By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On the last Monday of June, oil is moving downwards quite fast. Brent is under significant pressure and trading at $40.39.

Investors are pretty nervous because of monitoring the number of new COVID-19 cases. First of all, we’re talking about the USA, and it is reviving fears and concerns about the second wave of the coronavirus pandemic. Market players are really afraid of new outbreaks because a possible new wave of the disease may transform into something much more serious and make all the efforts put into stabilizing the global economy useless. If the world is flooded with the second wave, the demand for energies may go down and, as a result, commodity prices may plunge as well.

In the USA, potentially dangerous places right now are Texas, Florida, and Los Angeles.

The latest data from Baker Hughes showed another decline in the number of rigs in the USA. For example, since the beginning of the year, the number of oil rigs has dropped by 70%. Over the last week, the total number of rigs (bot oil and gas) lost 1 unit and now equals 265. It’s the lowest number since May 2009.

Stay tuned to the RoboForex Blog for exclusive financial forecasts, professional expert analysis, how-to articles and more.

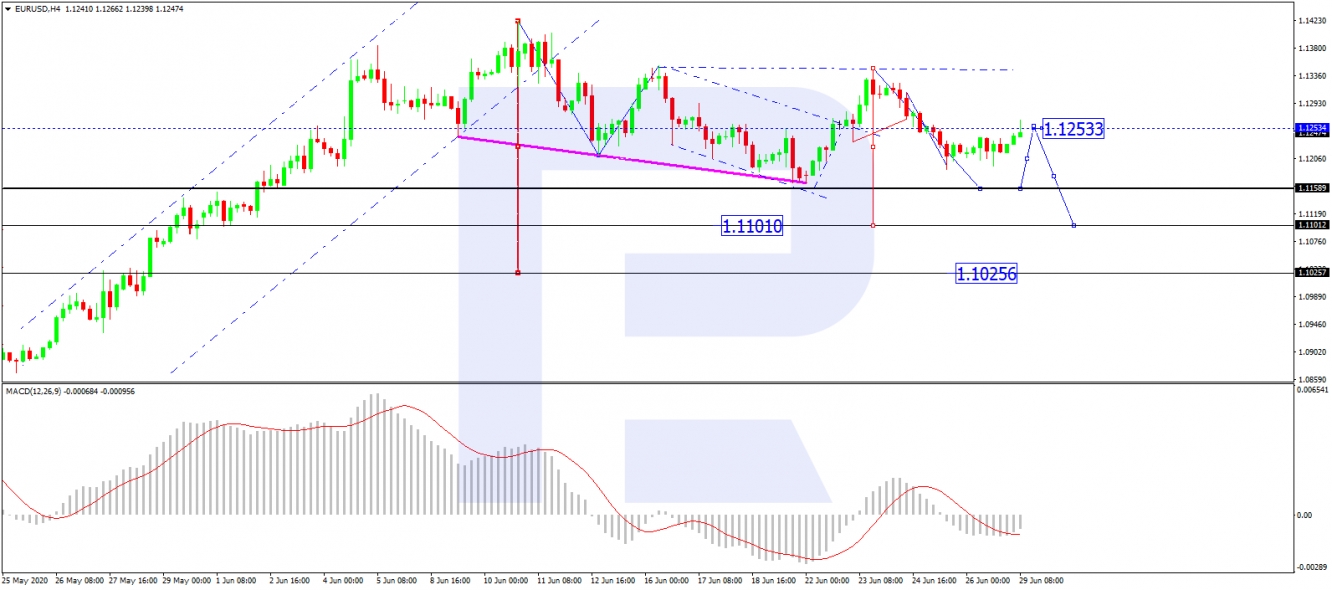

In the H4 chart, after finishing the descending impulse at 40.00 and the correction towards 41.74, Brent is expected to consolidate between these two levels. Possibly, the pair may form a Triangle pattern. If later the price breaks this range to the downside, the market may resume moving within the downtrend to reach 39.00 or even deeper, 37.00; if to the upside – form one more ascending structure towards 43.00 or even 45.20. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving below 0, thus implying a further decline of the price chart towards 39.00. However, if the line rises and breaks 0, the price chart may start rising to reach 43.00.

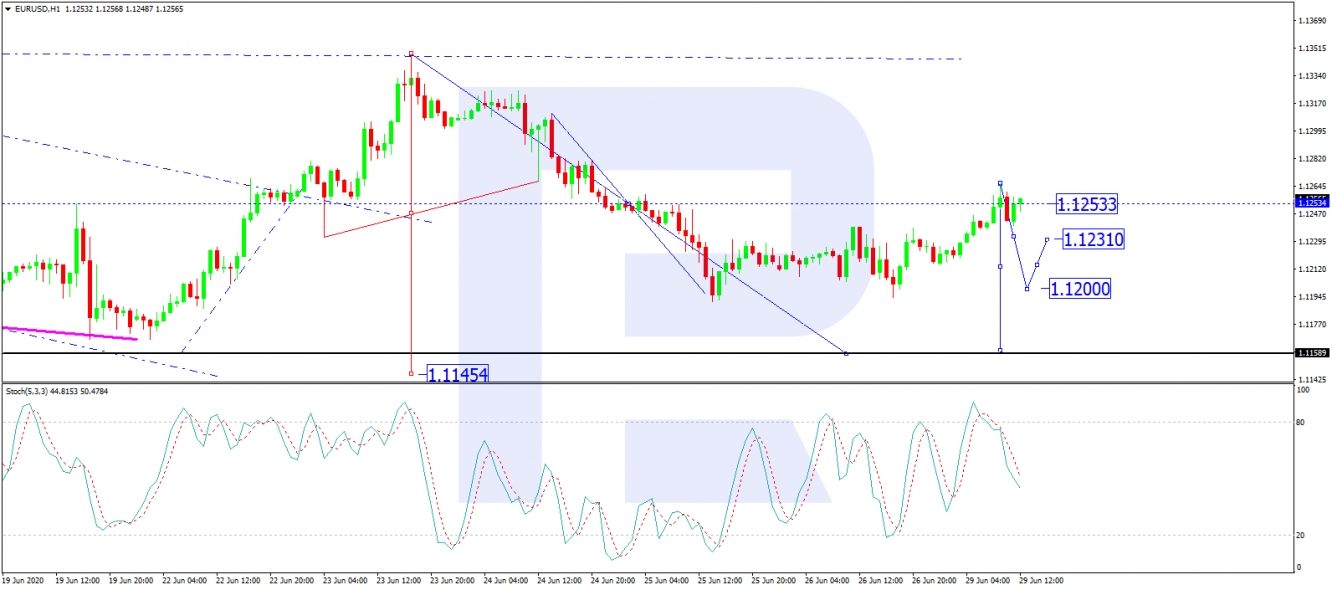

As we can see in the H1 chart, after breaking 40.00 to the downside, Brent is expected to fall with the short-term target at 39.00 and then start a new correction to test 39.50 from below. After that, the instrument may start a new decline to reach 37.00. However, this scenario may no longer be valid if the market grows towards 41.90. In this case, the asset may continue trading upwards to reach 43.00. From the technical point of view, this idea is confirmed by Stochastic Oscillator: its signal line is rising directly towards 50. If the line breaks this level, it may continue its ascending movement towards 80.

Disclaimer

Any predictions contained herein are based on the author's particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.