Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

ETO Markets Review: Broker Overview

ETO Markets is a multi-asset CFD broker established in 2013. It positions itself as a single venue for trading a broad set of markets, including forex, major indices, energies, precious metals, and crypto CFDs. The product range is described as 300+ instruments, which puts it in the “multi-asset” category rather than a forex-only offering.

For trading access, ETO Markets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This matters for day-to-day usability: MT4 is widely used for classic FX/CFD workflows and EAs, while MT5 adds more modern order-handling and asset coverage depending on the broker’s setup.

Accounts and pricing structure (high level)

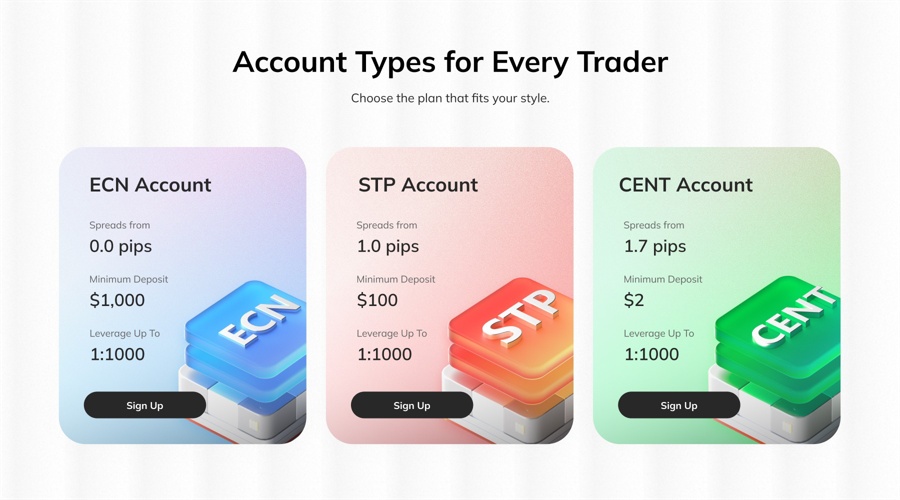

ETO Markets presents three core account options that mainly differ by minimum deposit and spread model:

Account type | Minimum deposit | Spreads from |

CENT | $2 | 1.7 pips |

STP | $100 | 1.0 pips |

ECN | $1,000 | 0.0 pips |

Leverage is stated as up to 1:1000, with trade sizes starting from 0.01 lots (the maximum position size depends on the instrument and account conditions). Since leverage can amplify both profits and losses, this is a key risk factor to consider especially for newer traders.

Platform features and tools

Beyond the core MT4/MT5 offering, ETO Markets highlights added functionality such as copy trading, “AI-powered” trading tools, market insights, and account management support for eligible clients. In practice, these features can be useful but the real value comes down to how they’re implemented (signal quality, transparency, and how easy it is to control risk).

Regulation & Trust

Regulation is one of the biggest trust signals for any broker, but it’s also entity-specific. In other words, what protections apply can depend on which ETO Markets company you onboard with and where you live.

Regulatory positioning and entities

ETO Markets presents a multi-jurisdiction setup, including an Australian-regulated arm and an offshore-regulated arm:

Entity (as presented) | Jurisdiction | Status shown | Reference details |

ETO Markets (AFS licence holder) | Australia | Licensed by ASIC | AFSL / AFS licence No. 420224 |

ETO Markets Limited | Seychelles | Authorised by Seychelles FSA | Securities Dealer licence No. SD062; Company No. 850672-1 |

Mauritius Financial Services Commission (FSC) | Registered company | Licence No. C119023893 |

What this means for traders

Your legal counterparty matters: In the broker’s risk disclosure, trading is described as taking place with ETO Markets Limited as counterparty for leveraged products like FX and CFDs.

Risk is clearly stated: The same document explicitly warns that leveraged trading can lead to losses that may exceed your deposit.

Protections can differ by entity: An ASIC-licensed entity typically operates under a different supervisory framework than an offshore-licensed entity, so the practical level of oversight, complaint handling routes, and client safeguards may vary depending on where your account is held.

Trading Platforms

ETO Markets offers trading on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), giving traders two familiar environments for charting, order execution, and automation (where supported).

MT4 vs MT5 in practice

Both platforms are positioned for CFD trading, with MT5 framed as the “next-generation” option. MT4 is described as supporting web (HTML5) plus Windows, Mac, iOS and Android, which helps if you trade across devices.

