- Global stocks continue to rally on upbeat US data and as virus fears ease

- Risk-on further aided after China cuts US tariffs and President Trump gets acquitted

- Dollar climbs to 2-month highs, yen retreats

Unstoppable Wall Street scales fresh records

A string of positive developments added further impetus to the rebound in global stocks, as the recovery extended into a third day. Global stock markets plunged last week with China playing catch up on Monday as fears about the economic impact of the coronavirus outbreak were heightened.

However, investor nerves have since calmed and the panic subsided – at least in financial markets – after China stepped in to support the markets and authorities took drastic measures to halt the spread of the virus. Investors got a glimmer of hope of a treatment for the virus yesterday following some unconfirmed reports of a vaccine and a cure.

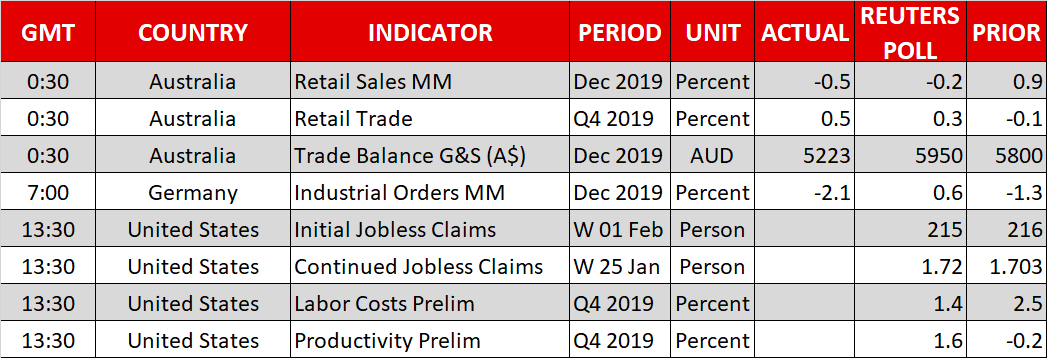

More crucially though for traders, there seems little impact yet on the global economy. In fact, evidence points to a strong bounce back in growth at the start of the year. The run of solid data out of the United States continued on Wednesday with larger-than-expected private employment gain in January according to the ADP survey and a further pickup in the ISM non-manufacturing PMI.

The improving sentiment helped the S&P 500 and the Nasdaq Composite to close at record highs overnight, while in Asia today, the Nikkei 225 index surged by 2.4% to end the day at a two-week peak.

China announces reduced tariffs for some US imports

In a further boost to risk appetite, China said it will halve the tariffs on some $75 billion of US imports as it seeks to increase its purchases of American goods as part of the ‘phase one’ trade deal signed last month. The move should not only benefit Chinese companies struggling from the hit to businesses from the coronavirus but may also smoothen the path towards ‘phase two’ talks with the US.

There was more good news for investors on Wednesday as the US Senate voted to acquit President Trump from the impeachment charges, as widely expected, ending months of political game in Capitol Hill.

Market reaction to Trump’s acquittal was muted as there was never a strong probability that the President would be voted out of office. The real political risk is likely to begin emerging now as the Democratic primaries and caucuses get underway. The first of the results from the Iowa caucus put an outsider, Pete Buttigieg, and the popular liberal Bernie Sanders in the lead. Should candidates like Sanders continue to perform well, it would only be a matter of time before Wall Street turns more cautious at the prospect of a ‘radical’ presidential nominee for the Democratic Party.

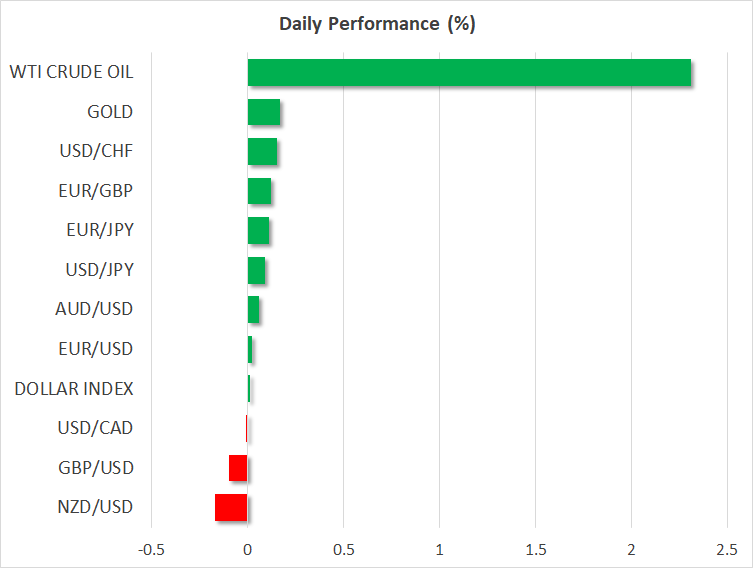

Dollar maintains bullish mode

In the currency markets, the US dollar outperformed its rivals as a rebound in US Treasury yields increased the greenback’s yield advantage. The dollar index climbed to a two-month high of 98.33, while against the yen, it came just shy of hitting the 110 level. With not much in terms of major releases on the US calendar today, the dollar will take its next cue from tomorrow’s nonfarm payrolls report. The ADP report has set the stage for a strong set of official jobs figures on Friday, which can only mean more upside for the US currency and more pressure for the euro and the pound.

The Australian dollar has been one of the few exceptions that hasn’t succumbed to the greenback’s latest rally as an unexpectedly neutral stance by the Reserve Bank of Australia has led investors to sharply scale back their rate cut bets. The aussie was last trading around one-week highs at $0.6746.