- US equities close at new highs as Powell confirms liquidity injections will continue

- Futures point to a higher open today as well, despite Bernie Sanders’ election victory

- Kiwi jumps as RBNZ abandons easing bias, signals an end to rate-cut cycle

Wall Street sets more records, yen and gold retreat

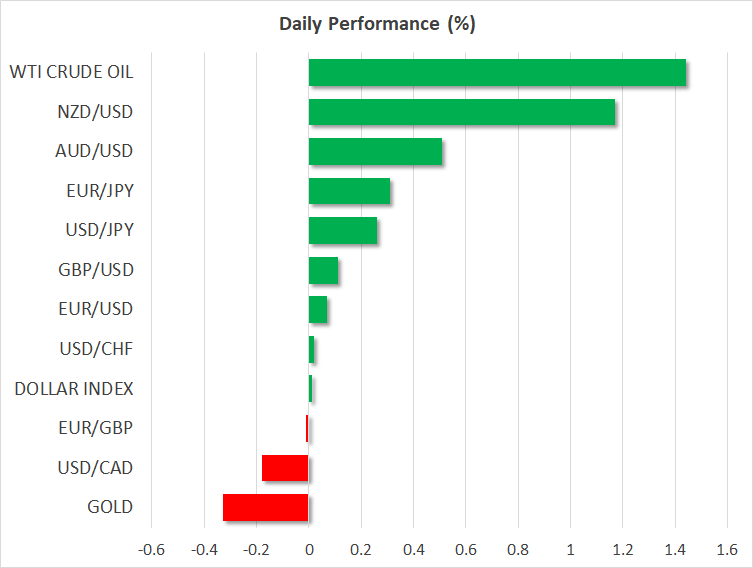

Financial markets continue to trade in a ‘risk-on’ manner as fears that the coronavirus will have a long-lasting impact on the global economy are gradually diminishing, thanks to a substantial slowdown in the number of new infections. The defensive Japanese yen struggled in this cheerful environment, retreating in tandem with gold prices as investors rotated funds towards riskier assets, like commodity currencies and stocks.

