Waiting for the end of the neutral trend

Corn prices are moving in a narrow neutral range almost 3 months due to the approximate balance of the supply and demand. Is it possible to have strong price movement in case corn leaves the range?

TIn 2016, corn prices fell by 2, 5%. Thus, the corn price decline is observed for already 4th year in a row. However, on the chart all this looks like a neutral trend. The downward price momentum was formed due to the large harvest in 2014/15 agricultural season which was 1014 million tons. In 2015/16 season, the harvest dropped to 961 million tons, but in 2016/17 season a record crop of 1030 million tonnes is expected. Optimistic global crop forecasts do not let corn prices rise. At the same time, prices are supported by the risk of drought in Argentina and northern Brazil on the background of the emerging La NIna natural phenomenon.

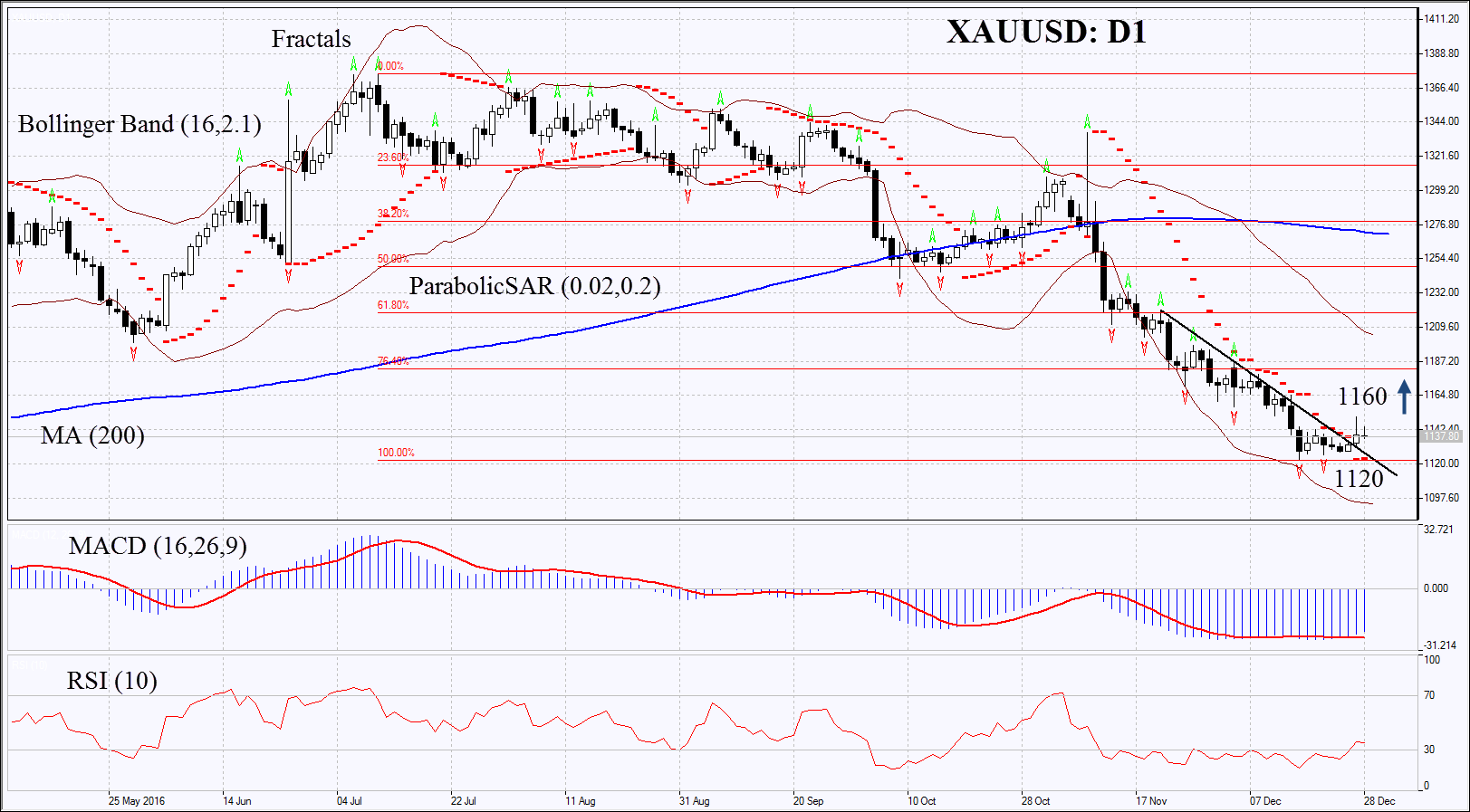

On the daily chart Corn: D1 is in the neutral trend. Further price increase is possible in case of worse weather conditions and increase in demand for corn.

- Parabolic indicator gives bearish signals.

- The Bollinger bands have strongly narrowed which indicates low volatility.

- The RSI is below 50. No divergence.

- MACD gives a signal to sell, but its amplitude is so small that it can be ignored.

In our opinion, a bullish momentum will develop after the price rises and breaks above the last two fractal highs, the Bollinger bands, the 200 – day moving average and Parabolic signal at 366, or in case the price falls below the two fractal lows and Bollinger bands at 340. Let the market choose the scenario of the movement. Two or more positions may be placed symmetrically: after opening one of the orders, the second order may be deleted: the market has chosen the direction. After opening the pending order we shall move the stop every 4 hours to the next fractal high (short position) or low (long position), following the Parabolic signal. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level without reaching the order we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

| Position | Sell |

| Sell stop | below 340 |

| Stop loss | above 366 |

| Position | Buy |

| Buy stop | above 366 |

| Stop loss | below 340 |