Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Alternatives

- South East Asia

Crypto

Yes

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Payment Asia Review 2025

Payment Asia is a leading payment gateway provider that was established in 1999. The company provides a time-saving online payment solution for customers and businesses, covering credit cards, debit cards, MasterCard, Visa, UnionPay, and e-wallets. In addition, Payment Asia offers a tailor-made omnichannel payment solution for enterprises such as digital marketing, and e-commerce strategy consulting.

The company has over 10,000 local and overseas merchants. They're known for offering top-notch electronic payment processing services in the SEA region including bank transfer, virtual accounts, QR code payment, and IBAN solutions.

Payment Asia is a comprehensive online payment gateway that offers great value to businesses across Asia. The platform provides businesses with a time-saving online payment solution and has a wide range of payment options, including credit cards, debit cards, MasterCard, Visa, UnionPay, and e-wallets.

Payment Asia pioneers as the leading Asia payment gateway and e-commerce payment solution. The company is committed to providing a quality payment solution that is convenient, reliable, and secure. Payment Asia has a team of experienced professionals dedicated to providing excellent customer service.

Customers are satisfied with Payment Asia’s service, including SMEs, large corporates, and government agencies. The company is constantly innovating and expanding its services to meet the ever-changing needs of its customers.

Payment Asia offers several features to merchants who are looking for an efficient and cost-effective way to process payments. When it comes to security, Payment Asia takes strictly PCI standard (Payment Card Industry Data Security Standard) and has implemented various measures to ensure that all business transactions are safe and secure. Overall, Payment Asia is a leading payment platform that offers businesses a convenient, reliable, and secure way to process payments.

Payment Asia payment safety information

Payment Asia is among the most popular online payment solution and is known for its security measures. The company has implemented various security measures to ensure that all transactions are safe and secure.

For example, Payment Asia uses SSL (Secure Socket Layer) encryption to protect all information transmitted between the customer's browser and the company's servers. In addition, Payment Asia has a fraud detection system that monitors all transactions and flags any suspicious activity.

Payment Asia has implemented strict AML (Anti-Money Laundering) policies in which all customers must undergo a verification process before they can use the platform. The company employs a special team of security experts who constantly monitor the platform for any suspicious activity.

In addition, Payment Asia has also implemented KYC policies in which all customers must provide proof of identity and address, and relevant company documents before they can use the platform.

Payment Asia is a reliable and secure payment platform that allows businesses to process payments conveniently. To give a better experience to clients, Payment Asia hires a team of experienced professionals dedicated to providing excellent customer service.

Moreover, their International Bank Account Number (IBAN) and Open Banking solutions are highly convenient for businesses that operate in multiple countries.

Payment Asia fees details

Payment Asia is among the top online transaction platforms that offer competitive rates. The company also offers multi-currency IBANs for overseas transactions. Businesses can also get a competitive exchange rate for EUR & USD and same-day payments. In addition, Payment Asia offers a secure and reliable way to get your IBAN.

The company also offers remote account opening, a great convenience for businesses. Lastly, Payment Asia also offers centralized transaction management in their master account, which helps businesses keep track of all their transactions.

Payment Asia has mentioned on their website that they offer competitive and reduced transaction fees for outgoing and incoming transactions. The process is simple for signing up as a merchant at Payment Asia. After that, you can start using Payment Asia to process payments.

In addition, Payment Asia offers PCI-DSS certified payment gateway that offers competitive rates and same-day payment processing. The company also offers a secure and reliable platform with 24/7 customer support. Please contact the Payment Asia customer support team for the exact pricing structure.

IBAN fee structure

The IBANs of Payment Asia offer a great way to manage overseas transactions. The company offers multi-currency IBANs, which businesses can use to process payments in multiple currencies conveniently. Payment Asia has mentioned on their website that they offer competitive USD and EUR rates compared to many other platforms.

However, the exact charges are not mentioned. Please contact the customer support team of Payment Asia for more information about their fee structure.

The Open Banking pricing structure

Payment Asia offers Open Banking solutions that are very cost-effective as there are no hidden charges. In addition, the company also offers a safe and secure platform with 24/7 customer support.

The Payment Asia company has not mentioned the fees on their website. Contact Payment Asia customer support for more information about the pricing structure. However, they have mentioned that there are no hidden charges and offer an instant settlement to the merchant. In addition, Payments Asia has also implemented QR code verification of transactions.

Deposit and withdrawal options at Payment Asia

Payment Asia offers a variety of deposit and withdrawal methods to merchants to process payments easily. The company offers bank transfer, debit/credit card, and e-wallet options for deposit and withdrawal.

