Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 50-500

Leverage

- 100:1

- 500:1

- 30:1

- 200:1

- 1000:1

- 400:1

- 300:1

- 20:1

Regulation

- FSCA

- FSC

- ASIC

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

VT Markets Review 2025: Fees, Platforms, and Account Types Explained

| Regulation and License | ASIC, FSCA, FSC |

| HQ | Sydney, Australia |

| Founding year | 2015 |

| Leverage range | Up to 1:1000 (varies based on client equity and location) |

| Min deposit | $100 for both Standard and Raw ECN accounts |

| Platforms | MetaTrader 5, MetaTrader 4, WebTrader, VT Markets App |

| Tradable Instruments | Forex, Indices, Energy, Precious metals, Soft commodities, ETFs, Share CFDs and Bond CFDs |

| Demo account | Yes |

| Base Currencies | USD, AUD, GBP, CAD, and EUR |

| Customer support | 24/7 multilingual support |

| Website | https://www.vtmarkets.net/ |

VT Markets Review Introduction

VT Markets, established in 2015, is a globally authorized broker that offers traders access to a diverse portfolio of financial assets, including forex, indices, energy, precious metals, soft commodities, and ETF-based CFDs. The broker provides affordable prices and a choice of account options to accommodate a wide range of trading needs.

The broker provides the popular MetaTrader 4/5 platforms, demo accounts with various base currencies for trial trading, and 24-hour multilingual customer support.

In this review, we will take a look at the products and services offered by VT Markets to help traders choose whether the broker meets their specific needs.

Broker safety details

VT Markets operates under the regulatory oversight of numerous recognized agencies, which increases trust in their services:

Australian Securities and Investments Commission (ASIC): Australia's regulator, ASIC, enforces stringent financial standards while prioritizing consumer protection. (AFS No. 516246)

Financial Sector Conduct Authority of South Africa (FSCA): The FSCA oversees the South African financial industry, protecting clients and ensuring fair practices. (FSCA No. 50865)

Mauritius Financial Services Commission (FSC): The Financial Services Commission (FSC) oversees Mauritius' non-bank financial services sector and foreign business. (FSC License No. GB23202269)

VT Markets' adherence to these guidelines demonstrates its commitment to customer fund protection and secure trading practices. Their multi-jurisdictional oversight adds security for traders.

Furthermore, customer assets are kept in separate accounts at top-tier institutions, KYC (Know Your Customer) requirements enhance security, and sensitive data is secured with SSL. The broker also offers negative balance protection (NBL), which protects traders from unexpected market volatility.

Fees details

VT Markets does not charge clients for deposits. Traders should be aware that their financial institutions (banks, etc.) may charge fees for foreign wire transfers or other payment methods. Withdrawal fees vary depending on the method used and should be confirmed with VT Markets for the most up-to-date data.

Withdrawals may incur fees depending on the method:

| Fees Type | VT Markets |

| Fasapay | 0.5% Handling Fee |

| Skrill | 1% Handling Fee |

| Neteller | 2% Handling Fee |

| Minimum Withdrawal | $40 |

VT Markets does not charge clients any inactivity or maintenance fees. Traders should be informed that raw ECN accounts have a commission of $6 per standard lot (round turn).

Deposit and withdrawal options

VT Markets supports a variety of convenient deposit and withdrawal methods, including:

Unionpay transfer

Mobile Pay

Skrill, Neteller, Fasapay

Instant bank transfers (for clients in Vietnam, UK, and Thailand)

USDT

Credit/Debit card

To ensure security, the broker uses strong anti-fraud measures and Know Your Customer (KYC) verification. This is a one-time verification process required prior to trading.

Most deposits are processed quickly, however internationally bank transfers can take 3-7 business days. Withdrawals are processed in the same way as deposits, with a minimum of $40. It is important to note that certain methods may incur expenses. Withdrawals are usually processed instantly, although they can take 3-7 business days to reach a client's account.

