By Giles Coghlan, Chief Currency Analyst at HYCM

Use this in your trading

Last week we looked at the role of the JPY and the CHF as safe-haven currencies. Today we shall look at the reasons why oil falls in a risk off-market.

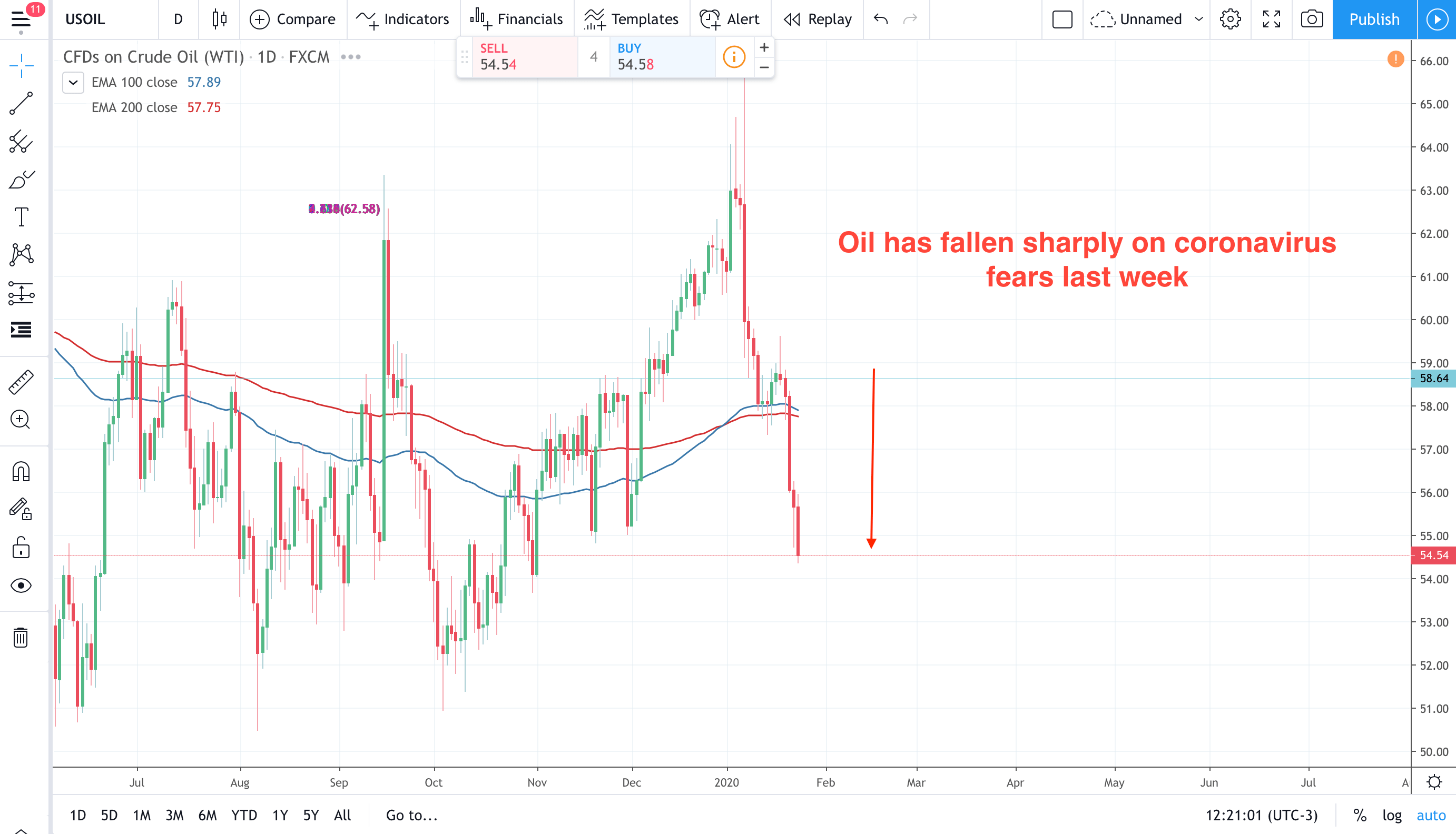

Oil has been falling on coronavirus fears

Last week we saw the move to a risk-off market on the fears that the Chinese coronavirus would become a global pandemic. These fears have continued this week. One of the casualties of these fears is the commodity oil. It fell sharply last week. Why? Well, when the market is in a risk-off mood it is fearing that the global economy is going to shrink. See US Oil Chart for a recent fall in oil prices.

