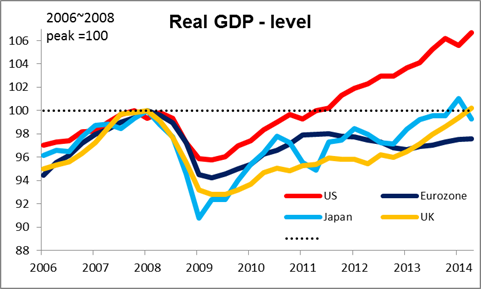

Strong US growth contrasts sharply with Eurozone and Japan The market was braced for a small downward revision to US 2Q GDP, but in the event it was revised up to 4.2% qoq SAAR from 4.0%. Moreover the mix of growth was good: final domestic demand was revised up as business investment grew more than initially thought, the net exports contribution was revised up and the inventories contribution was revised down. This favorable mix bodes well for growth in the rest of the year and sent the dollar up against almost all the currencies we track (the only exception being BRL). That despite a small (1.5 bps) drop in Fed funds rate expectations, further small falls in bond yields, and lower stock markets around the world. (Although with even Spanish 10-year yields below US Treasury yields, US bond still have an overwhelming rate advantage over their Eurozone equivalents, so I’m not sure how much difference yield differentials make any more.) In any event, either the stronger growth or the worsening tensions in Ukraine turned sentiment for the dollar around. Today will be a tug-of-war between end-of-month dollar selling and flight-to-safety demand for the US currency. I expect the latter to win.

The US data was also in sharp contrast with Japan’s numbers out overnight. Spending has shown no signs of recovering after the hike in the consumption tax in April. Household spending fell far more than expected and the fourth year-on-year decline, while retail sales, expected to be up modestly, were down 0.5% mom. Weak demand fed through to weak output and industrial production rose only 0.2% mom, hardly the strong bounce that was expected after June’s sharp decline. The unemployment rate unexpectedly rose to 3.8% (market forecast: unchanged at 3.7%) despite the job-offers-to-applicants ratio staying at the highest level since 1992, indicating a skills mismatch that growth won’t necessarily fix. And inflation slowed further, as expected, with the national CPI for July easing to +3.4% yoy from +3.6%. Excluding the impact of the rise in the consumption tax, CPI rose a steady 1.3%, still below the BoJ’s 2% target. The news adds to my conviction that the BoJ will have to take further action to boost the economy later this year, because Japan, like Europe, is running out of steam. (Note: boost the economy = weaken the yen.) Nonetheless JPY gained on many of its crosses as the stock market declined and tensions in Ukraine increased, adding a bid to safe haven assets (including gold).

Today’s indicators: The key indicator during the European day will be Eurozone CPI for August. It’s expected to slow to +0.3% yoy from +0.4% yoy in July. On top of the low German CPI print, the weak Eurozone CPI may give an additional impetus for the ECB to “acknowledge” this development and take further measures at next week’s meeting. I expect that they will make some announcement about a program to buy asset-backed securities (ABS), given the Bank has hired an outside advisor to advise on such a program.

Germany’s retail sales for July fell mom, another sign of weakness in the supposed locomotive of growth in Europe. We also have the Eurozone’s unemployment rate for July, which is expected to remain unchanged from June.

Norway’s official unemployment rate for August is coming out and the market consensus is for the rate to decline. The NOK-supportive figure may offset Wednesday’s poor AKU unemployment rate and strengthen the Norwegian krone, especially against its Nordic counterpart SEK. Riksbank publishes its Banking report and Norges bank releases the Q3 expectations survey.

In the UK, the Nationwide house price index for August is expected to rise at the same mom pace as in the previous month.

From Canada, the GDP for June is expected to have increased by 0.2% mom, a slowdown from +0.4% in May, however, the yoy rate is expected to accelerate to 3.0% from 2.3%.

In the US, personal income and personal spending for July are expected to have decelerated a bit. The PCE deflator and core PCE are forecast to show the same yoy rate of growth as in June, in line with the unchanged 2nd estimate of Q2 core PCE in Thursday’s GDP figures. The final U of Michigan consumer confidence sentiment and the Chicago purchasing managers’ index both for August are expected to show some improvement, which may be enough to keep the dollar on its upward trajectory.