Available tradable markets

VT Markets offers traders a wide selection of tradable markets to choose from. FX, indices, energy, precious metals, soft commodities, ETF Share CFDs and Bond CFDs. Traders can have access to a wide range of markets and benefit from the broker's competitive spreads and commission rates. Let's take a look at all of the tradable markets offered by this broker:

Forex

VT Markets provides a diverse selection of over 40 forex pairs, including majors, minors and exotics. Traders can take advantage of razor-thin spreads starting as 0.0 pips on the ECN account.

Those wishing to maximize their market exposure can take advantage of customizable leverage options of up to 1:1000 (client equity and location dependent). Popular currency pairs include EUR/USD, USD/JPY, GBP/USD, and AUD/USD, allowing individuals to profit from a wide range of market conditions.

Indices

VT Markets provides access to over 15 major global indices, including popular choices such as the S&P 500 and FTSE 100. Traders can benefit from competitive spreads that begin as 0.0 pips on specific indices, as well as a $1 commission per lot. This, combined with a transparent trading environment, makes this broker perfect for index traders seeking to profit from larger market movements.

Energy trading

VT Markets employs CFDs to facilitate energy trading in oil and natural gas. Traders benefit from competitive features like spreads starting at 0.05 pips, accessible commissions, and leverage ratios of fix 1:1500 on Oil spot and futures. This gives opportunities to benefit from price volatility in the energy markets.

Precious metals

VT Markets offers traders access to a wide range of precious metals, including gold, silver, platinum, palladium, and copper. They can also trade certain exotic metals against various currencies. Traders earn from spreads as low as 1 pip and leverage of up to 1:1000 (for Gold dependents on client equity and location).

Soft commodities

VT Markets allows traders to speculate on agricultural markets like cocoa, coffee, cotton, orange juice, and raw sugar. These soft commodities offer competitive leverage of up to 1:20, allowing traders to potentially profit from price fluctuations in global commodity markets. Additionally, To add to the transparency of costs, VT Markets charges a commission of 2 per standard lot round turn.

ETFs

VT Markets offers exposure to 51 ETFs. Traders can benefit from tight spreads and leverage of up to 1:33 without owning the underlying assets. This gives traders more flexibility and possible cost savings when diversifying their portfolios or participating in larger market swings.

Share CFDs

VT Markets provides traders with access to more than 800 worldwide corporations through Share CFDs. This trading product enables users to speculate on the price swings of significant corporations without directly owning the underlying shares. Share CFDs on VT Markets offer competitive spreads and leverage of up to 1:20 (depending on trader location). These characteristics can provide investors with flexibility and potential cost savings when diversifying their portfolios or trading based on specific company performance.

Bond CFDs

VT Markets offers traders the chance to trade Bond CFDs. Bond CFDs provide a flexible option to profit from bond market swings. Traders can speculate on bond prices without actually purchasing the bonds themselves. On Bond CFDs, VT Markets offers cheap spreads and leverage of up to 1:100.

Leverage Details

VT Markets provides variable leverage across asset types. The possible leverage is based on users location and the exact instrument:

Forex: Up to 1:1000

Indices & Energy: Up to 1:500

Precious Metals: Up to 1:1000

Soft Commodities: Up to 1:20

ETFs: Up to 1:33

Understanding Leverage

Leverage allows traders to control larger positions with less upfront capital, resulting in higher earnings. However, it is critical to understand that leverage increases losses. Use leverage sparingly, and only invest funds that are willing to risk.

For example, if a user trades forex with 1:30 leverage with $450 capital, they will have a position of $13,500. A 10% loss in the wrong direction may completely deplete their account.

Key Takeaway: While leverage can boost returns, users must manage their risk through proper position sizing and stop-loss orders.

Negative Balance Protection (NBP)

VT Markets prioritizes trader safety by offering Negative Balance Protection (NBP) across all accounts and asset types. This critical feature prevents traders account balance from dropping below zero, protecting them against unplanned losses that could exceed their deposit amount. NBP gives traders peace of mind and enables them to manage risk more confidently.