In addition, the company offers SEPA, SWIFT/BIC, and local bank transfer options for bank transfer. For debit/credit cards, Payment Asia supports Visa, MasterCard, and American Express. Lastly, for e-wallets, Payment Asia supports Alipay and WeChat Pay.

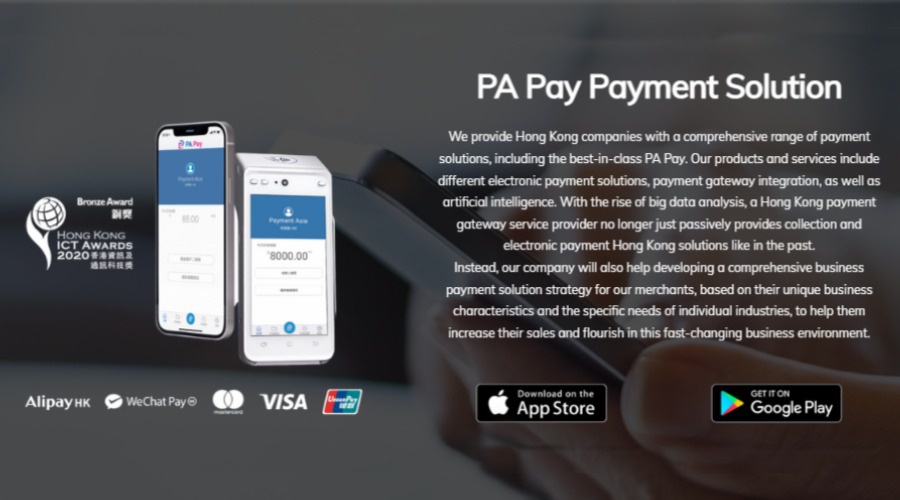

Moreover, all the deposit and withdrawal methods are secured with SSL encryption. In addition, Payment Asia also offers a mobile app that allows businesses to manage their account and process payments on the go easily. The Payment Asia app is available for both Android and iOS devices.

In addition, Payment Asia is a PCI-DSS compliant company which means that all the credit/debit card information is stored in a secure and encrypted environment. You also get the option of UnionPay QR code payments, in which you can scan the QR code to make a payment.

Payment Asia also offers merchant account services that allow businesses to accept customer payments easily. With a merchant account, businesses can choose to receive payments in different currencies. Payment Asia also offers a convenient way to pay with their payout options. The company offers same-day payouts via the IBAN solution to merchants.

Finance services offered by Payment Asia

Payment Asia is a full-fledged payment platform that offers a wide range of payment solutions, including an online payment gateway, offline mobile payment solution, digital marketing solution, and credit card payment financing package. The company also offers an IBAN & Instant Bank Transfer solution for businesses in the UK and Singapore. Let's look at all options available at Payment Asia:

Offline Mobile Payment Solution — PA Pay

The PA Pay solution offered by Payment Asia is a great option for businesses that want to accept payments offline. With this solution, businesses can use the Payment Asia mobile app to process payments. You get access to the omnichannel payment gateway, and the company also offers a wide range of features such as a QR code scanner, loyalty program, and real-time reporting. In addition, you can use the PA Pay solution to process payments in multiple currencies.

Online Payment Gateway

The online payment gateway offered by Payment Asia covers many payment methods, including credit cards, Union Pay, Alipay, and WeChat Pay. The company offers a PCI-DSS certified payment gateway that is simple to use and comes with a clear transaction history. In addition, businesses can use the online payment gateway to process payments in multiple currencies. Moreover, it supports various e-shopping and online stores.

Moreover, you can access modern cross-border and settlement solutions with Payment Asia. Moreover, with the online payment gateway of Payment Asia, you get flexible settlement schedules.

Southeast Asia Online Payment Solution

This solution is best for businesses that want to expand their reach in Southeast Asia. Payment Asia has a wide network of banks and financial institutions. With this solution, businesses can process payments in local currency.

In addition, businesses can also use the cross-border payment solution to make international payments. This solution is simple to use and comes with a user-friendly interface. You get support for 14+ currencies with this solution. The company has a wide network of banks and financial institutions that offer competitive rates.

IBAN & Instant Bank Transfer (UK and Singapore)

This solution is best for businesses that operate in the UK and Singapore. With this solution, businesses can use their IBAN to make international payments. The company offers a secure and reliable platform with 24/7 customer support.