Platform | Best suited for | Notes highlighted |

Traders who want a classic MT workflow and broad compatibility | Web + desktop + mobile support is emphasized. | |

Traders who want a newer MetaTrader environment and expanded capability | Positioned as a more advanced platform in the broker’s materials. |

Social and copy trading ecosystem (ETO CopyTrading / ETO Plus)

ETO Markets promotes an in-house social/copy trading ecosystem through products such as ETO CopyTrading and ETO Plus.

The copy trading feature-set is described around three themes:

Transparency: performance statistics such as returns, drawdowns and trading cycles are highlighted to support provider comparison.

Synchronization: order copying is described as millisecond-level synchronization to reduce friction when mirroring trades.

Control: followers can adjust position sizing and apply risk limits (including drawdown-based controls) to keep risk parameters defined.

A practical note for readers: copy trading can reduce the learning curve, but it doesn’t remove risk. The quality of risk controls, the visibility of real track record, and how copying behaves during fast markets are what matter most.

Markets & Instruments

ETO Markets positions itself as a multi-asset CFD broker, meaning you’re generally trading price movements via CFDs rather than owning the underlying asset. In its product messaging, the broker highlights coverage across the major retail trading categories forex, precious metals, indices, and energies and also references commodities, cryptocurrency CFDs, and US shares CFDs in its broader instrument descriptions.

Core asset classes you can expect

Market | What it’s typically used for | How ETO Markets describes it |

Trading currency pairs (major/minor/exotic) | Access to a “wide range of currency pairs.” | |

Broad market exposure via leading stock indices | Exposure to “the world’s leading stock indices.” | |

Gold/silver-style hedging and volatility plays | Trading “gold, silver, and other precious metals.” | |

Oil/gas-style macro and event-driven trading | Energies are listed as a supported market. | |

BTCUSD, DOGUSD, ETHUSD | Cryptocurrencies with flexibility and deep liquidity. |

In addition, ETO Markets’ own materials reference commodities more broadly, alongside cryptocurrency CFDs and US shares CFDs, which expands the offering beyond the “four core” categories above.

Account Types, Spreads & Fees

ETO Markets structures pricing primarily through three account types, where the main differences are minimum deposit and how trading costs are presented (spread-only vs raw spread + commission style). Like most CFD brokers, the headline “from” spread is a minimum that can widen during volatile periods, illiquid sessions, or around major news.

Account types (headline conditions)

Account type | Typical positioning | Minimum deposit | Spreads from |

Entry-level, smaller sizing | $2 | 1.7 pips | |

General trading, lower cost vs entry level | $100 | 1.0 pips | |

Raw pricing focus | $1,000 | 0.0 pips (with commission referenced) |

ETO Markets also references leverage up to 1:1000 across this lineup.

How fees show up in real trading

Spreads: The spread is the most visible cost (the difference between bid and ask). On the “ECN” style option, the broker highlights raw spreads from 0.0 pips, which usually implies the spread can be very tight at times, with most of the cost shifting to commissions.

Commissions: For certain markets, the broker publishes per-instrument trading specifications that include a commission figure. For example, its specifications pages for precious metals and energies show a commission of 7 USD alongside average spread and contract details.

Practically: commissions can be instrument-dependent and may also vary by account type, so the cleanest way to verify your exact cost is to check the specification table for the instruments you trade most.)

Funding-related fees: ETO Markets positions its fees as transparent and states that withdrawals of $100 / 100 USDT and above are processed free of charge, while smaller withdrawals only pass through third-party service charges (no “hidden” broker fee stated for those).

Deposits & Withdrawals

ETO Markets promotes a “multi-channel” funding setup designed to support both traditional and alternative payment rails. In practical terms, this includes bank transfers, regional card/payment networks, and crypto-based transfers, with an emphasis on fast settlement and clear fee handling.

Funding options and flexibility

For deposits and withdrawals, ETO Markets describes four main routes:

USDT (blockchain transfers) for fast, borderless funding.

UnionPay for regions where it’s a common payment network.

Localized payment gateways that support local-currency flows in markets such as Indonesia (IDR), Thailand (THB), and Vietnam (VND).

International bank transfers via SWIFT for traders who prefer standard banking rails.

It also states support for 20+ currencies, which can help reduce unnecessary conversions if you choose a base currency that matches how you fund and withdraw.

Withdrawal processing and fees

ETO Markets outlines a same-day withdrawal workflow under specific conditions: withdrawal requests submitted by 03:00 AM GMT are processed on the same business day (T+0), and it notes no upper withdrawal limits in that context.

On fees, the broker’s stated policy is straightforward: withdrawals of $100 USD / 100 USDT and above are processed free of charge, while smaller withdrawals only pass through the actual third-party service charges (no hidden broker fee is indicated).