Available trading platforms

MetaTrader 5 (MT5)

VT Markets offers MetaTrader 5, which has even more functionality. MT5 provides hedging, market depth, more exact technical analysis tools, and a wider choice of tradable assets, such as forex, indexes, energy, commodities, ETFs, bonds, and cryptocurrencies.

The interface remains user-friendly and allows for automation using Expert Advisors. MT5 is unique in that it lets users run many EAs simultaneously, increasing approach diversification.

MetaTrader 4 (MT4)

VT Markets offers the well-known MetaTrader 4 platform, which is notable for its user-friendly interface, charting tools, market news, price alerts, and robust support for automated trading (Expert Advisors). MT4 allows traders to access a wide range of markets from both desktop and mobile platforms.

VT Markets Web Trader

This browser-based platform requires no application downloads, making it both adaptable and user-friendly. The online trader offers charting tools, market news, notifications, and access to the same markets as MT4 and MT5, all of which can be accessed via any browser-enabled device.

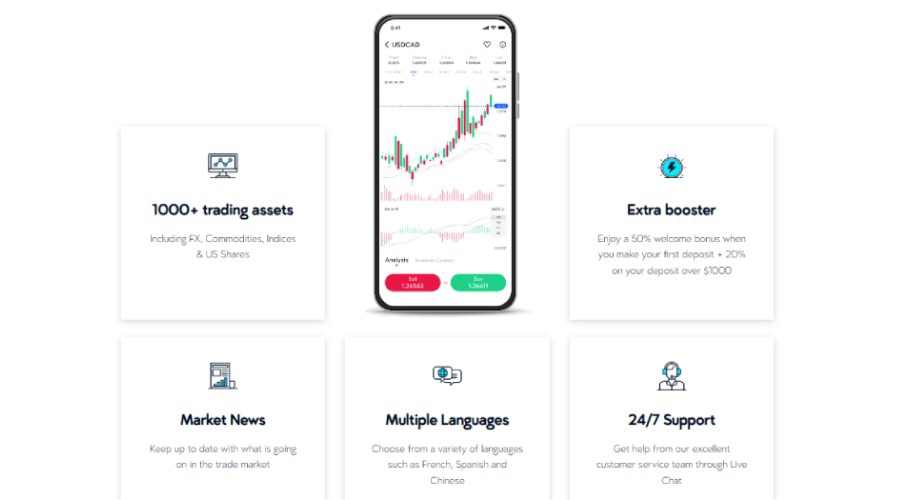

VT Markets App (Android & iOS)

The VT Markets App allows for easy on-the-go trading, with market access similar to other platforms. The software lets users manage multiple trading accounts, trade over 230+ assets, get multilingual support, stay up to date on market news, and access bonuses.

Available trading accounts

VT Markets offers a streamlined range of account types to suit a variety of trading styles. They offer options for both beginners looking for a low-cost entry point and experienced traders seeking the narrowest spreads. Let's take a closer look at their account types.

