Falling long bets in agricultural commodity futures weigh on wheat prices

Speculators cut net long position in futures and options in agricultural commodities, including grains, last week. However early next year rebalancing of index funds is expected to result in buying of grains futures. Will the wheat price continue falling?

According to the Commodity Futures Trading Commission data managed money, a proxy for speculators in commodity futures contracts or commodity options, cut their net long position in futures and options in the top 13 US-traded agricultural commodities in the week to last Tuesday. The selling was led by grains in which the net long was cut by 44259 contracts to less than 29000. At the same time analysts note that many index funds are poised to start buying grains in early-year rebalancing of portfolios. For Chicago soft red winter wheat and Kansas City hard red winter this rebalancing process is expected to result in buying equivalent to 8.9% and 14% respectively of daily trading volumes during January 9-13 rebalancing period, according to Societe Generale estimates. This may be bullish for wheat prices.

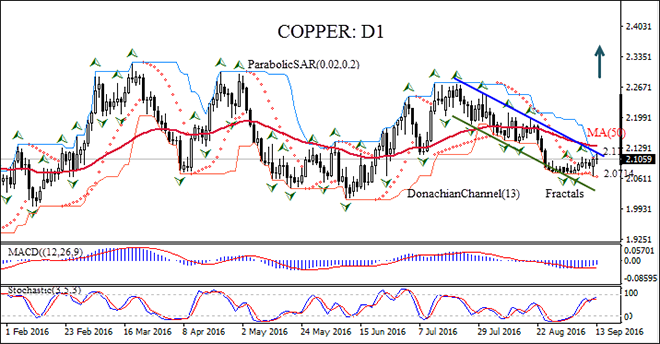

On the daily timeframe WHEAT: D1has been trading with negative bias after hitting sixteen-month high in mid-June. The price failed to breach above the 50-day moving average MA(50) on Tuesday after rallying 3.5%, the biggest one day gain in over two and half months.

- The Donchian channel gives a neutral signal: it is flat.

- The Parabolic indicator has formed a sell signal.

- The MACD indicator gives a bullish signal.

- The stochastic oscillator is rising and has not reached the overbought zone yet.

We expect the bearish momentum will continue after the price breaches and closes below the lower Donchian channel at 395.5, confirmed also by last fractal low. It can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 413.9. After placing the pending order the stop loss is to be moved following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (413.9) without reaching the order (395.5), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

| Position | Sell |

| Sell stop | Below 395.5 |

| Stop loss | Above 413.9 |