Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Paytiko Review 2025: Overview of Key Features

Introduction

Paytiko is a modern payment orchestration platform , designed to simplify and centralize payment processes for businesses of all sizes. By unifying multiple payment methods and providers into a single, streamlined interface, Paytiko enables organizations to manage transactions more efficiently, reduce operational costs, and enhance customer satisfaction.

Built with flexibility and security in mind, the platform supports a wide range of payment services including pay-ins, pay-outs, refunds, recurring billing, and a newly developed AI-driven payment recommendation engine. Its user-friendly dashboard, comprehensive reporting tools, and extensive API capabilities make it a preferred choice for merchants, PSPs, and developers seeking a scalable and reliable payment infrastructure. With office locations in Sofia, Bulgaria, Dubai, UAE, and now most recently Larnaca, Cyprus, Paytiko has strategically positioned itself in supplying merchants with advanced payment management capabilities, no matter where they are located.

In this detailed 2025 review of Paytiko, we will explore it’s key features, integrations, technical support, pricing models, and overall value proposition for businesses navigating the complexities of digital payments.

Paytiko Services and Features

Paytiko delivers a comprehensive suite of payment solutions tailored to support the full transaction lifecycle. Designed for operational efficiency, the platform combines functionality with scalability to meet the evolving demands of digital commerce.

Pay-In Services

Paytiko simplifies the acceptance of customer payments through a wide range of payment processors and methods, including credit cards, bank transfers, and e-wallets. The platform supports recurring billing ideal for subscription-based businesses and ensures secure, seamless transactions across global markets.

Pay-Out Capabilities

Businesses can disburse funds efficiently to partners, vendors, or affiliates using Paytiko’s pay-out services. With options for direct bank transfers and digital wallets, the platform also supports bulk payments, reducing manual effort and minimizing error rates.

Centralized Dashboard

A customizable, real-time dashboard provides a unified view of all payment activities. Users can monitor transaction flows, manage cash movements, and analyze performance metrics all from one intuitive interface.

Advanced Reporting and Reconciliation

Paytiko offers in-depth reporting and reconciliation tools that allow businesses to generate customized financial reports, track historical data, and ensure accurate reconciliation of settlements. These analytics support strategic decision-making and maintain operational transparency.

Growth Hub: AI-Driven Payment Recommendations

Paytiko’s new feature, Growth Hub, helps businesses by automatically analyzing trends and data from both merchants and customers. It then gives personalized payment suggestions like which processors to use, how to route payments more efficiently, and provides helpful analytics. This saves time by automating routine payment tasks.

Paytiko Integration Capabilities

Paytiko is built with integration flexibility at its core, offering businesses and Payment Service Providers (PSPs) seamless connectivity across multiple systems and platforms. Its scalable architecture supports both technical adaptability and operational reliability, making it ideal for modern, growth-oriented enterprises.

Payment Services Integration

The platform supports diverse payment workflows, including:

Credit Card Processing: Secure handling of card transactions with rapid authorization and settlement.

Alternative Payment Methods: Acceptance of bank transfers, e-wallets, and localized payment solutions.

Recurring Payments: Automation of subscription billing to enhance customer retention and streamline revenue flow.

Fraud Prevention: Built-in tools to detect and mitigate fraudulent activity, ensuring compliance and payment integrity.

These features allow businesses to offer customers flexible, secure, and efficient payment experiences.

PSP-Focused Solutions

Paytiko offers PSPs a robust support infrastructure:

Technical Assistance: Detailed API guidance and hands-on support during integration to ensure uninterrupted service.

Ongoing Support: Dedicated teams provide continuous help for troubleshooting and platform optimization.

Strategic Partnerships: Collaborative opportunities to enhance service portfolios and co-develop solutions.

E-Commerce Plugins

Paytiko simplifies deployment through ready-to-use plugins for popular platforms such as WooCommerce, OpenCart, and Magento. These pre-built modules enable merchants to quickly integrate payment capabilities without custom development.

Paytiko Developer Tools and API Support

Paytiko is engineered to provide developers with the flexibility and control needed to build, customize, and optimize payment workflows. Through robust APIs and dedicated technical resources, the platform empowers businesses to integrate seamlessly and scale effectively.

Comprehensive API Integration

Paytiko offers a reliable and adaptable API suite designed for easy integration with existing business systems. Key features include:

Detailed Documentation: Step-by-step integration guides, code examples, and reference materials help streamline development.

Modular Architecture: Developers can tailor API functions to meet specific operational needs without unnecessary complexity.

Secure Protocols: All API interactions are encrypted and authenticated to maintain data privacy and compliance.

