‘Risk on’ was once again the main game in town yesterday as headlines that US-China talks entered a third day increased hopes that a deal may be closer than previously thought. As for today, apart from news on the trade front, CAD traders are likely to focus on the BoC rate decision. No action is expected but given that this is one of the “bigger” meetings, attention is likely to fall on the statement, the economic projections and the press conference by Governor Poloz. The minutes from the latest FOMC meeting are also published.

‘Risk-on’ Prevails as Hopes for US-China Truce Increase

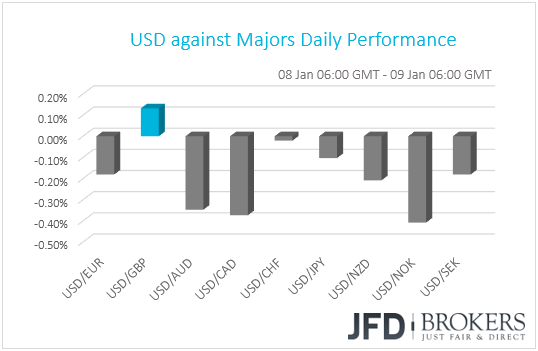

The dollar traded lower against most of the other G10 currencies on Tuesday. It gained only against GBP, while it traded virtually unchanged versus CHF. NOK, CAD, AUD and NZD were the main winners, while the yen was the currency that gained the least.

The strengthening of the commodity-linked currencies and the failure of the safe-havens to gain ground suggests that the broader risk appetite remained supported. Indeed, European and US equity indices were a sea of green yesterday, with the positive sentiment rolling into...

Read the full financial markets daily report on JFD Research.