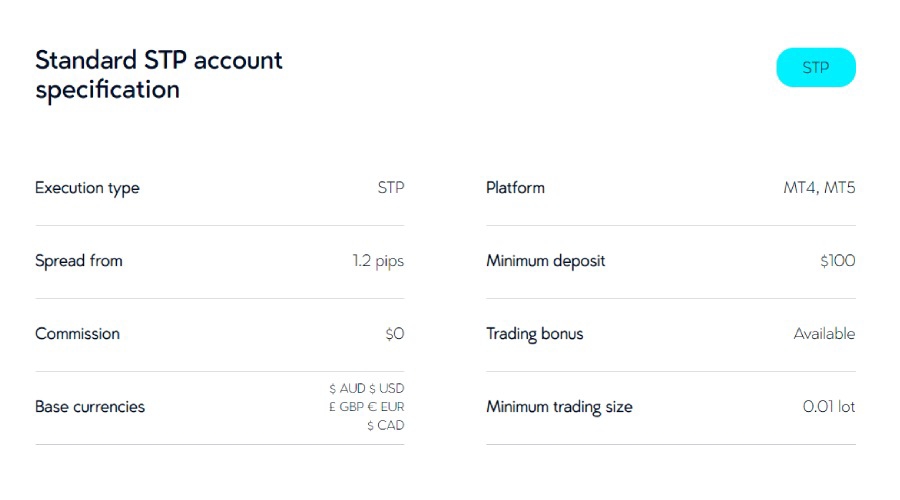

Standard STP Account

VT Markets' Standard STP Account prioritizes low-cost trading, with spreads as low as 1.2 pips and no commissions. This account type is suitable for novices because it requires only a $100 deposit and works with both the MT4 and MT5 platforms. Traders benefit from having access to market news and price updates. The basic currency options are: AUD, USD, GBP, EUR, and CAD.

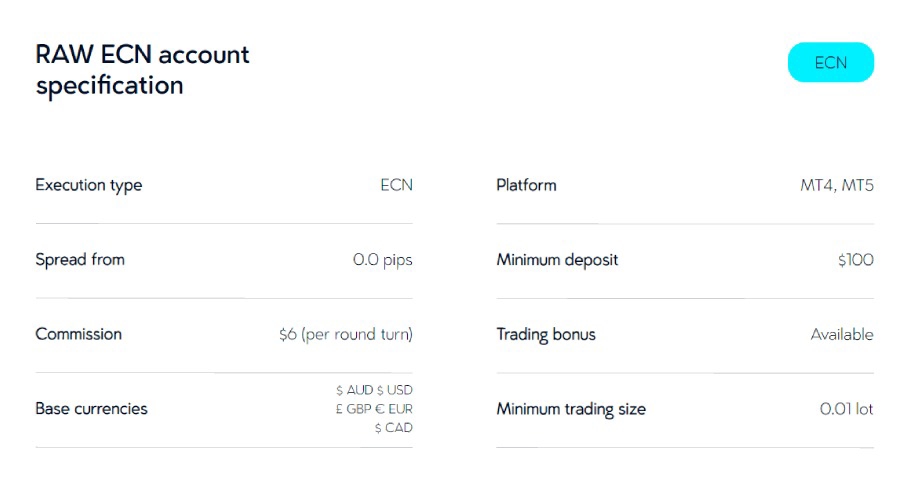

Raw ECN Account

The Raw ECN Account is intended for experienced traders seeking the tightest possible spreads, which start at 0.0 pips and carry a $6 minimum commission per standard lot (round turn). Its compatibility with MT4, MT5, and the Web Trader platform provides increased flexibility. The Raw ECN Account provides the same basic currency options as the Standard STP account (AUD, USD, GBP, EUR, and CAD), as well as a modest $100 minimum deposit.

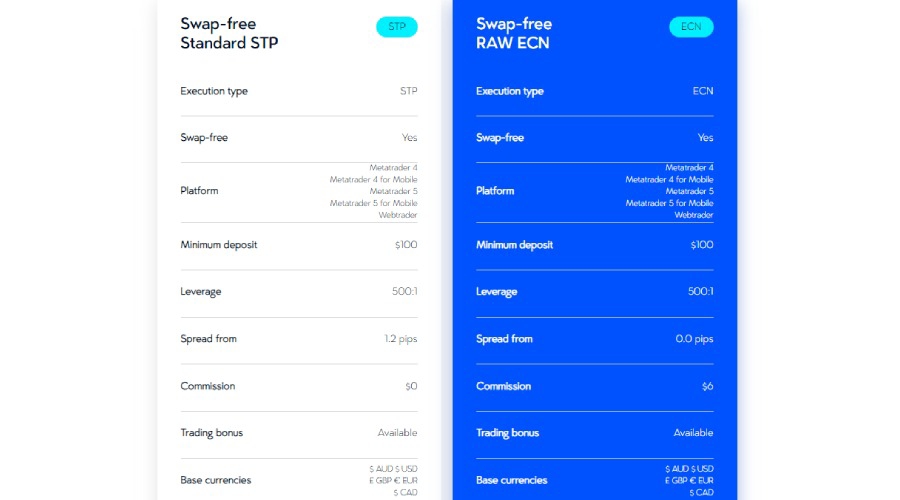

Swap-Free Islamic Account

VT Markets' Swap-Free Islamic Account caters to faith-based trading. This account adheres to Sharia law by deleting both commissions and swap fees. It combines features from the Standard STP and Raw ECN accounts to ensure consistency and ease of usage.