Technical Assistance and Customization

A dedicated support team is available to assist developers throughout the integration process:

Setup Support: Guidance through initial onboarding and sandbox testing.

Issue Resolution: Prompt troubleshooting and optimization advice to maintain performance.

Custom Features: Businesses can request tailored API functionalities to address unique payment requirements.

Future-Ready Roadmap

Paytiko continues to innovate through an active development roadmap, focusing on:

Feature Enhancements: Ongoing upgrades to existing tools for improved performance and usability.

New Integrations: Expansion into additional payment processors, currencies, and regional gateways.

User Experience Optimization: Continuous UI and UX improvements to streamline backend and customer-facing processes.

Adoption of Futuristic Payments: Research, development, and adoption of ever-changing payment advancements and technologies to enhance current systems and propel services forward, like with its Growth Hub technology.

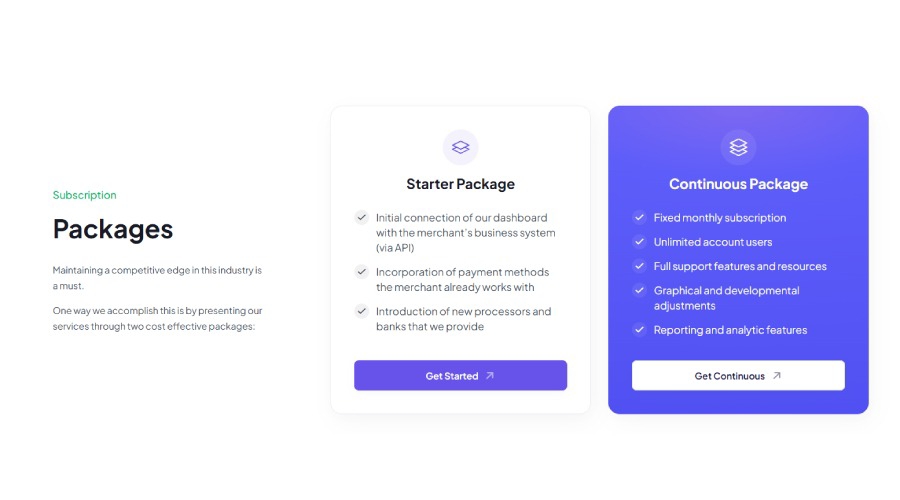

Paytiko Pricing

Paytiko offers transparent and flexible pricing packages tailored to meet the operational needs and budgets of growing businesses. Its two-tiered model ensures that companies can scale their payment infrastructure without incurring unnecessary costs or complexity.

Starter Package

Ideal for businesses beginning their integration journey, the Starter Package includes:

Initial API Setup: Seamless onboarding and connection to the Paytiko dashboard.

Existing & New Payment Methods: Integration of current providers alongside access to Paytiko's network of 500+ banks and other payment processors.

Basic Support Access: Direct communication channels for support and guidance.

This package serves as an entry point for organizations looking to centralize and optimize their payment flows.

Continuous Package

Designed for established businesses seeking advanced features and ongoing optimization, the Continuous Package offers everything in the Starter Package, along with:

Fixed Monthly Subscription: Predictable pricing structure for easier financial planning.

Unlimited User Access: Ideal for teams across departments managing payment workflows.

Advanced Support: Comprehensive technical and operational support.

Custom Development & Branding: Tailored graphical and functional adjustments based on business needs.

In-Depth Reporting Tools: Advanced analytics for transaction monitoring and process improvement.

Paytiko’s pricing structure is designed to provide cost-effective access to its powerful payment orchestration platform, helping businesses grow without compromising functionality or support.

Conclusion: Is Paytiko the Right Choice for Your Business?

Paytiko stands out as a comprehensive and forward-thinking payment orchestration platform tailored for businesses seeking to streamline complex payment operations. The platform excels in providing unified access to a wide array of payment services, including pay-ins, pay-outs, refunds, and recurring billing all from a centralized and intuitive dashboard.

The platform’s robust integration capabilities, developer-friendly API suite, and ready-to-use e-commerce plugins make it adaptable across industries and scalable as business needs grow. Paytiko’s dedicated support for Payment Service Providers (PSPs), coupled with real-time reporting and fraud prevention tools, positions it as a strategic partner in digital payment management.

With flexible pricing options and a strong roadmap focused on continuous innovation, Paytiko offers value for both emerging startups and established enterprises. For businesses aiming to enhance efficiency, reduce operational costs, and provide secure, seamless payment experiences, Paytiko presents a highly competitive solution.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.