- Stocks extend rebound but caution keeps gains in check

- Yen and gold edge back up as coronavirus death toll continues to rise

- OPEC+ holds technical meeting to discuss fresh cuts to output amid virus impact

Markets remain calm but growth worries persist

This week’s cash injection by Chinese authorities and pledges of additional stimulus if needed to stabilize the economy from the disruptions caused by the coronavirus outbreak helped maintain calm in financial markets on Wednesday. Stocks in Asia headed higher for a second day, though the gains were smaller than yesterday’s steep bounce back.

Market sentiment was underpinned by a strong close on Wall Street overnight where the Nasdaq Composite managed to notch up another record close. Some of the big gainers included Tesla (13.7%) and eBay (8.8%), whose shares were boosted by strong earnings and M&A rumours, respectively.

With the US earnings season still underway, there’s plenty to keep equity markets energized even as there seems no imminent end in sight to the spread of the coronavirus, which has now infected about 24,500 people globally and the death toll is fast approaching 500.

While it’s unclear what the full cost of the pandemic will be on China’s and the global economy, investors so far see the damage as being only a short-term one as they feel reassured by the measures taken by the Chinese government to halt the spread of the virus as well as by its willingness to intervene with policy support.

Still, the immediate risks to the Chinese economy are clearly to the downside and this is reflected in the yuan’s slide, which this week crossed above the 7 per dollar level.

Safe havens stay in demand

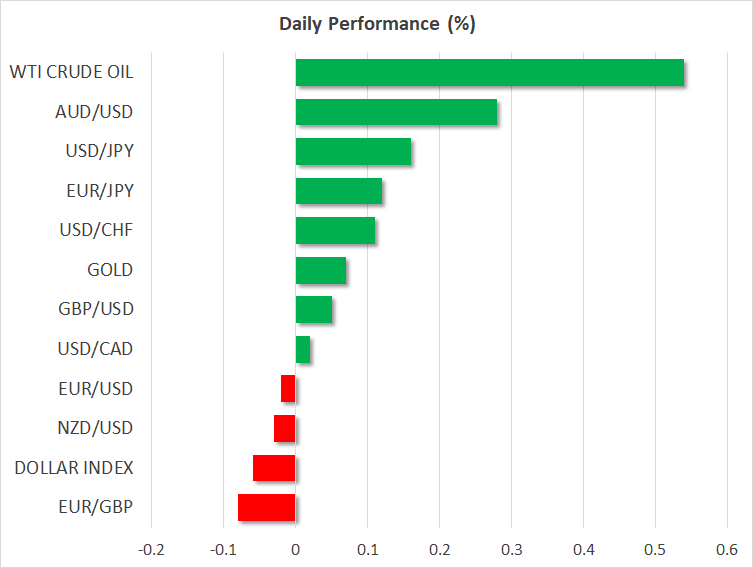

The mild risk-on mood in equity markets failed to transpire in the FX sphere, with safe havens gaining some traction early on Wednesday. Gold inched up to $1555 an ounce as many traders remained nervous about the fallout from the coronavirus. However, the Japanese yen gave up earlier advances to retreat to 109.60 per dollar – a near two-week low – as some reports emerged that scientists may have found a drug to treat the new virus.

The euro was mostly flat against the dollar, while the pound recovered slightly from the past two days’ tumble when it was hit by ‘hard’ Brexit fears.

The Australian dollar extended yesterday’s rebound when it was lifted by the Reserve Bank of Australia’s decision to leave policy unchanged. Expectations of further rate cuts by the RBA have been pared back sharply following yesterday’s meeting, with Governor Philip Lowe reaffirming the Bank’s neutral stance in remarks earlier today.

The New Zealand dollar was also firmer today as an unexpected drop in the country’s unemployment rate in the fourth quarter dashed rate cut expectations by the RBNZ.

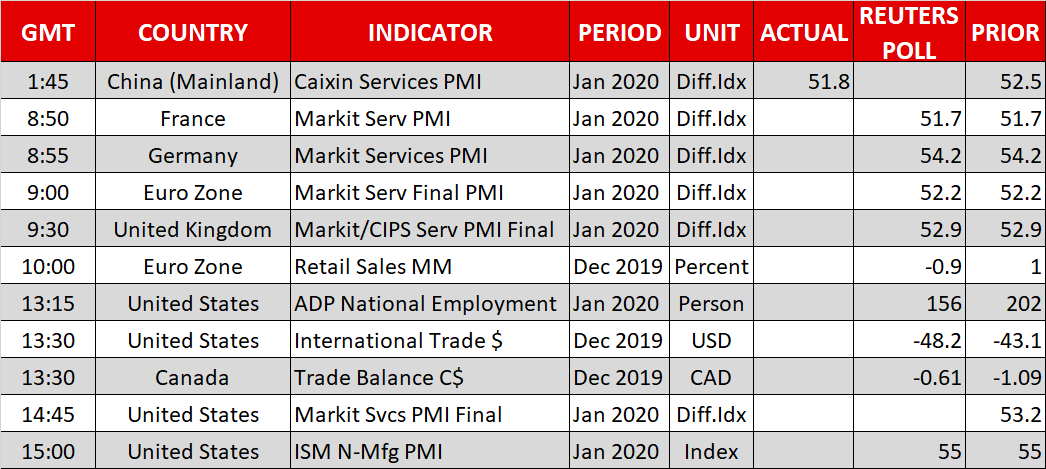

The focus later in the day will be on the ISM non-manufacturing PMI and ADP employment report out of the United States. A run of better-than-expected factory data in recent days has eased concerns about a fresh slowdown in the US economy and more upbeat numbers would help reinforce this view.

Oil climbs on talk of output cuts

Oil prices moved off more than one-year lows as technical experts from the OPEC+ group of countries met in Vienna to discuss whether additional production cuts are needed to counter the recent slide in the commodity. If the technical committee recommends that new reductions are needed, then an emergency meeting of ministers could be held as early as mid-February.

WTI oil and Brent crude were up about 2% on hopes that new output restrictions would ease the oversupply in the market. In the bigger picture, however, the weak demand outlook goes beyond the latest hit from the virus outbreak and only a marked turnaround in global growth is likely to boost prices sustainably.