US dollar bullish bets fell to $22.45 billion from $28.0 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to December 20. The decline in bullish US dollar bets happened despite the Fed Decision to hike short term rates 0.25 percentage points for the second time in a decade on December 14. And while the rate hike was widely expected as most policy makers had expressed their support for the move, the indication of a faster pace of rate hikes in 2017 than previously believed was a surprise.

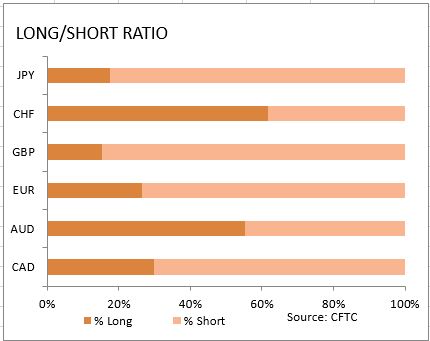

The dot plot of policy makers’ predictions of the number of rate hikes in 2017 showed that the median estimate of rates rises to between 1.25% and 1.5% at the end of 2017 from between 0.5% and 0.75% at the end of 2016, suggesting three hikes of 25 basis points each over the next year. The new plot is more hawkish than the September chart where the median projection was 2 hikes in 2017. Clearly policy makers see a need to tighten the monetary policy more forcefully with the proclaimed support of president elect Trump for more fiscal stimulus measures such as tax cuts and infrastructure projects justifying expectations of higher inflation. Meanwhile the data during the week were not unequivocally positive. The headline inflation fell to 0.2% from 0.4% in October with core inflation unchanged at 2.1%. The industrial production fell 0.4% on month in November as did the retail sales to 0.1% from 0.6%. And while the flash Manufacturing PMI for December rose to 54.2 from 54.1 in November the expansion of the services sector slowed as the flash Services PMI fell to 53.4 from 54.6 driving the flash Composite PMI lower to 53.7 from 54.9. Housing starts and building permits also fell in November. Investors cut the dollar bullish bets for the first time in more than a month after the FOMC decision. As is evident from the Sentiment table, sentiment improved for all currencies except of Japanese yen and Australian dollar. And the Swiss franc joined the Australian dollar as the second major currency held net long against the US dollar.

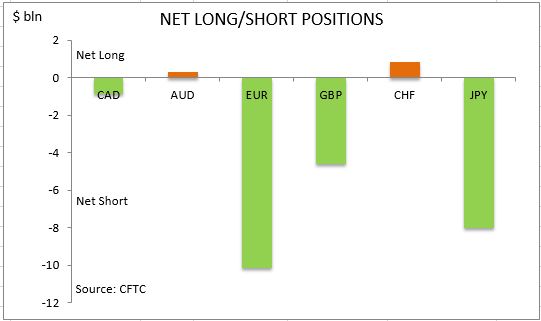

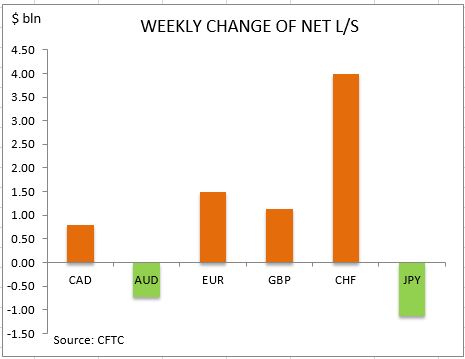

The euro sentiment improved with the net short euro position narrowing by $1.5bn to $10.1bn. Investors cut considerably both the gross longs and shorts by 6107 and 15605 contracts respectively. The British Pound sentiment also improved after the decision by the Bank of England to keep the policy unchanged. The Pound net shorts fell by $1.1bn to $4.59 billion. The net short position in British Pound narrowed as investors increased the gross longs and covered shorts by 3637 and 9356 contracts respectively. The Japanese yen sentiment grew more bearish as the net short position widened $1.1 to $8.0bn. Investors increased both the gross longs and shorts by 1768 and 13788 contracts respectively.

The Canadian dollar sentiment improved considerably with the net shorts declining by $0.79bn to $0.88bn. Investors cut both the gross longs and shorts. The bullish sentiment further deteriorated for the Australian dollar with net longs falling by $723 million to $0.29bn. Investors cut the gross longs and built shorts. The sentiment toward the Swiss franc continued to improve as the Swiss National Bank decided to leave the monetary policy unchanged turning the $3.1bn net short position into a net long of $0.86bn. Investors increased the gross longs as they covered shorts.

CFTC Sentiment vs Exchange Rate

| December 20 2016 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | positive | -880 | 786 |

| AUD | bullish | positive | 286 | -723 |

| EUR | bearish | positive | -10133 | 1489 |

| GBP | bearish | positive | -4587 | 1136 |

| CHF | bullish | positive | 864 | 3988 |

| JPY | bearish | negative | -8001 | -1121 |

| Total | -22450 |