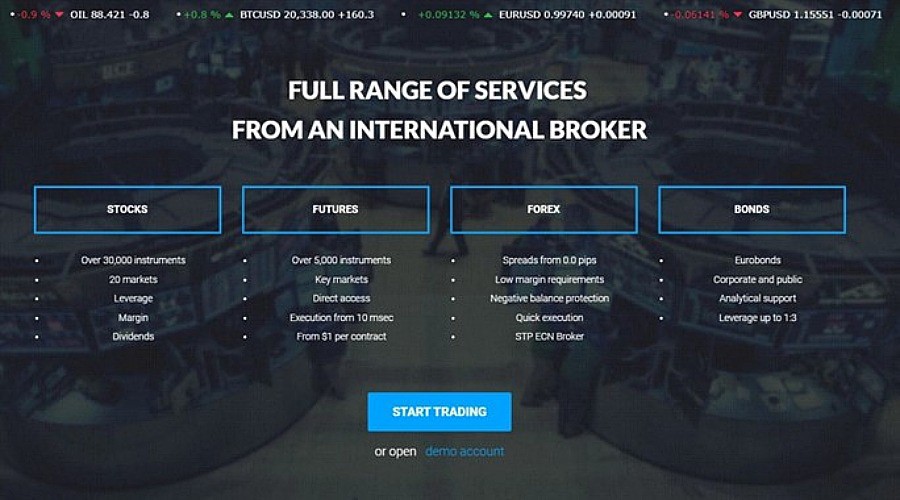

Just2Trade Assets Offered

Just2Trade offers a diverse range of assets, such as currency, bonds, stocks, and futures. They offer access to over 30,000 stock assets and over 90,000 option assets.

It's worth noting that the MT5 account provides full access to all assets. The Standard and currency ECN accounts primarily provide CFDs for currency, precious metals, and stocks/indices/energies.

These are the major asset classes available:

- Forex - over 60 pairs, with all the major pairs, many minor pairs, and even some exotic pairs

- Shares – More than 30,000 including most of the largest global companies such as Apple, Tesla, and JPMorgan

- Futures – a variety of indices, currencies, precious metals, energy, and several agricultural commodities

- Options – Over 90,000 instruments are offered

- Bonds – Eurobonds, along with corporate and other public issues

Just2Trade Trading Platforms

Just2Trade offers a larger selection of trading platforms than many other online brokers. Their six platforms include the widely used MetaTrader 4 and MetaTrader 5. They also offer the CQG Trading Platform, ROX Premium, Sterling Trader Pro, and the Lightspeed Trader platform.

MetaTrader 4

MetaTrader 4 is a well-known platform with a long history. It was released in 2005 and quickly became popular among traders for market analysis and strategy development. MetaTrader 4, which focuses mostly on forex trading, is compatible with Just2Trade's Standard, Forex ECN, and Forex ECN Pro accounts. It is available in the desktop, smartphone, and web app formats.

MetaTrader 5

MetaTrader 5 is the successor to the MetaTrader 4 platform, allowing traders to trade CFDs, stocks, and other assets in addition to forex. It remains popular and is widely available through online brokers. Just2Trade offers MT5 through its MT5 Global account, available in desktop, smartphone, and web app versions.

CQG Trading Platform

CQG Trading Platform has been in operation for more than 35 years. It gives traders access to more than 40 global exchanges and the assets that are traded on them. Clients of Just2Trade mostly use CQG to trade options and futures. While the base desktop version of the CQG platform is free, additional features or upgrades may incur charges. To use the CQG platform, Just2Trade requires at least a $3,000 account balance.

ROX Premium

ROX Premium gives users access to US stock markets, options (including IPOs), and key exchanges in the US, Canada, Mexico, and Europe. Direct market access to the NYSE, NASDAQ, and CBOE are available. It is vital to understand that ROX Premium requires monthly data payments.

Sterling Trader® Pro

Sterling Trader® Pro is a platform specifically intended for professional traders and proprietary trading organizations. It provides features that prioritize performance and functionality for navigating competitive markets. It is widely utilized in the industry and offers access to over 50 execution routes and venues, including DMA, dark liquidity providers, market makers, floor brokers, and smart routes.

Lightspeed Trader

Lightspeed Trader is a platform designed for professional traders who prioritize reliable market data, extremely low latency, and high performance.

Just2Trade Customer Service

Just2Trade offers customer service with 24/7 availability. They provide contact options including online chat, email, and telephone.

- Phone: +357 25 055 966

- Email: 24_support@just2trade.online

Just2Trade Review in Conclusion

Just2Trade is a long-standing international broker that offers a wide range of assets and trading platforms. CySEC regulation and participation in the Investor Compensation Fund instill a substantial level of confidence regarding safeguarding client assets. Account options appeal to a wide range of experience levels and market access. Just2Trade offers low fees, and their 24/7 customer support may appeal to traders who require assistance outside of usual business hours.

Overall, Just2Trade is an appealing choice for traders looking for a reputable broker with a diverse asset range and several platform options.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.