The US dollar came under strong selling interest yesterday following comments by several FOMC members, who noted that they should wait before proceeding with more rate hikes. The Bank of Canada kept interest rates unchanged but maintained the view that more hikes may be warranted over time. On the trade front, the US-China talks concluded on a positive note, but with no final accord. As for today, EUR-traders are likely to focus on the minutes from the latest ECB meeting.

Greenback Tumbles on Fed Speakers, ECB Minutes in Focus

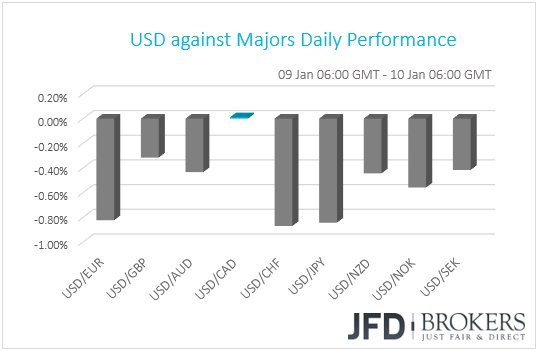

The US dollar traded lower against all but one of the other G10 currencies yesterday. The only currency that did not manage to outperform the US currency was CAD, with USD/CAD ending the day virtually unchanged. The main winners were CHF, JPY and EUR in that order, while the currency that gained the least was GBP.

The driver behind the dollar’s tumble were remarks by a number of Fed members, who said that they would wait before proceeding with more rate increases. Chicago President Evans and Boston President Rosengren supported more hikes this year but...

Read the full financial markets daily report on JFD Research.