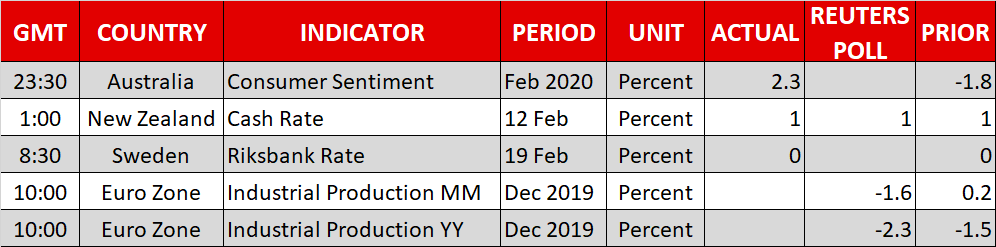

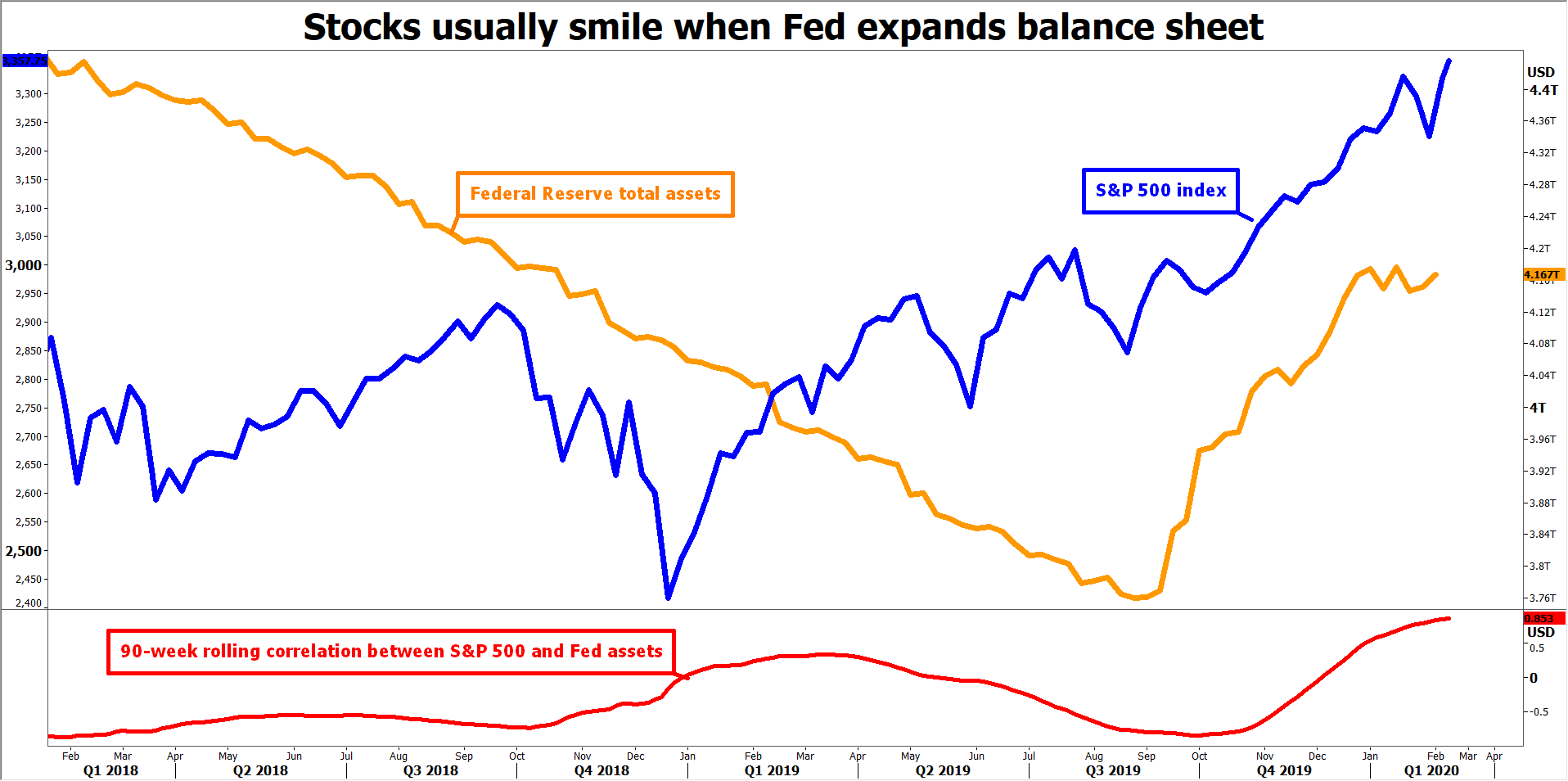

The benchmark S&P 500 (+0.17%) closed at another record high on Tuesday, with equities also taking heart from some comments by Fed Chairman Powell. Speaking before the US House Financial Services Committee, he said his central bank will continue to inject massive doses of liquidity into the system for at least a few more months. This was probably music to the ears of stock bulls, as expansions in the Fed’s balance sheet typically push investors further out into the risk spectrum and by extension, boost equity markets.

US stocks pared some gains late in the session though, following reports that the Federal Trade Commission will expand its monopoly investigation into big tech firms – Amazon, Apple, Facebook, Microsoft, and Google. Federal regulators want to determine whether these giants bought smaller competitors to stifle competition.

Stock futures not ‘feeling the Bern’

What’s striking is that futures are pointing to another positive open on Wall Street today, despite what should have been a nightmare outcome for stocks overnight, with Bernie Sanders winning the Democratic primary in New Hampshire. The Senator from Vermont – who advocates for higher business taxes and higher public spending – has also taken the lead both in recent nationwide opinion polls and in betting markets, so it may be just a matter of time before asset managers take his chances seriously too.

Given his flagship policies like ‘Medicare for All’ and a ‘Green New Deal’, the more he gains momentum, the more sectors like Healthcare and Energy are likely to lag the broader market, even if many assume Trump would destroy him in the general election. In other words, this might be a major theme - and therefore risk - for equities going forward.

NZD jumps as RBNZ doesn’t forecast rate cuts

In New Zealand, the local dollar jumped overnight after the Reserve Bank kept rates unchanged and surprisingly abandoned its easing bias, not penciling in any rate cuts for 2020. Policymakers appeared rather optimistic despite the coronavirus outbreak, indicating that they expect most of that impact to be short-lived, and that fiscal policy in New Zealand will help boost investment and cushion the economy.

The officials even incorporated a rate hike in late 2021 into their forecasts, though admittedly, that’s so far away it has little value, given how many things can change in the meantime.

As for the kiwi, the currency is not out of the woods yet. While the RBNZ is optimistic, markets are still pricing in a ~40% chance for a rate cut by September, as there’s a real risk that the virus fallout proves more significant and persistent than policymakers expect. For the kiwi to be able to rally in a sustainable manner, contagion fears need to subside further, setting the stage for a real recovery in commodity prices as well.

Finally, we have three Fed speakers on the agenda today. Chairman Powell continues his testimony at 15:00 GMT, this time before the Senate. Before that, we’ll hear from regional Fed presidents Harker (13:30 GMT) and Daly (14:00 GMT).