Demo Accounts

VT Markets offers demo accounts to individuals looking to practice trading before going live. Individuals can test trading tactics and become acquainted with their systems using virtual funds to reduce initial risk.

Trading Tools

VT Markets offers its clients a variety of trading instruments to help them succeed in today's dynamic market scenario. Let us take a deeper look at their available resources.

Expert Advisors (EAs)

VT Markets fully encourages the usage of Expert Advisors (EAs) by clients looking for automated trading solutions. These software-based systems use the MetaTrader 4 and MetaTrader 5 platforms to analyze market circumstances, execute trades, and manage risk depending on trader-defined parameters.

EAs enable 24-hour trading, eliminate emotional decision-making, and allow for the back testing of techniques prior to live deployment.

Forex Signals

VT Markets provides strong Forex Signals to help traders of all levels make informed decisions. These signals, delivered via a variety of media, provide timely market insights and prospective trading opportunities based on technical analysis and/or expert observations.

Forex signals can help traders save time, gain insights from expert analysts or automated systems, provide learning opportunities, and keep them up to date on future market changes.

Economic Calendar

The VT Markets Economic Calendar allows traders to remain ahead of market-moving events. This comprehensive tool gives real-time updates on macroeconomic data releases, political pronouncements, and central bank decisions that have a substantial impact on financial markets.

The calendar can be customized by importance, nation, currency, and timeframe, allowing traders to focus on the most essential information for their trading. In addition to economic data, VT Markets may incorporate market research to help traders comprehend the potential impact of these occurrences.

Trading Central MT4 tools

VT Markets collaborates with Trading Central, a renowned provider of market analysis and trading suggestions, to supply traders with useful information. These products connect easily with the MetaTrader 4 platform.

Trading Central provides technical analysis patterns, analyst suggestions, prospective market situations, and adaptive candlestick and divergence indicators, all of which are designed to give traders an advantage.

MAM/ PAMM

VT Markets provides professional money managers with reliable Multi-Account Manager (MAM) and Percent Allocation Management Module (PAMM) solutions.

These tools make it easier to manage several client accounts at once, allowing for more effective order allocation and flexible performance-based charge systems. VT Markets collaborates with MetaFX to provide a user-friendly MAM/PAMM console.

Daily Market Analysis

VT Markets helps traders grow by providing a variety of educational resources. Their Daily Market Analysis reports provide detailed overviews of major market developments, technical analysis, and prospective trading opportunities.

VT Markets' in-house market analysts provide their thoughts on numerous instruments, allowing traders to make more educated selections.

Learn Forex

VT Markets' "Learn Forex" area caters to traders of all skill levels, allowing them to broaden their trading knowledge. The contents address forex fundamentals, technical analysis, trading methods, and risk management ideas.

MT4 Guide

For individuals looking to grasp MetaTrader 4, VT Markets provides a detailed MT4 Guide that covers interface navigation, order placement and management, customization, and advanced technical analysis capabilities.

Trading Central tools guide

Finally, VT Markets offers a thorough Trading Central Tools Guide. This resource assists traders in maximizing the insights supplied by the Trading Central collaboration, including instructions on how to access and use various features within the MetaTrader platform. It covers how to evaluate technical patterns, expert suggestions, and Trading Central's adaptive indicators.

