Exit uncertainties weigh on British Pound

UK economy is expected to slow down in 2017. Will the British Pound continue weakening?

The Bank of England left the interest rate unchanged at 0.25% at its meeting on December 15 and kept the total volume of annual asset purchases at 435 billion Pounds. The central bank cut the interest rate after the Brexit vote to stimulate the economy in light of dimmer prospect for growth under uncertainty surrounding the actual terms of exit from the European Union. While the British economy fared better than initially feared in months after the Brexit vote, the GDP slowed slightly to 0.5% on quarter in the third quarter growing from a 0.7% expansion in the previous quarter. The central bank estimates the economy will decelerate next year as slower increase in real household income negatively impacts household spending. The GfK report on Thursday showed the GfK’s consumer confidence index changed little this month to negative 7 from negative 8 , while its measure of household’s outlook for the economy slipped to minus 23 from minus 22. Excluding the sharp drop in July after the Brexit referendum, that’s the lowest reading in almost four years. At the same time the UK government net borrowing grew from the previous month and at £12.6 billion ($15.5 billion) in November was higher than expected. The development was in line with British Finance Minister Philip Hammond’s 23 November budget statement which indicated that the government plans slower-than-expected fiscal consolidation. And while the central bank expects the inflation will rise to its target of 2.0% in the next six months and increase above the target in 2018 due to the depreciation of the sterling which will prompt appropriate monetary tightening to curb inflation, slower fiscal consolidation and expected economic slowdown as business investment falls ahead of actual exit from the common EU market is bearish for the British Pound in near term. On January 3 December Manufacturing PMI will be reported, no change is expected. On January 4 and 5 December Construction PMI and Services PMI will be published, slight improvement is expected.

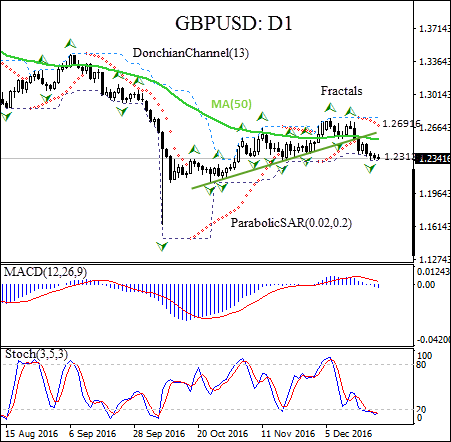

On the daily chart the GBPUSD: D1is below the 50-day moving average MA(50) which is leveling off. The price has breached below the support line of the uptrend and is edging lower.

- The Parabolic indicator has formed a sell signal.

- The Donchian channel is flat, indicating no trend yet.

- The MACD indicator gives a bearish signal.

- The stochastic oscillator has breached into the oversold zone, this is a bullish signal.

We believe the bearish movement will continue after the price breaches below the lower Donchian bound at 1.23129, confirmed also by fractal low. It can be used as an entry point for a pending order to sell. The stop loss can be placed above the Parabolic at 1.26916. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (1.26916) without reaching the order (1.23129) we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

| Position | Sell |

| Sell stop | Below 1.23129 |

| Stop loss | Above 1.26916 |