Nasdaq records seventh straight day of gains

US stocks rebounded on Wednesday as oil prices jumped. The dollar slid as Trump’s press conference yielded no clarity on president-elect’s fiscal stimulus measures. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.18% lower at 101.846. The S&P 500 advanced 0.3% settling at 2275.32 with the energy and utilities sectors the best performers. The Dow Jones industrial average rose 0.5% to 19954.28, led by gains in Merck and IBM shares. The Nasdaq Composite index ended at a new record high up 0.2% at 5563.65, the seventh straight day of gains for the technology index.

Trump’s comments weigh on drug stocks

European stocks extended gains on Wednesday with drug stocks limiting markets’ advance. Both the euro and British Pound strengthened against the dollar as US Treasury yields slipped after Trump’s press conference. The Stoxx Europe 600 added 0.2%. Germany’s DAX 30 outperformed rising 0.5% to 11646.17 . France’s CAC 40 ended marginally higher at 4888.71 and UK’s FTSE 100 index gained 0.2% to 7290.49, recording an an all-time high for a tenth straight session helped by 2.1% rise in industrial production in November.

Asian markets slip after Trump’s news conference

Asian stocks are retreating today after Trump’s conference on Wednesday failed to provide additional details on president-elect’s stimulus plans. Nikkei fell 1.2% to 19134.70 as yen continued strengthening against the dollar. Investors shrugged off the report the surplus in the current account rose 28% from a year earlier. Chinese stocks are also in negative territory with the Shanghai Composite Index down 0.5% and Hong Kong’s Hang Seng index 0.6% lower as investors booked gains from previous session. Australia’s All Ordinaries Index slid 0.04% as the Australian dollar edged still higher against the dollar.

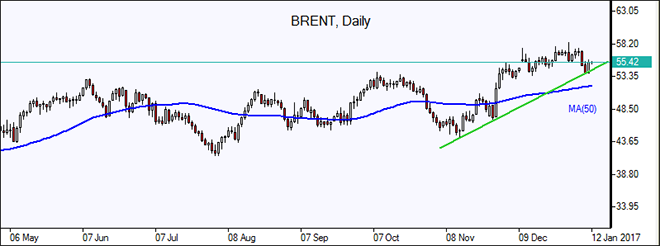

Oil prices rise despite US inventory build

Oil futures prices are edging higher today after the report of the Energy Information Administration US crude stocks climbed by 4.1 million barrels to 483.11 million barrels. However, record US refinery runs of 17.1 million barrels per day (bpd), up 418000 bpd on the week, indicated strong demand, supporting prices. March Brent crude closed 2.7% higher at $55.10 a barrel on Wednesday on London’s ICE Futures exchange.