Volatility continues to collapse Yesterday’s range for EUR/USD was a mere 0.12%, the second-narrowest range since the beginning of the euro, excluding New Year’s day (the /narrowest range was back in April). It’s not just the euro, either. During the same time period, USD/JPY has had a narrower range only twice. That’s pretty astonishing when you consider the number of big announcements coming out this week, including the FOMC meeting, US NFP, US Q2 GDP and Eurozone inflation data. Currencies only move when there is a disagreement on the price – it looks like people have pretty well reached agreement on the value of the major currencies.

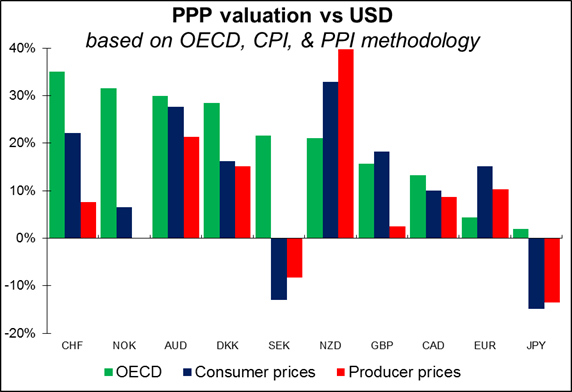

In fact when we look at the OECD measures of purchasing power parity (PPP), EUR is only 4.2% overvalued vs USD and JPY is only 1.5% overvalued. That suggests the low volatility in these two currencies may be appropriate – they are trading around their fundamental values. (Based on CPI and PPI measures however they are less fairly valued.) In that case, perhaps we should listen more to the central bank governors of New Zealand and Australia, who have been complaining bitterly about the overvaluation of their currencies (overvalued by 19.6% and 29.6%, respectively, on the OECD measure). But in that case we would all be short CHF, 35% overvalued, and NOK, 31.2% overvalued. And GBP is 15.3% overvalued vs USD on that measure, not so far behind NZD.

The only thing that these measures seem to agree on is that USD is undervalued. The only measures on which the dollar is overvalued are the CPI and PPI methodology vs SEK and JPY. So in theory the dollar should rise. However, we know that although currencies do generally mean revert towards PPP, it can take a long long time.

In any case, the drop in volatility has had a big impact on interbank trading volumes – or is it the other way around? Central banks yesterday reported the results of their twice-yearly survey of turnover in the FX market. The average daily currency volumes in most key financial centers around the world rose or were little changed in April from October, but were far below the year-earlier levels. Daily currency trading in London for example rose 7% in April this year from October, but trading in the spot market was down 21% from a year ago.

As for the indicators, US pending home sales fell unexpectedly in June, raising doubts over the housing market recovery. Following last Thursday’s disappointing reading in new home sales for the same month – a drop from an initially reported six-year high in May to just above the low for the year — yesterday’s figure confirmed Fed Chair Yellen’s remarks before the Senate Banking committee earlier this month about the overall slowdown in the housing sector. So although it’s likely that the FOMC will upgrade their view of the economy in this month’s statement following the meeting, the Committee is still likely to include warnings about housing that could hedge the upward revision to the view that I expect. In June they said that “the recovery in the housing sector remained slow.”

In Japan, retail sales fell more than forecast in June, suggesting that the rebound from the hike in the consumption tax is going more slowly than expected. At the same time, the unemployment rate unexpectedly rose, although the job-offers-to-applicants ratio rose slightly too. The struggling Japanese economy and PM Abe’s slumping popularity rating suggest that the Bank of Japan is going to have to get busy later this year expanding its quantitative easing, which could put downward pressure on the yen.

Today: There is a relatively light calendar today. We have no major events or indicators coming out from the Eurozone.

In the UK, mortgage approvals for June are expected to rise slightly after four consecutive declines. The modest increase from the lowest level this year may confirm that buyers are concerned about paying the current high prices.

From the US, S & P/Case-Shiller house price index is forecast to show that the pace of increase in house prices accelerated in May from the previous month.