- Rising rates and inflation worries torment stock markets

- Sterling crumbles despite mounting bets for BoE rate hikes

- Japan gets a new prime minister, China releases PMIs

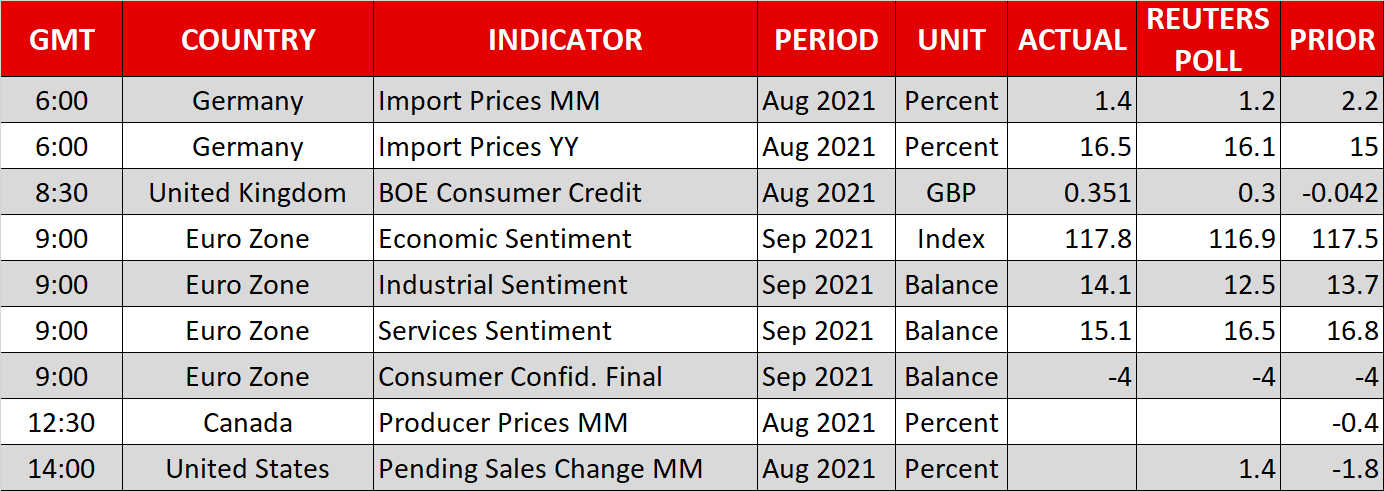

Yields go into overdrive

Stock markets continue to dance to the tune of rising bond yields. It is not so much the magnitude of the spike in yields but rather the speed of this move that has caught investors by surprise. The burning question is what’s driving this sharp repricing in interest rates - is it concerns inflation will be more persistent, expectations that central banks will normalize faster, the deadlock on Capitol Hill, or a combination?

The energy crisis in China probably plays into all this. Rolling power shortages threaten to kneecap industrial production, dealing another blow to struggling supply chains that concludes with inflation being exported abroad as manufacturers are forced to raise prices to cope with the squeeze on margins.

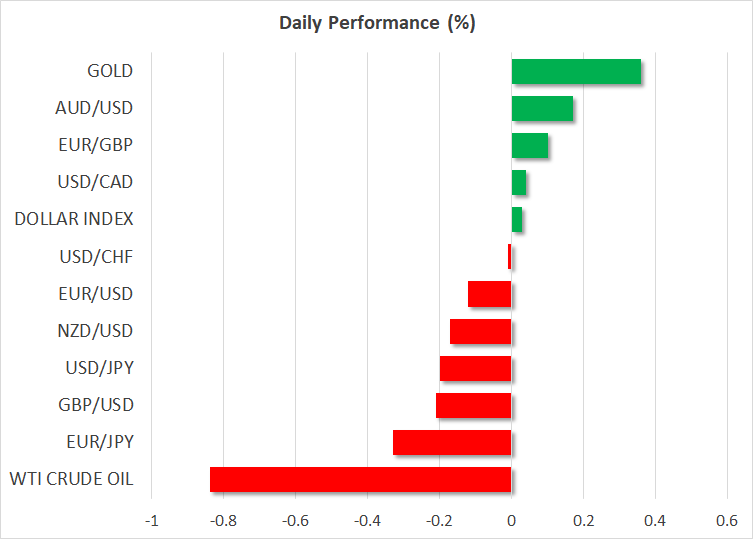

Most of the damage so far has been inflicted on growth and tech stocks, which are the most vulnerable to changes in interest rates as the present value of their future cash flows depends heavily on the discount rate used to price them. Hence, the tech-heavy Nasdaq got hit the hardest yesterday, falling by 2.8%.

The good news is that when stock markets panic about rising rates, the problem usually works itself out. When investors dump stocks because yields are moving higher, there comes a point where the risk aversion becomes so overwhelming that traders are willing to rotate back into bonds just for safety, stabilizing yields and calming stocks.

Yen steadies, sterling crumbles

A similar dynamic can play out in dollar/yen. The pair rigorously followed Treasury yields higher in recent sessions, but when the selloff in equity markets intensified yesterday, its gains were capped as safe-haven flows rushed back into the yen. It is trading a touch lower today, mirroring the minor pullback in yields.

Staying in Japan, Fumio Kishida just won the leadership contest of the ruling LDP party. His victory almost guarantees he will become the next prime minister given the party’s majority in parliament, but he may not hold that position for long as a national election must take place in the next two months. The market reaction was muted, with the yen and Japanese stocks driven mainly by global forces.

Over in the UK, the pound was caught in the perfect storm yesterday. The optics of the fuel crisis and concerns over an economic slowdown joined forces with the selloff in equity markets and a stronger US dollar to push Cable to its lowest level since January.

Even mounting bets for earlier rate increases by the Bank of England couldn’t stop the bleeding in sterling. A quarter-point rate increase is now almost fully priced in for March following some signals from Governor Bailey that rates could be hiked even before asset purchases end this year, to fight inflation. Markets seem to be reading that as a potential policy mistake.

Dollar shines, China PMIs in focus

As usual, the dollar emerged as the biggest winner from the spike in global yields and the ensuing risk aversion. Euro/dollar just touched new lows for the year as investors look for shelter from the storm and after Fed chief Powell noted yesterday that cost-push inflation doesn’t seem to be cooling.

Monetary policy signals will hit an apex today with the leaders of all the major central banks - Fed, ECB, BoJ, and BoE - appearing together in an online panel at 15:45 GMT.

But the real fireworks could come from the Chinese PMIs overnight. Between a painful deleveraging in the real estate sector and the latest energy shortages, the surveys could show economic momentum continues to evaporate. The silver lining is that in this case, Chinese authorities will likely pull on the stimulus levers soon.