However, you need to contact Payment Asia customer support for the exact pricing structure. IBANs are ideal for businesses that want to send or receive large sums of money. The company also offers an instant bank transfer solution that is simple and comes with a user-friendly interface.

Cryptocurrency Payment Gateway

Payment Asia is one of the leading cryptocurrency payment gateways that allow businesses to accept major digital currencies such as BTC, ETH, and XRP. The company offers a secure and reliable platform with 24/7 customer support. You need to contact Payment Asia customer support for the exact pricing structure.

With the support of digital currencies, businesses can use this gateway to expand their reach in 200+ new markets. Moreover, you get the instant locking of currency rate feature as it helps businesses minimize their risk. Another advantage of using Payment Asia cryptocurrency payment gateway is that the withdrawals are processed within a business day.

Digital Marketing Solutions

Payment Asia offers a wide range of digital marketing solutions that can help businesses improve their online visibility. The company offers social media marketing, cooperative promotion, and an e-commerce platform. With the help of Payment Asia, businesses can reach new customers and grow their businesses.

The Payment Asia company has a team of experienced professionals who can help businesses achieve their goals. You need to contact Payment Asia customer support for the exact pricing structure. In addition, Payment Asia offers end-to-end bespoke promotional packages that can be customized according to your business needs. It's among the unique features that you get with Payment Asia.

Credit Card Payment Financing Package

It is a financing package that helps businesses get the working capital needed to grow their business. The company offers a secure and reliable platform with 24/7 customer support. You need to contact Payment Asia customer support for the exact pricing structure.

The company offers excellent financing for businesses that want to expand their reach in new markets. In addition, Payment Asia offers access to 58 days of interest-free financing that can help businesses save on costs. Payment Asia offers a more flexible and affordable financing solution compared to other platforms.

Country-wise SEA payments details at Payment Asia

Payment Asia is known for offering costumed payment solutions based on the needs of businesses of a particular Asian country. Compared to other payment providers, the company better understands the local market.

The company also has an efficient account management team that helps businesses set up their account, get started with the platform, and manage their transactions.

The company also offers a better exchange rate for Asian countries like Vietnam, the Philippines, and Indonesia.

Malaysia Solution

Payment Asia provides a safe and secure platform for businesses to process online bank transfers which is a low-risk payment method making the payment experience smoother and easier. As a result, Payment Asia is the first choice for businesses in Malaysia looking for an efficient and cost-effective way to process payments.

Philippines Solutions

The Philippines is a rapidly growing market, with many businesses looking for efficient and cost-effective payment solutions. Payment Asia offers many digital payment options, including credit cards and e-wallets. In addition, the solution supports around 14 banks in the Philippines, which means that you can easily process payments through the platform.

Thailand Solutio

Payment Asia understands the demand of clients, they provide an online payment solution in Thailand not only contains customer service but also covers all Thai banks. The company offers a wide range of payment options and various other custom payment solutions.

In addition, Payment Asia has a dedicated customer support team for Thailand business that covers all time zones. Payment Asia's QR code solution is one of Thailand's most popular payment methods.

Vietnam Solution

As the government of Vietnam promotes cashless payment, Payment Asia recognizes the trend and provides businesses in Vietnam with a cost-effective and efficient payment processing solution. The solution offers various payment options, including e-wallets, ATM online, and QR code payments.

Moreover, Payment Asia provides businesses with a virtual account solution to receive payments within seconds. The virtual account solution supports more than 10+ Vietnamese banks and is a convenient way for businesses to process payments.

Indonesia Solution

For Indonesia, Payment Asia offers a virtual account solution that allows businesses to conduct payments through online banking, inter-bank transfer, mobile banking, and ATM transfers with their supported banks. With the solution, businesses receive payments in real-time, which makes managing transactions much easier. The company also provides an e-wallet solution that allows businesses to complete payments instantaneously through one of the most renowned Indonesian e-wallets.

Payment Asia contact details:

Payment Asia’s platform offers businesses a convenient, reliable, and secure way to process payments. Payment Asia customer support is responsive and helpful, with a wide range of satisfied customers. Below are the details of Payment Asia's contact details:

- Phone: +852 30088337

- WhatsApp: +852 91651125

- Email: services@paymentasia.com

Research resources at Payment Asia

Payment Asia is among the few companies offering research resources to their clients. The company has a team of experienced research professionals dedicated to providing quality research resources that are convenient, reliable, and secure. Let's look at all research resources available at Payment Asia:

PA Blog

The PA Blog is a great resource for businesses to stay up-to-date on the latest news and developments in the payments industry. The Payment Asia blog covers a wide range of topics, including new payment technologies, trends in the payments industry, and Payment Asia's latest product updates. Moreover, you also get to know how Payment Asia is constantly innovating to meet the ever-changing needs of its customers. As a result, their blog section is among the most comprehensive and informative payments industry.

