US dollar bullish bets fell to $14.98 billion from $17.08 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to February 14. The Sentiment for dollar is still being driven by expectations of more details about expansionary policies proclaimed by President Trump prior to election. Last week President Trump promised to unveil a "phenomenal" new plan for corporate taxes very soon.

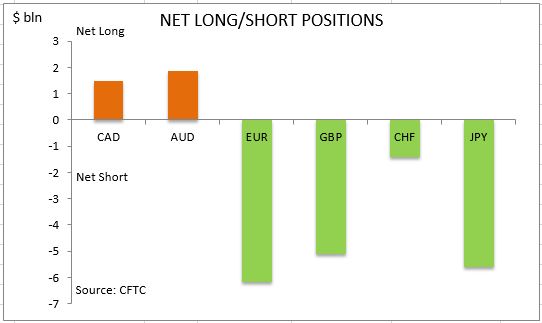

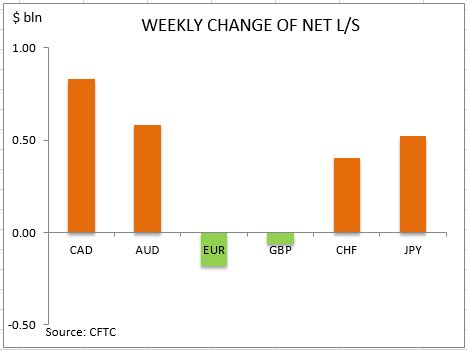

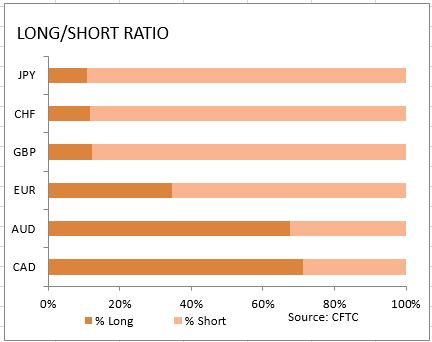

Other economic data were mixed. Initial jobless claims fell to 234 thousand from 246 thousand while continuing claims edged higher to 2078 thousand from 2063 thousand. Both the increase in export and import prices on year accelerated in January compared with previous month though the growth on month was slower at 0.1% and 0.4% respectively. Producer prices remained steady on year at 1.6% in January while the PPI growth on month accelerated. Wholesale inventories also were steady at 1%. And on the negative side consumer sentiment as reported by Michigan University declined to 95.7 in February from 98.5. Investors cut the dollar bullish bets for the eighth time in nine weeks. As is evident from the Sentiment table, sentiment improved for all currencies except for the euro and British Pound. And Canadian dollar together with the Australian dollar remain the two major currencies held net long against the US dollar.

The euro sentiment deteriorated with the German and euro-zone GDP growth falling short of expectations: the fourth quarter GDP grew 0.4% over quarter instead of 0.5% expected gain. The net short euro position widened by $0.18bn to $6.18bn. Investors cut the gross longs and increased shorts by 1375 and 438 contracts respectively. The British Pound sentiment also deteriorated marginally as the inflation in January rose less than expected: 1.8% instead of 1.9%. The net short position in British Pound widened by $63 million as investors built both the gross longs and shorts by 904 and 1893 contracts respectively. The Japanese yen sentiment grew less bearish despite slower than expected GDP growth: the fourth quarter GDP grew 0.2% over quarter instead of 0.3%. The Japanese yen net short position narrowed $0.5bn to $5.6bn. Investors built the gross longs and covered shorts by 1827 and 1949 contracts respectively.

The Canadian dollar improved considerably with the net longs rising by $0.8bn to $.1.4bn against the dollar. Investors built the gross longs and covered shorts. The bullish sentiment further improved for the Australian dollar with net longs increasing by $0.5bn to $1.8bn. Investors built both the gross longs and shorts. The sentiment toward the Swiss franc continued to improve with consumer prices remaining steady after disinflation in previous two months. Net shorts narrowed by $0.4bn to $1.4bn. Investors cut both the gross longs and shorts.

CFTC Sentiment vs Exchange Rate

| February 14 2017 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bullish | positive | 1480 | 831 |

| AUD | bullish | positive | 1858 | 581 |

| EUR | bearish | negative | -6182 | -182 |

| GBP | bearish | negative | -5107 | -63 |

| CHF | bearish | negative | -1427 | 406 |

| JPY | bearish | negative | -5607 | 521 |

| Total | -14985 |