Dow fails to break above 20000 yet

US stock indices closed lower on Wednesday as Dow failed to break above 20000. The dollar pulled back with investors consolidating recent gains. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.25% lower at 103.026. The S&P 500 ended 0.1% lower settling at 2265.18 weighed by losses in health care stocks, with eight of its eleven main sectors finishing in the red. The Dow Jones industrial average ended 0.2% lower at 19941.96, yet again closing below the psychologically important level 20000 and retreating from the all-time high set the previous day. Losses in biotechnology shares pulled down the high tech index Nasdaq 0.2% to 5471.43.

Italy’s parliament approves bank rescue loan

European stocks pull back from 2016 highs with falling bank shares dragging the market lower on Wednesday. The euro ended higher while the British Pound weakened against the dollar as data showed the £12.6 billion ($15.5 billion) the UK government borrowed in November compared with the year-earlier period was higher than expected. The Stoxx Europe 600 ended 0.5% lower. Germany’s DAX 30 outperformed as it edged up 3.9 points to 11468.64. France’s CAC 40 fell 0.3% and UK’s FTSE 100 index inched down less than 0.1% to 7041.42.

Asian stocks mixed ahead of holidays

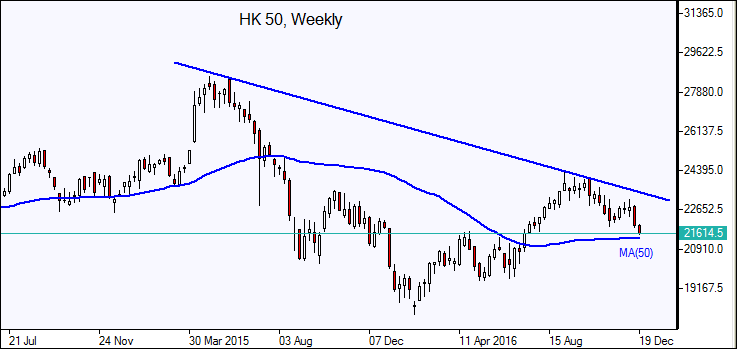

Asian stocks are mixed today as investors are reluctant to make big bets in the run-up to the Christmas holidays. Nikkei fell 0.1% to 19427.67 despite a weaker yen against the dollar. Investors booked gains after the index hit one-year highs the previous day, pulling down financial stocks while exporter shares advanced. Chinese property stocks were under pressure after President Xi Jinping confirmed China will limit credit flowing into property speculation in 2017 and restrain property bubbles: the Shanghai Composite Index is up 0.1% and Hong Kong’s Hang Seng index is 0.8% lower. Australia’s All Ordinaries Index gained 0.5% while the Australian dollar edged higher against the dollar.

Oil prices pull back on surprise US inventory build

Oil futures prices are retreating today after a surprise report of the Energy Information Administration US crude stocks climbed by 2.3 million barrels instead of an expected decline of 2.5 million barrels. An additional negative for the oil market was Libya's National Oil Corporation announcement it hoped to add 270000 barrels per day (bpd) to national production after it confirmed on Tuesday that pipelines leading from the Sharara and El Feel fields had reopened. Libya recently doubled output to 600,000 bpd. February Brent crude closed 1.6% lower at $54.46 a barrel on Wednesday on London’s ICE Futures exchange.