Interviews

Payment Asia also has a section on their website where they have been interviewed by different media. These interviews provide insights into the latest trends in the payments industry, as well as the challenges and opportunities that businesses face regarding payments. The interviews are a great way to stay up-to-date on the latest developments in the payments industry. In addition, these interviews will help you understand the payments industry better and make more informed decisions about your business.

O2O case studies

Payment Asia also has a section on their website where they share case studies of businesses that have used their platform to process payments. These case studies provide insights into how businesses have used Payment Asia's platform to streamline payment processes. The case studies are a great way to learn about the benefits of using Payment.

Anti-money laundering resources

Payment Asia has a section on its website that provides resources for businesses to learn about anti-money laundering (AML) compliance. The resources include comprehensive FAQs covering a wide range of topics related to AML compliance. In addition, the website also provides links to external resources that businesses can use to learn more about AML compliance. So, to keep your business compliant, you will get all the needful AML information from this platform.

FAQ section

Payment Asia has a FAQ section covering a wide range of topics related to its platform and services. The Payment Asia FAQ section is a great resource for businesses to learn about the features and benefits of using Payment Asia's platform. In addition, the FAQ section also provides answers to common questions that businesses have about processing payments through Payment Asia.

Payment Asia in a nutshell

Payment Asia is among Asia’s most popular payment platforms, with over 10,000 merchants using the solution. They're a compliant and regulated company, and Payment Asia solution offers online payments and offline mobile payments. In addition, Payment Asia supports cryptocurrency payment solutions and digital marketing solutions.

Coming to their IBANs offering, Payment Asia provides a comprehensive IBAN solution that supports overseas transactions. The solution offers a real-time view of your current account balance and allows you to send payments in multiple currencies. For Asian countries, Payment Asia offers bank transfer, digital payment, QR code payment, e-wallet, and virtual account solutions that cover the client needs of Southeast Asia markets. Overall, Payment Asia is a great choice for businesses looking for efficient and cost-effective payment processing.

FAQs:

How long has Payment Asia been in business?

Payment Asia has been in business since 1999.

What services does Payment Asia provide?

Payment Asia provides businesses with time-saving online payment solutions and has a wide range of payment options, including bank transfer solutions, digital payment solutions, QR codes, and e-wallets solutions.

What are the benefits of using Payment Asia?

Payment Asia has been focusing on providing online and mobile payment solutions since 1999, with the safest and most innovative technology.

Is Payment Asia secure?

Payment Asia takes a strict KYC process and AML policy. The company takes every measure to secure transaction safety and data assets.

What are some of the features of Payment Asia?

Some features of Payment Asia include instant payments, real-time reporting, and a wide range of supported banks, the company also provides cryptocurrency solutions. Payment Asia also provides digital marketing solutions together with payment services.

How to apply as a merchant at Payment Asia?

To apply as a merchant at Payment Asia, please visit the website https://www.paymentasia.com/en/contact-us/ and fill out the online application form.

What are the requirements for merchants to use Payment Asia?

The requirements for merchants to use Payment Asia vary depending on the type of business and the payment solution being used. For more information, please contact Payment Asia.

How can I contact Payment Asia?

You can contact Payment Asia by phone and email.

- Phone: +852 3008 8337

- WhatsApp: +852 9165 1125

- Email: services@paymentasia.com

What documents are required at Payment Asia?

The documents required at Payment Asia depend on the type of business and the payment solution used. But some common company documents are business licenses, company registration certificates, and bank statements.

Why do you need to submit documents at Payment Asia?

Due to AML, KYC, and other regulations, Payment Asia requires merchants to submit certain documents for account verification.

How long does it take to get approved at Payment Asia?

The time it takes to get approved at Payment Asia varies depending on the type of business and the payment solution being used.

Does Payment Asia have a mobile app?

Yes, Payment Asia does have a mobile app.

How can a customer make a payment to Payment Asia’s clients?

They can make a payment at Payment Asia’s clients by credit cards, debit cards, UnionPay, or e-wallet.

What is POS at Payment Asia?

POS at Payment Asia is a point-of-sale system that allows businesses to accept payments in person.

How does the POS system at Payment Asia work?

The POS system at Payment Asia connects to a supported bank and allows businesses to accept payments in person.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.