Leveraged fund blows up, sending ripples across equity markets

Yet, the real risk this week may be signals for US tax increases

Calmer tones prevail in FX market, with dollar finding some love

Forced liquidations keep stock markets on edge

Global stock markets closed near record highs on Friday, but it was a stormy ride with lots of volatility. It turns out that a leveraged fund named Archegos Capital blew up, sparking a wave of forced selling as its positions were liquidated. This 'mysterious seller' kept markets on edge until investors finally deciphered what was happening late on Friday.

Once the uncertainty was out of the way, a massive rally followed. When traders sense that a big player is panic selling, everyone freezes, fearful of a cascade. But after it becomes clear that this is simply a result of some bad risk management and that the incident is isolated, investors are happy to pick up the pieces at discount prices.

Wall Street futures point to a lower open today, amid concerns that there might be more liquidation trades pending. This incident reminded markets of the dark side of leverage, likely leading some players to cut their risk exposure near record highs to avoid any serious losses if the selling snowballs.

Quarter-end rebalancing might also be at play. Since stocks outperformed bonds dramatically this quarter, funds that have to maintain a fixed equity/bond ratio could be selling stocks to buy back bonds.

Will the 'tax man' play havoc in markets?

While the longer-term trajectory for stocks is likely higher, markets will have to grapple with some serious risks soon. President Biden is pushing hard for an enormous infrastructure package later this year, which will be financed by increasing corporate and capital gains taxes.

The Democrats will try to ram this bill through Congress without Republican support again, and even the most fiscally conservative Democratic lawmakers seem to be on board. The overall economic impact of raising corporate and investment taxes to fund infrastructure spending should be positive, but the market impact is another story.

If markets sense that higher capital gains taxes are imminent, a substantial correction may follow as investors lock in some profits with the current lower rates. Company valuations could also deflate somewhat, as a higher tax rate is baked into pricing models.

That said, it's doubtful whether this will spark anything more than a mere correction. The Democrats won't risk shattering the recovery by hammering too hard on taxes, and the fiscal tightening could even make the Fed more patient about raising rates. With the vaccination program firing on all cylinders and a stimulus-fueled boom in sight, even the 'tax man' might not derail this rally.

President Biden is expected to provide the details of his infrastructure plan on Wednesday.

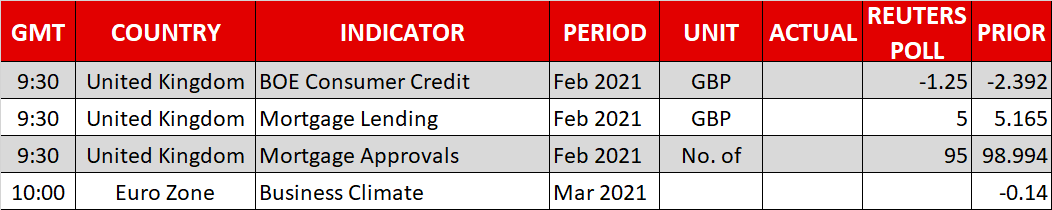

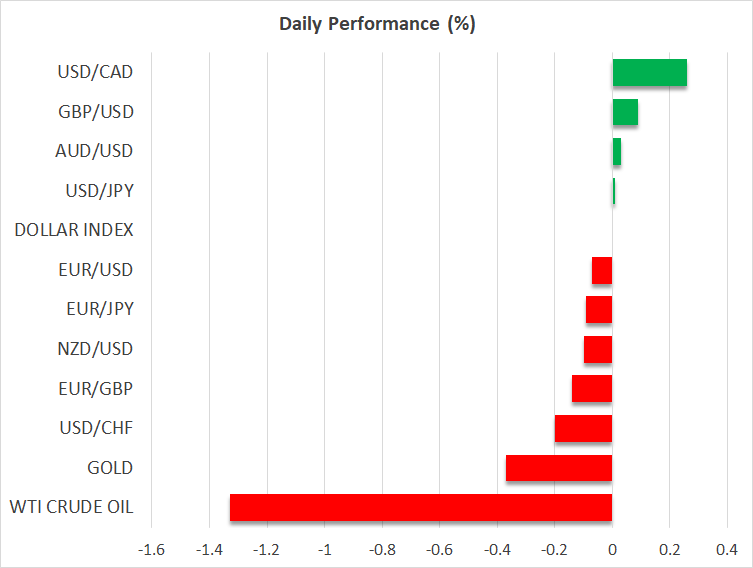

Dollar holds firm, euro/sterling breaks lower

Over in the FX arena, things are calmer. The dollar is finding some love on Monday, likely because of the defensive atmosphere in the broader market. While the greenback could take some fire this week amid signals for higher taxes, the overall picture remains positive against the euro and the yen.

In a nutshell, the US economy is much stronger and miles ahead in the immunization game compared to Europe's and Japan's. This ultimately translates into the Fed normalizing policy years before the ECB or the BoJ. Speculators are still net-long on the euro, so there is scope for euro/dollar to retreat further as those bullish bets are unwound.

Elsewhere, euro/sterling resumed its downtrend to touch a fresh one-year low, as the divergence in EU/UK vaccination fortunes continues to dictate sentiment.

In other news, the Suez Canal has been almost unblocked, adding some weight to oil prices today.

The calendar is almost empty today, though a speech by the Fed's Christopher Waller at 16:00 GMT could be interesting. He is a new addition to the FOMC and a permanent voting member, so markets will be trying to decipher where he stands on the hawk/dove spectrum.