Following last week’s Parliamentary debate over PM May’s Brexit plan, as well as Friday’s reports that Britain will seek to delay Brexit, this week, GBP-traders are likely to lock their gaze on Tuesday’s vote in Parliament. That said, with the plan set to be rejected, the question on everyone’s mind may be: What happens next? We also get data from several G10 nations, including Japan, UK, and Canada.

On Monday, during the European morning, we get Sweden’s inflation data for December. Expectations are for both the CPI and CPIF rates to have held steady at +2.0% yoy and 2.1% yoy respectively. That said, once again, we will pay more attention to the core CPIF metric, which excludes energy. At its latest policy meeting, the Riksbank decided to raise rates to -0.25% from -0.50%, the first increase since 2011, while in the accompanying statement, officials noted that the next increase is likely to come during the second half of 2019. The core CPIF rate currently stands at +1.4% yoy after ticking down from October’s +1.5%. Even though a rebound is unlikely to raise bets for another hike at the Bank’s upcoming gathering, which is scheduled for the 13th of February, it could spark some hopes that the policymakers may bring somewhat forth the timing of when they expect to hike again, especially if the rebound in the core CPIF rate is accompanied by decent headline rate. On the other hand, another slide could generate concerns that the Bank may wait a bit longer before lifting interest rates to zero.

From the Eurozone, we the bloc’s industrial production for November, and expectations are for a 1.5% mom decline, after a 0.2% mom rise in October.

On Tuesday, the highlight is likely to be the vote of the UK Parliament over the Brexit deal agreed by PM Theresa May and the EU. With May still facing opposition from all sides within the Parliament, her plan is set to be rejected. Unless of course the Prime Minister secures last-minute concessions from the EU and then manages to convince MPs to support her deal, a conditional probability we see as very low, given the EU’s stance that the current deal is not negotiable.

Thus, the big question in everyone’s mind may be: What happens next? Last week, the Parliament voted that the government should come up with an alternative plan within three working days if the existing deal is rejected. But, what if it doesn’t? In order to avoid a disorderly Brexit, the Parliament may seek to delay Brexit or revert Brexit altogether. With the government denying any headlines regarding the former front, and clearly saying that it won’t revoke its notice, the options left may be a second referendum or a no-confidence vote that could lead to general elections.

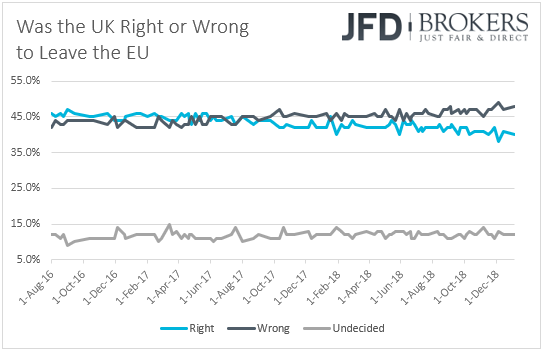

Having said that though, hardliners within the Parliament are unlikely to risk staying within the EU, especially with polls now suggesting that the Britons who believe that...

Read the full financial markets weekly outlook on JFD Research.;