It is day 6 of the US government shutdown, which is taking centre stage, as the disagreements between Trump and Congress continue. Dow surges more than a 1000 points making the biggest gain in a one-day trading session.

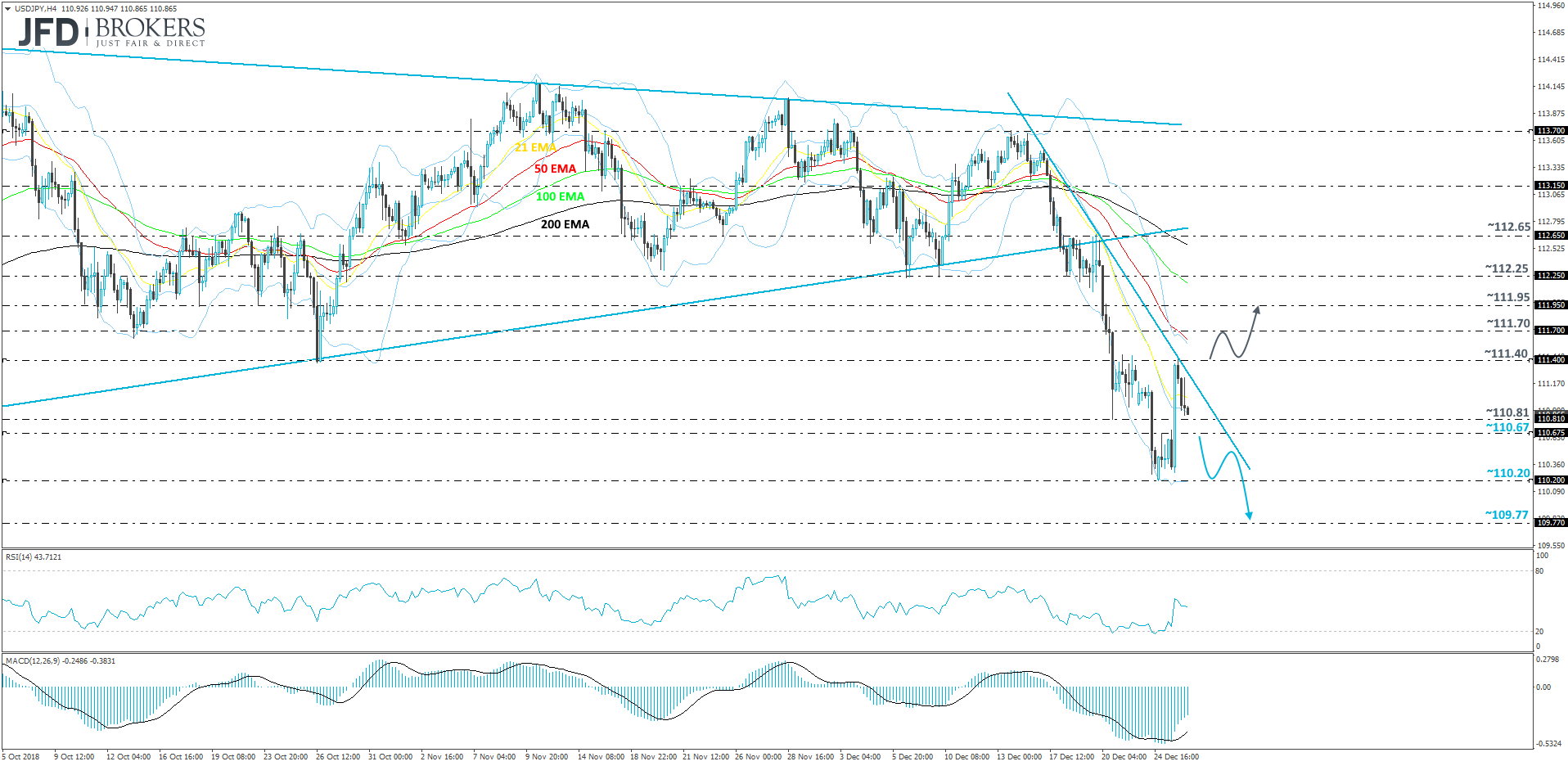

USD/JPY – Technical Outlook

USD/JPY had a great run yesterday, together with the US equity markets, where the pair managed to get back some of its lost grounds. That said, overall, USD/JPY still looks bearish, as near-term trend has turned to the downside. The pair is trading below its short-term downside resistance line taken from the high of the 17th of December. As long as it remains intact, we will continue aiming lower.

A drop back below the 110.67 hurdle, marked by the intraday swing high of yesterday, may lead towards a re-test of the recent December low at 110.20. This is where the rate could stall for a bit, but if the bears remain strong, a new December low may be established. This is when we will aim for the 109.77 zone, which was the low of the 21st of August.

Alternatively, if USD/JPY breaks the aforementioned short-term downside resistance line and moves above the 111.40 barrier, this might open the door to the next potential area of resistance at 111.70, a break of which could lead towards a test of the 111.95 level, marked by the inside swing high of the 26th of October and the lows of the 18th and the 23rd of the same month.

The Stock Market Rebounds

Yesterday, while parts of the world were still celebrating the second day of Christmas, the US market opened as usual. Even before the opening bell, the top three US indices were above their Monday’s closing prices, but when the bell rang...

Final link from Tuesday to Friday:

Read the full financial markets daily report on JFD Research.