Fiscal policy coming to the fore in Europe As the ECB gives in on monetary policy and announces more and more easing, the focus of attention is turning to Eurozone fiscal policy. ECB President Draghi Friday entered that debate when he said in his Jackson Hole speech that fiscal policy had an essential role to play in reviving economic activity to bring down unemployment. Then yesterday, French President Hollande dismissed his government after Economic Minister Arnaud Montebourg lashed out at fiscal austerity as the wrong way to go about fostering growth in the economy. If the anti-austerity movement does gain traction, it’s hard to say what the impact on the euro might be. Faster growth and higher yields would probably be euro-positive, but rising debt levels and falling credit ratings would be negative. Certainly the policy mix of looser monetary and fiscal policy has done nothing to help the yen recently. I think a looser fiscal policy is likely to be negative for the euro, at least initially, as investors worry about the loss of discipline, until eventually higher growth might convince them otherwise. In any event, it remains to be seen whether the troubled Eurozone countries can convince Germany that austerity is counter-productive. So far their arguments don’t seem to have convinced the Germans, but the pattern so far in the Eurozone crisis has been for Germany to resist and resist until finally giving in to almost everything.

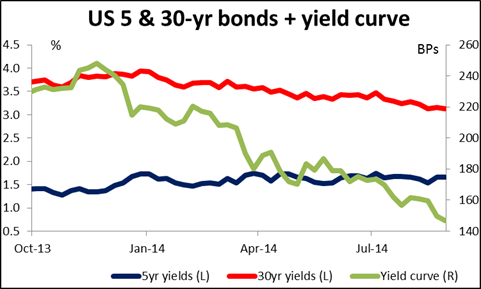

The market continues to adjust up its expectations for US rates. Fed funds futures for two years out and beyond were 2.5 bps higher, while the Treasury yield curve is flattening, with longer-dated yields declining and shorter-dated yields rising – the classic pattern that occurs in anticipation of tighter monetary policy. This is a good sign for the USD. Expectations of Fed tightening are likely to underpin the dollar, which in the past has generally registered strong gains six to nine months before the start of a tightening cycle.

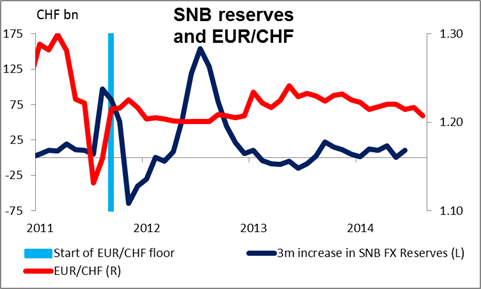

As the euro weakened, EUR/CHF hit a low of 1.2072 yesterday before bouncing just slightly. This is the lowest level since end-2012. I haven’t heard anything about the Swiss National Bank (SNB) changing its commitment to the 1.20 floor and I don’t expect it to. That means the risk/reward ratio for long EUR/CHF positions is about as good as it gets right now. The rate can go somewhat lower even within the current framework, and of course the SNB is not required to notify investors before changing its strategy, but past performance – while no guarantee of future performance – does suggest they will keep the rate above 1.20.

Today’s schedule: Russia's President Vladimir Putin meets with Ukraine's President Petro Poroshenko, Customs Union member-states and European Commission officials in Minsk, Belarus. This could be a key event for FX and for gold.

There are no major indicators coming out from Eurozone. Sweden’s PPI is coming out, but no forecast is available. In the UK, the BBA mortgage approvals are expected to have increased in July.

From the US, durable goods orders for July are forecast to rise 8.0% mom, a pickup from +1.7% mom the previous month. On the other hand, durable goods excluding transportation equipment are estimated to have slowed to +0.5% mom from June’s +1.7% mom pace. The Federal Housing Finance Agency (FHFA) home price index is forecast to show that the pace of increase in house prices slightly decelerated in June, while the S P/Case-Shiller house price index for the same month is expected to show no change in prices compared with a small drop in May. Consumer confidence index for August and the Richmond Fed manufacturing index for the same month are expected to decline slightly. Overall these figures are slightly negative, but given the dollar’s tepid response to yesterday’s disappointing new home sales, the dollar may not be that much affected if they come in as anticipated.

We have no speakers scheduled on Tuesday.