By Giles Coghlan, Chief Currency Analyst at HYCM

Gold’s been under the weather

Last week we were surprised by the limited reaction in gold. With so much risk-off tones in the air due to the coronavirus, we had expected to see more than the very muted reactions in gold. So, it was helpful to come across this Bloomberg piece which illuminated the perspective for gold. The following factors have been keeping a lid on gold:

1. Recession fears have fallen. The Bloomberg Economics US Recession probability model shows receding chances of a downturn within the next 12 months. The latest reading is strongly down from 2019 highs and below the levels that anticipated past recessions. The November reading was 26% down from 29% in October and early indications are that December’s readings will show reduced risks for 2020.

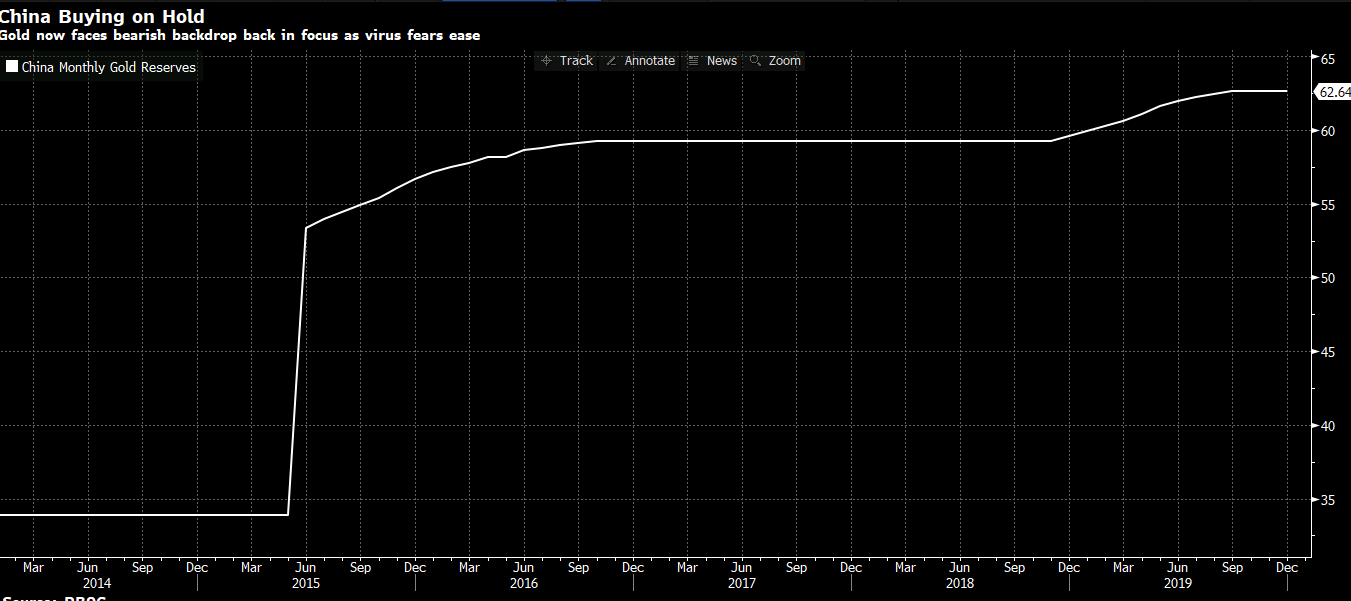

2. Russia’s gold buying is expected to be the lowest in 6 years and China’s gold buying is on hold.

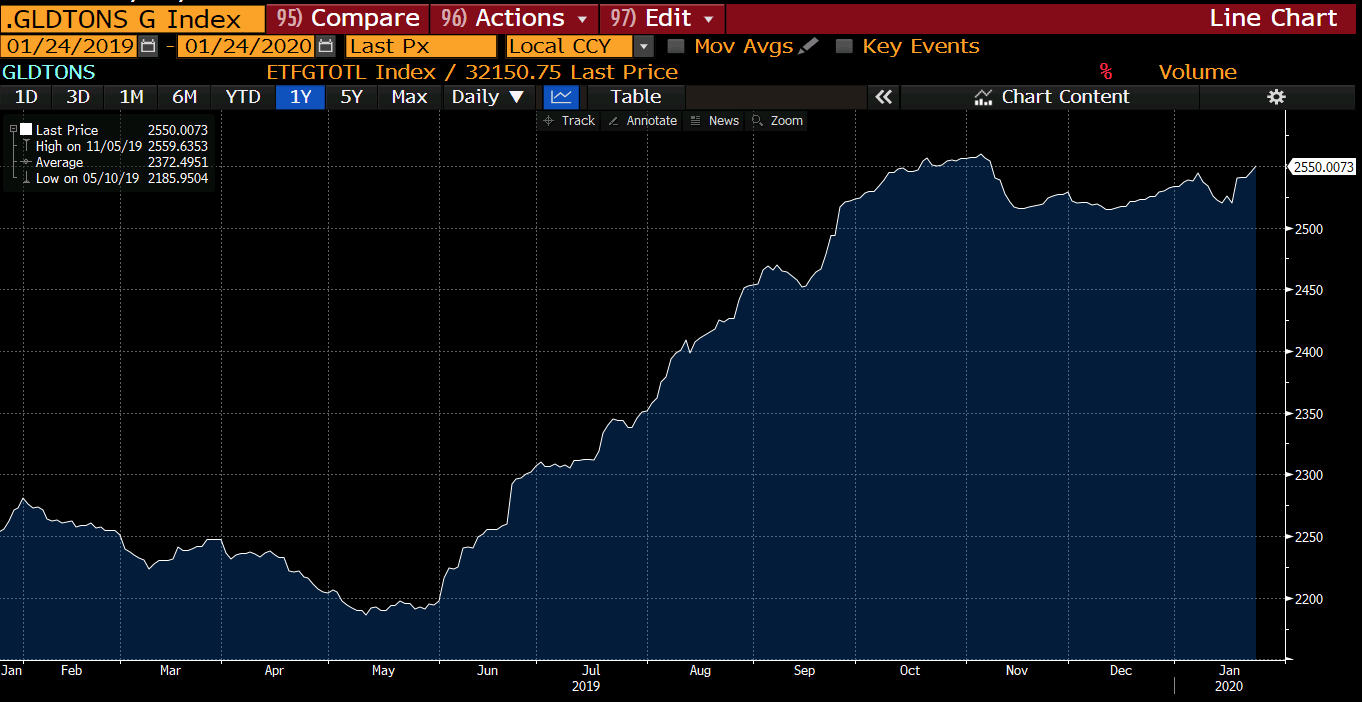

3. Gold ETF holdings, at already elevated levels, moved higher again. However, subject to a major geopolitical flare-up tensions remain elevated.

Sadly, the coronavirus is now gripping the market after a 2% fall in the Nikkei overnight and the extent of the coronavirus starts to expand. We liked Nikkei shorts last week and they look set to fall further through near term daily support.

Learn more about HYCM