Customer Support & Service Quality

ETO Markets markets its support as round-the-clock, with “24/7 support” referenced across its main site messaging and service-focused materials. In a separate security-focused write-up, support availability is described as 24/5 for certain channels or religions, which is a meaningful difference so it’s worth confirming the exact hours that apply to your account region and contact channel before relying on it for time-sensitive issues.

From a service-structure perspective, the broker highlights a multi-channel setup typically live chat, email, and phone aimed at fast responses for both technical and account-related questions. It also describes assigning dedicated account managers for more personalized guidance (generally positioned for eligible clients).

Languages and accessibility

ETO Markets places heavy emphasis on multilingual support. One service standards piece lists nine languages: English, Simplified Chinese, Traditional Chinese, Vietnamese, Thai, Indonesian, Korean, Filipino, and French. Elsewhere, the broker indicates support is available in 10+ languages, explicitly mentioning English, Chinese, and Arabic (among others). The practical takeaway is that multilingual coverage is a core part of the broker’s positioning, but the exact language set can vary by channel and team so confirm your preferred language on the specific contact method you plan to use.

Account Opening & Verification (KYC)

Opening an account follows a simple sign-up flow, with an email verification step built into the application. The live-account form is presented as a two-step process: you enter personal details (name, email, phone number, country/region of residence), confirm your email via a verification code, then continue to the next step to complete the application.

What you typically need to verify a live account

For a live account, identity checks require standard “proof of identity” and “proof of address” documents:

Proof of identity: a valid passport or a valid identity card (front and back).

Proof of address: a utility bill (electricity/gas/water) from the last 3 months or a bank statement from the last 3 months.

A key requirement is consistency: the documents must clearly display your name and (for POA) your address, and these details should match what you entered in the application.

What happens after you submit

Once you’ve completed the application and uploaded the required documentation, the usual outcome is an approval notification by email after the documents are reviewed and verified.

Education, Research & Trading Tools

ETO Markets supports traders with a mix of learning materials, market commentary, and on-site tools designed to help with day-to-day decision-making. The overall setup leans toward practical content: short, frequent updates on major markets, plus a dedicated education area for foundational learning.

Education

ETO Markets maintains an education hub positioned as a structured knowledge centre for traders at different levels, from beginners learning core concepts to more experienced users looking to deepen market understanding.

Research and market insights

For ongoing research, ETO Markets runs a dedicated Market Insights stream and a separate blog with recurring market coverage. The blog is organised into clear categories such as Market Buzz, Gold Market, Forex Market, and Commodity Market, and it publishes “latest update” posts with market context and commentary.

A good way to use this content is as a “first read” to understand sentiment and upcoming themes then validate the trade idea using your own chart levels, risk limits, and (if relevant) an external economic calendar or primary data source.

Pros and Cons

Pros | Cons |

MT4 and MT5 platform support for familiar trading workflows. | Product availability and conditions may differ by region/account entity; confirm what applies to your account. |

Tiered account structure (CENT / STP / ECN) supports progression from smaller to more cost-focused setups. | Commissions/fees can vary by instrument and account type; confirm pricing for your most-traded symbols. |

Broad multi-asset CFD coverage (e.g., forex, indices, metals, energies, crypto CFDs). | |

Low entry barrier via a small minimum deposit on the entry-level account. | |

Copy/social trading features for traders who prefer strategy-following (with proper risk limits). | |

Ongoing market insights and support tools that can help with daily market context. |

Final Verdict

ETO Markets fits the profile of a MetaTrader-first, multi-asset CFD broker with a clear “ladder” of accounts from a low-entry CENT option to a more pricing-focused ECN-style setup. If you want MT4/MT5, broad market access, and the option to start small while you test execution and platform workflow, the overall proposition makes sense.

Where you should be more cautious is around cost realism and risk exposure. The headline pricing is presented as competitive, but your real trading cost depends on spreads/commissions on the instruments you actually trade, and how the broker behaves during volatile windows. Also, the availability of very high leverage can be useful for experienced traders with strict risk control, but it can also turn small mistakes into large losses quickly.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

ETO Markets Buzz Growth Slows as Tariff Ruling Shakes Policy Outlook ETO Markets

Multi-asset BrokersETO Markets TrendWatch: Walsh Shock Triggers Cross-Asset Liquidity Repricing ETO Markets

Multi-asset BrokersETO Markets Buzz | Equity Strength Meets Inflation Reality as Policy ETO Markets

Multi-asset Brokers

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.