After the boost received from upbeat headlines with regards to last week’s US-China trade talks, risk appetite eased somewhat, with negotiations set to continue in Washington this week. Concerns over a potential escalation between the US and the EU with regards to auto tariffs may have been one of the reasons behind the slightly softer investor morale. Overnight, the RBA minutes echoed Governor Lowe’s remarks with regards to a potential rate cut, noting that members saw scenarios where interest rates could increase or decrease, with the probabilities more evenly balanced than before.

US and China Trade Talks Resume, RBA Members See Rate-Cut Scenarios

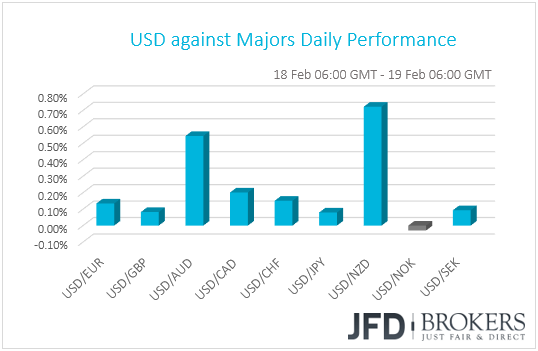

After sliding on Friday, the dollar stabilized on Monday, trading higher or unchanged against the other G10 currencies. The currencies that lost the most were NZD and AUD in that order, with CAD, CHF and EUR taking the third, fourth and fifth place respectively, although suffering much less than the former two. The greenback traded virtually unchanged, within a ±0.10% range, against GBP, JPY, NOK and SEK.

With no major economic data on yesterday’s agenda, the stabilization of the dollar and the yen, combined with the weakening of the commodity-linked currencies, suggests that...

Read the full financial markets daily report on JFD Research.