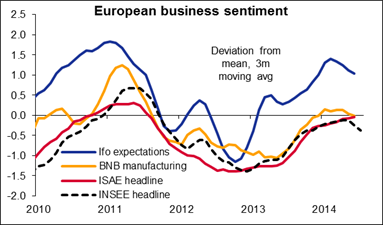

Mixed messages from the data It’s hard to know what to make of yesterday’s data. On the one hand, the Bundesbank was telling us recently that growth was slowing in Germany, but on the other hand, yesterday’s July PMIs for Europe – particularly Germany -- exceeded expectations. There was a similar mixed picture in the US. On the one hand, jobless claims in the week of July 19 plummeted to the lowest level since 2006, both for the latest result and the 4-week moving average. You might expect that better employment conditions would mean a better housing market as people who are more confident about their futures go out and buy homes, but on the contrary: the previously reported 19% spike in new home sales to 504,000 in May saw a record revision down all the way to 442,000, and then June fell further to 406,000, the lowest figure since March. All told, the data seems to have clouded the picture more than clarified it. The market’s conclusion though seems to have been to take it all positive: Bund and Treasury 10-year yields both rose about 3 bps, while Fed Funds expectations for three years from now rose 6.5 bps. The higher US rate expectations supported USD, which was unchanged to higher against all the G10 currencies except SEK. AUD dropped the most of any of the G10 currencies, with no particular news behind the fall, perhaps just profit-taking after the recent rise. The rise in SEK was fairly inexplicable as it follows the higher-than-expected unemployment and fall in producer prices for June that were announced yesterday.

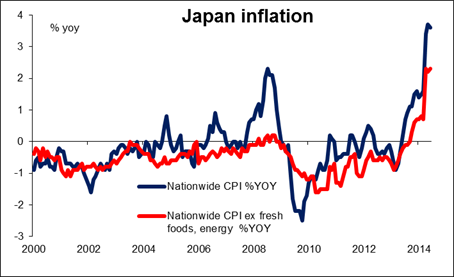

Japan’s inflation seems to be cooling. The national CPI for June slowed to 3.6% yoy from 3.7% in the previous month (although this was higher than the forecast of 3.5%), while the Tokyo CPI eased to 2.8% yoy from 3.0%. On the other hand, the core CPIs (excluding fresh food and energy) were both higher: national rose to 2.3% yoy from 2.2% while Tokyo rose to 2.1% from 2.0%, suggesting that firms may still be passing some of the increase in the consumption tax onto consumers. Imported inflation, particularly with regards to energy prices, should cool as the yen is no longer falling so much on a year-on-year basis. The yen’s trade-weighted index was down around 4% yoy in July, vs -13% in January. The Bank of Japan’s base scenario is that inflation will pick up towards the end of the year, but if this doesn’t happen – as seems likely – they may have to take further easing steps. The yen is likely to weaken further as more and more investors anticipate such a move, in my view.

Today: There are several major indicators out today. The German Ifo current assessment index and expectations index are both expected to decline, which could weaken EUR/USD. The Ifo index is in contrast to Thursday’s positive PMI figures, perhaps because the Ifo incorporates more recent data on the impact that sanctions on Russia are likely to have on the German economy.

In the UK, the nation’s preliminary GDP for Q2 is estimated to have remained unchanged in pace at 0.8% on a quarterly basis. This will drive the yoy rate up to +3.1% from +3.0%. Such a strong growth figure could be a reason for the pound to regain momentum following Thursday’s weak retail sales data.

From the US, durable goods orders for June are expected. The headline figure is forecast to rise +0.5% mom, a turnaround from -0.9% mom the previous month, likewise, durable goods excluding transportation equipment are estimated to have risen +0.5% on a mom basis, after May’s 0.0% mom. Overall these figures are positive and the dollar could strengthen if they come in as anticipated.

We have no speakers scheduled on Friday.