High global crop estimate is bearish for wheat prices

Global wheat harvest is expected to reach third record high in 2017-18 due to favorable weather conditions. Will the wheat price continue falling?

World wheat production will decline next season – just slightly, according to the International Grains Council (IGC). IGC estimates the 2017-18 global wheat harvest at 735m tonnes. It is just 17m tonnes below the all-time high, making it the third biggest on record. The harvest is forecast to change little as the rise in Indian wheat sowings offsets sharp declines in US plantings while favorable weather conditions are expected in northern hemisphere, which accounts for the majority of world production. Ending season stocks in 2017-18 also are forecast to decline only marginally. High crops and ending season stocks are bearish for crop prices.

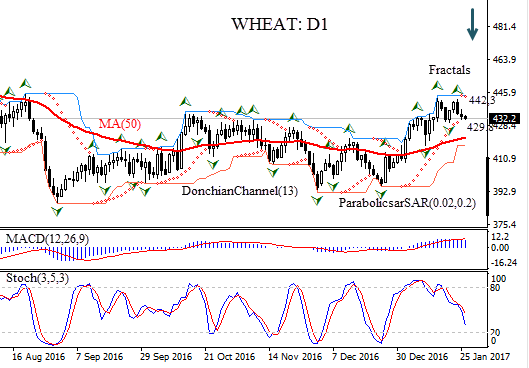

On the daily timeframe WHEAT: D1 is falling after rising to four month high in mid-January.

- The Donchian channel gives a neutral signal: it is flat.

- The Parabolic indicator has formed a sell signal.

- The MACD indicator gives a bearish signal.

- The stochastic oscillator is falling and has not reached the oversold zone yet.

We expect the bearish momentum will continue after the price closes below the last fractal low at 429.8. It can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 442.3. After placing the pending order the stop loss is to be moved following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (442.3) without reaching the order (429.8), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

| Position | Sell |

| Sell stop | Below 429.8 |

| Stop loss | Above 442.3 |