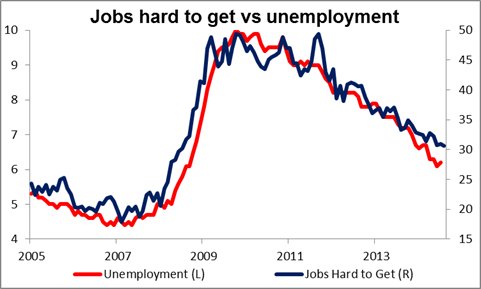

Risk sentiment boosting EM currencies; time for carry trades The dollar was higher this morning against most of its G10 counterparts but lower vs EM currencies as improving risk sentiment and narrow ranges pushed investors into carry trades. Stock prices at a record high in the US and generally better US data are supporting risk sentiment despite expectations of eventual Fed tightening. In addition to the astonishing leap in US durable goods orders in July and the rise in the Richmond Fed manufacturing index, the market focused on the continuing improvement in consumer confidence back to levels last seen in 2007, and in particular a recovery in the “net jobs hard to get” measure to the best level since July 2008, before the financial crisis. That indicator has a good correlation with the US unemployment rate.

Among G10 currencies, the three commodity currencies were the only ones to gain on the dollar. This could have been due to better risk sentiment, although in the case of NZD and CAD there were also individual stories. For NZD, Fonterra announced a partnership with a Chinese food manufacturer to sell milk into China, involving investments of more than NZD 1bn, and at the same time surprised the market by leaving its 2014-2015 milk purchase price forecast unchanged rather than lowering it. CAD is getting a boost from Burger King Worldwide Inc.’s USD 11bn purchase of Canadian coffee-and-doughnut chain Tim Hortons Inc., plus slightly higher oil prices. For AUD, the picture was not so clear; apparently there was demand for AUD on the AUD/NZD crosses even though construction work done in Q2 came in below expectations. Also, industrial commodity prices such as iron ore are collapsing in China as inventories hit record levels. That should be pressuring AUD, in my view. This milk vs iron ore story illustrates why I expect that as the Chinese economy rebalances away from investment and towards domestic consumption, the relative prices of Australia’s and New Zealand’s exports to the country will change and NZD should gain relative to AUD.

PLN and HUF were the only EM currencies to fall significantly vs USD. RUB was down only slightly. This is odd in my view, considering that the outcome of yesterday’s Customs Union talks involving Russian President Putin and Ukraine President Poroshenko seem to have been positive (that being the word Putin used to describe the talks), although fighting continues in eastern Ukraine. On the other hand, the usual carry trade favorites such as TRY, ZAR and MXN were up significantly. I would expect PLN and HUF to join the carry trade parade and recover their losses as the high-level talks on Ukraine continue. Meanwhile, BRL soared on a poll showing that former Environment Minister Marina Silva was likely to win Brazil’s presidency in a runoff against incumbent Dilma Rousseff.

Today’s schedule: Wednesday’s calendar is very light, with only secondary importance indicators coming out. We have no indicators released from Asia.

During the European day, we get German Gfk consumer confidence for September and France manufacturing confidence for August.

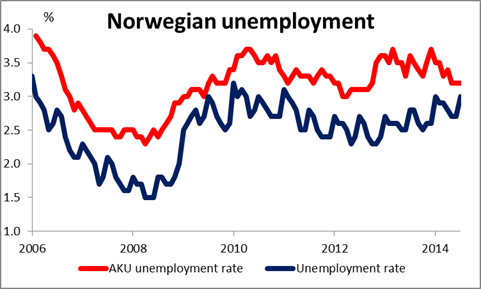

From Sweden, we get trade balance for July and the forecast is for the surplus to decline, adding to the recent mixed data coming from the country. In Norway, the AKU unemployment rate for June is expected to remain unchanged from May. On top of the recent strong GDP growth reading, the low unemployment rate could push USD/NOK slightly down.

From the US, we get the MBA mortgage application for the week ended on the 22nd of August.

We have no speakers scheduled on Wednesday.