Less growth means less machinery movement for transportation and construction. This, in turn, means there is less demand for oil, so oil prices fall. In the coronavirus instance, people will also travel less by airlines. Remember, in the current market conditions oil is heavily oversupplied, so there is already an oversupply which is keeping oil prices pressured. So we can expect sellers on oil retracements during the coronavirus crisis.

Does oil ever rise in a risk-off market?

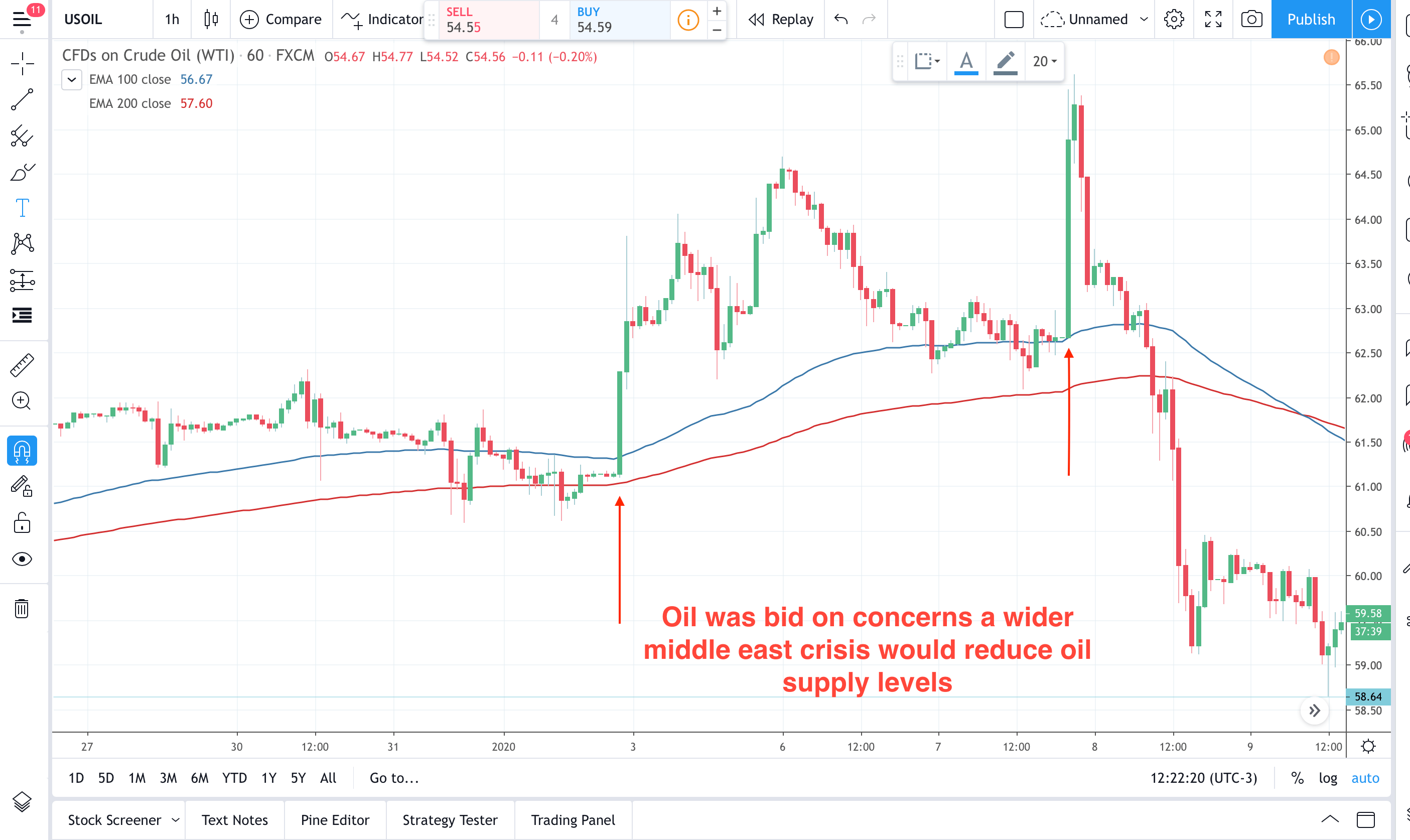

Yes, when the risk is impacting oil’s supply levels. So, during the US-Iran crisis at the start of this year, the market was concerned that a wider middle east conflict would impact some of the world’s largest oil producers. Saudi Arabia, Kuwait, Bahrain, Iran, and Iraq. In this case, although the markets went into a risk-off mood, oil prices increased. Why? Simply because in this instance a middle east conflict would have reduced the supply of oil and pushed it up. See the chart below:

However, this is the exception to the general rule that oil markets fall in a risk off-market.

Learn more about HYCM