Big day ahead of us Fixed income markets were in the forefront yesterday as yields in several European countries – Germany, France, Spain and Italy – hit record lows. US Treasury yields got dragged down with them. Yet the dollar managed to gain against most G10 and EM currencies as well, with significant demand from both companies and trend-following hedge funds. EUR/USD hit a new low for the year as US consumer confidence rose sharply with employment measures improving. The stronger dollar prevented gold from breaking through its 200-day moving average and the metal moved lower despite rising tensions in Ukraine, which indicates weak underlying demand for gold. Today’s economic events seem likely to keep the dollar well bid, while the technicals largely reinforce that view (see below).

Japanese industrial production collapsed in June, dropping 3.3% mom as companies cut back production in response to the drop in consumer spending after the rise in the consumption tax. Nor are exports picking up the slack. The figures, which were the worst since the 2011 tsunami, were in sharp contrast to neighboring South Korea, where IP was up 2.9% mom in June. This poor performance calls into question the Bank of Japan’s inflation target and simply reaffirms my view that the BoJ will have to take further action to weaken the yen later this year. The news had no immediate impact on USD/JPY but over the longer term should keep the pair moving higher. I remain bearish JPY.

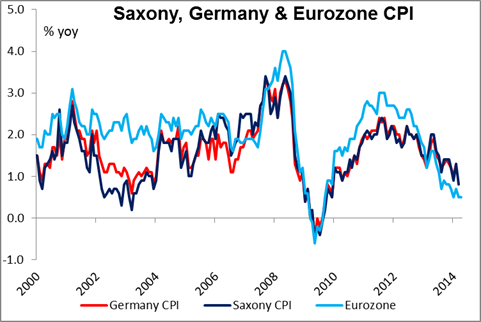

Today’s action: During the European day, the preliminary German CPI for July is expected to have fallen to 0.8% yoy, down slightly from 1.0% yoy in June. As usual the drama will start several hours earlier when the CPI for Saxony is released ahead of the country’s headline CPI. I don’t think a decline in German inflation would increase the likelihood of any new measures at next week’s ECB meeting, because the ECB probably wants to have time to gauge the impact of its already-announced measures before taking new steps. Nonetheless a further decline in inflation on top of last week’s poor German Ifo readings would probably raise questions about the underlying health of the Eurozone’s strongest economy and add to the sense that the bloc’s only hope is a weaker currency. I remain bearish on EUR.

Elsewhere in the region, Eurozone’s final consumer confidence and French consumer confidence indices, both for July are also coming out. Sweden’s preliminary Q2 GDP will be announced and the forecast is for a rebound from Q1. In Norway, the AKU unemployment rate for May is forecast to have risen slightly.

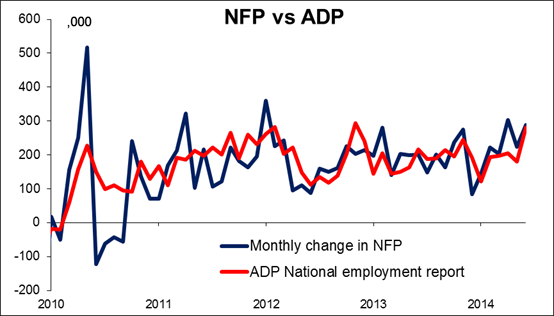

Then a huge day in the US! The ADP employment report is expected to show that the private sector gained 230k jobs in July, almost the same as the 231k NFP consensus forecast. The average miss for the ADP report over the last year has been 41k or around 25% of the NFP number, so this is an imperfect guide at best. Nonetheless I expect that if the ADP does come in as expected, it would support USD as it would imply that the US labor market continues to perform well (average 214k a month new jobs for the last six months).

Then 15 minutes later we get the flash estimate of US GDP for Q2. It’s expected to rise +3.0% qoq SAAR, a rebound from the unexpected 2.9% drop in Q1. It may be hard to play the GDP figures as the reaction is not particularly consistent. Of the last four positive surprises, USD/JPY was unchanged or lower an hour later in three cases, while USD/JPY moved slightly higher in one of the last four lower-than-expected prints. The GDP data will be accompanied by the annual revisions. These typically produce large changes in quarterly GDP and therefore the trend patterns, although not particularly big changes in the annual growth rates.

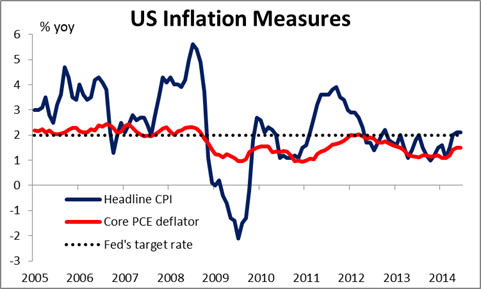

The GDP figures also bring the first estimate of the core personal consumption index, the Fed’s favorite inflation measure. It’s forecast to jump to +1.9% qoq from +1.2% qoq, close to the Fed’s 2% target. A jump like that would make it more likely that the FOMC members will have to move up their inflation forecasts and therefore accelerate the timing of the first rate hike as well.It would be significantly USD-bullish, in my view.

Then later in the day, the FOMC ends its two-day policy meeting. There are neither updates to the forecasts nor a press conference following the meeting, just the release of the statement. I expect they will update the section describing the economy to bring it into line with the more robust data that’s been released recently, but I doubt whether it will include any new clues to when the Committee might raise rates. Neither the economy overall nor inflation specifically have been firm enough recently to warrant any change in the FOMC’s message. Although several of the more hawkish members have been making their views known quite clearly, I do not expect anyone to dissent from the statement yet. Nonetheless insofar as the statement should reflect the improvements in the economy, I expect it will be USD-positive.

From Canada, we get the industrial product price for June. We have no speakers scheduled on Wednesday.

Finally, the most frightening thing I’ve ever read: In yesterday’s FT there were several articles about the ruling that Russia would have to pay Yukos’ shareholders USD 50bn. The article ended on this chilling note: One person close to Mr Putin said the Yukos ruling was insignificant in light of the bigger geopolitical stand-off over Ukraine. “There is a war coming in Europe,” he said. “Do you really think this matters?”