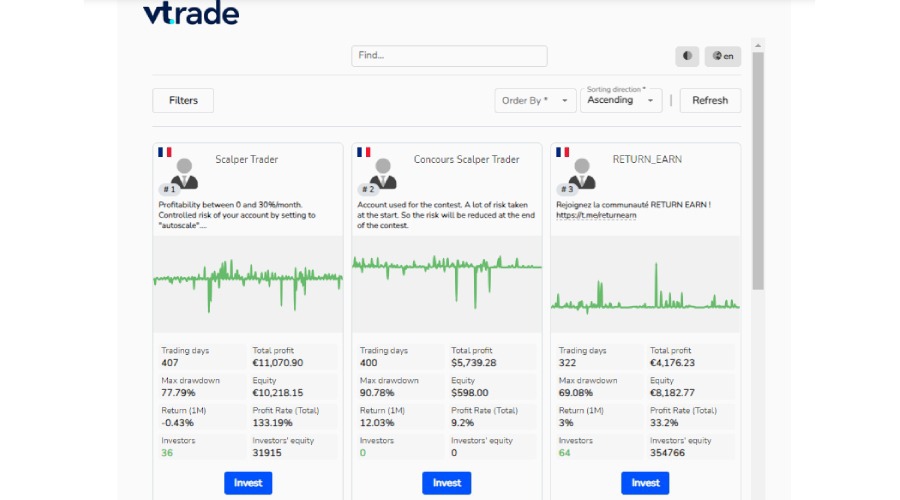

Copy Trading

VT Markets provides a streamlined copy trading experience, allowing traders to possibly profit from the methods of more experienced market participants. This service automates the replication of trades completed by specific Strategy Managers.

VT Markets assists users in finding Strategy Managers who match their specific goals based on characteristics such as performance history, risk tolerance, and trading styles.

Customer support details

VT Markets emphasizes customer service by offering round-the-clock multilingual support. Clients have several ways to contact their team:

Email: info@vtmarkets.com

Phone: +61 02 9054 9999, +27101412968

Live Chat: Access quick help directly on their website.

For additional support or more detailed inquiries, clients can also visit their customer service page. Their support representatives have been recognized for their expertise and commitment to providing outstanding service.

VT Markets Broker Review in a nutshell

VT Markets is an appealing alternative for traders seeking a well-regulated broker that puts client satisfaction first. The platform's competitive spreads and low minimum deposits make it suitable for a number of trading strategies. Traders receive excellent customer support as well as a suite of tools to assist them with market analysis.

The broker's regulation by trusted businesses such as ASIC and the FSCA demonstrates a commitment to transparency and the safety of customers' funds. This combination of characteristics makes them an attractive option for traders of all skill levels.

| Pros | Cons |

| Low minimum deposits | Not available to traders in the US |

| Quick & easy to register | |

| Regulated broker | |

| Good range of assets | |

| Multiple platform support |

FAQs

Is VT Markets Regulated?

VT Markets is regulated by the Australian Securities & Investments Commission (ASIC) and Financial Sector Conduct Authority (FSCA) of South Africa, and registered under the Mauritius Financial Services Commission (MU FSC).

What markets can I trade with VT Markets?

With VT Markets, you can trade Forex, precious metals, Commodities, Indices, and Shares (US / UK/ EU) markets.

Does VT Markets accept clients from the US?

Due to CFTC regulation, US traders are unable to trade with non US brokers. CFTC regulations mean that VT Markets is unfortunately unable to accept clients based in the US. Traders from all other countries are welcome to apply.

What account types does VT Markets offer?

VT Markets provides 2 account types for you to choose from:

Standard STP account and Raw ECN account

What leverage does VT Markets offer?

The maximum Forex leverage is 500:1. If users wish to alter their Forex leverage, users may submit a request via Client Portal. Please be aware that it can result in a high risk and widen their profit or loss.

Do VT Markets offer a swap-free account?

Their swap-free accounts are normal CFD trading accounts. The only difference is no swap fee being applied to your trades if you hold overnight. However, please note that a small admin fee still applies to such transactions.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.