- Markets in a cautious mood as lockdown reality eclipses vaccine hype

- Stocks pull back, dollar climbs, but moves rather small in size

- Main event today: Discussion panel featuring Fed, ECB, and BoE chiefs

- ECB sticking to its guns about more stimulus, will Fed follow suit?

Back to reality for markets

A sense of caution has crept back into global markets on Thursday as investors grapple with the short-term covid reality on the ground, which has reined in the enthusiasm around the vaccine endgame. Infection numbers and hospitalizations keep rising in the United States, leading states like New York to reintroduce soft curfews targeting bars and restaurants.

One of president-elect Biden's covid advisors called for a 4-6 week nationwide shutdown to bring the outbreak back under control, which investors may have interpreted as a taste of what is to come. In other words, it is great that a vaccine is now on the horizon, but markets seem to be absorbing the fact that we won't get there for several more months and the world economy could remain under severe duress in the meantime.

Faced with such uncertainties, investors have reverted back to the classic pandemic playbook: buy big tech names that are less sensitive to covid pain. The tech-heavy Nasdaq outperformed the S&P 500 on Wednesday as traders went back to stay-at-home winners and took some profit on the re-opening plays that ripped higher amid the vaccine hype. Futures point to a slightly lower open for both indices today.

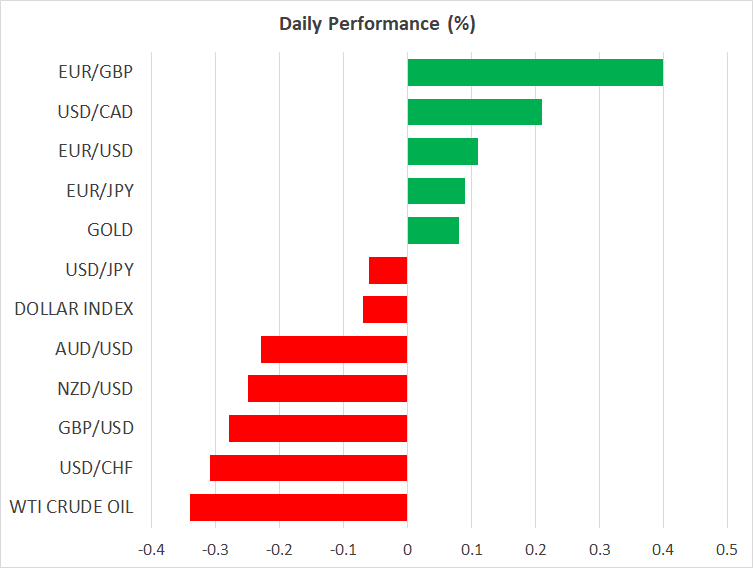

FX market dancing to the cautious beat too

It was a similar story in the currency domain, with the defensive dollar posting some broad-based gains yesterday and commodity-linked currencies being under pressure early on Thursday. That said, all these moves are relatively minor in size, so markets are not exactly panicking either, just factoring in some uncertainty for now.

In the UK, the pound snapped its recent winning streak after briefly touching a six-month high against the euro, without any clear catalyst other than reports of a bitter power struggle in Downing Street. Boris Johnson's director of communications resigned, sparking a round of infighting among his top advisors and threats of further departures within the upper echelons of the administration.

Political drama aside, the main variable for sterling is Brexit, where the talks are now expected to extend into next week and hopes of an imminent agreement are running high. This has been the driving force behind the pound's latest gains, and a deal being finalized over the coming few weeks could be just what the doctor ordered for the beleaguered currency.

Tough time to be a central banker

As for today, all eyes will be on a panel discussion at 16:45 GMT featuring Fed Chairman Powell, European Central Bank President Lagarde, and Bank of England Governor Bailey. Markets are eager to find out how the Fed chief in particular views the latest vaccine news, and whether this diminishes the chances of another round of QE in December.

Other than a shutdown in America, this is arguably the greatest risk for markets now. The entire recovery this year has been built on tremendous central bank liquidity, so any hints that the Fed won't deliver another dose soon could see markets suffer some withdrawal symptoms, sending the dollar higher.

That said, the ECB chief stuck to her guns yesterday, playing down the vaccine optimism and highlighting the dangers the economy currently faces, keeping the door wide open for more action in December. Whether Powell follows in her footsteps today will likely determine the next wave in euro/dollar, and perhaps risk sentiment more broadly.