Europe in turmoil, US going smoothly The ECB confirmed that it had started buying covered bonds. It bought French and Spanish bonds, but yields of peripheral sovereigns rose nonetheless (Spain up 9 bps, Italy up 10 bps, Portugal up 18 bps), perhaps because the purchases were too small (estimated around EUR 800mn). By contrast, the Fed bought USD 1.1bn of Treasuries with no fanfare whatsoever. The ECB’s purchases also did nothing to encourage European stock markets, which were down across the board on weak earnings results. Stocks in the US managed to recover on the day as the VIX index steadily declined, and Fed funds rate expectations eased a bit in the long end.

Despite the better performance of US markets, the dollar weakened against most of its G10 counterparts. USD/JPY fell the most, partly in reaction to Friday’s rally and in part tracking the fall in Tokyo stocks. PM Abe was hit by the resignations of two female Cabinet members after allegations of financial impropriety. These scandals may hurt Abe’s public support, which is important as he nears the deadline for deciding whether to raise the consumption tax again as scheduled to 10% from 8%. The majority of the public oppose the tax hike, but the markets like the idea. If he’s forced to back off from the hike in order to keep his popularity, the market may see that as the end of so-called “Abenomics.” In fact that could strengthen the yen, as stocks might fall in response, but on the other hand, it could force the BoJ to redouble its efforts to jumpstart the economy through monetary stimulus, which would weaken the currency. In other words, the long-term impact is unclear.

Gold rallied on hopes that demand will improve ahead of the Hindu Diwali festival on Wednesday and the start of the Indian wedding season. In my view, “hope” is not a trading plan.

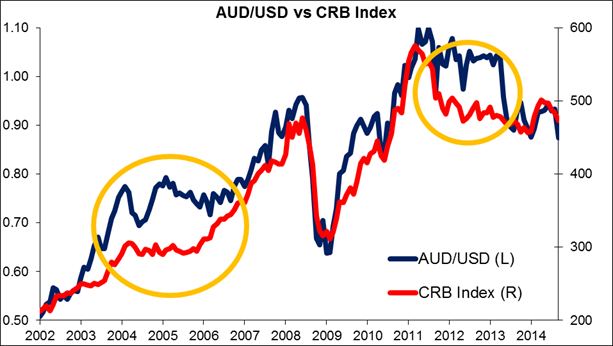

AUD rallies on China GDP Although the impact of Chinese data on AUD has been waning of late, still it can have a clear impact, as it did today. China’s Q3 GDP rose 1.9% qoq (7.3% yoy), better than expected (1.8% and 7.2%, respectively). AUD/USD went shooting up immediately in response. Industrial production was also higher than expected, while fixed asset investment and retail sales were both a bit weaker than expected and below the previous month’s figure. Still, it appears to me that China’s economy is slowing gradually, and the government’s recent operations in the money market suggest targeted help to particular sectors rather than any general loosening of monetary conditions. The minutes from the recent Reserve Bank of Australia meeting repeated the usual phrase that the currency “remained high by historical standards – particularly given recent declines in key commodity prices.” Admittedly, AUD/USD can remain divorced from commodity prices for sustained periods, so this is not necessarily going to send the currency plunging. However I still think the trend will be for Chinese growth to slow and AUD/USD to decline with it.

Today’s indicators: There are no major indicators due to be released during the European day from either the Eurozone or the UK.

In the US, existing home sales for September are coming out. Housing starts and building permits rose in September, indicating that the housing sector is growing again after a soft summer. The forecast of an increase in existing home sales suggests that the US economy is on a strong track. If the forecast is met this could strengthen USD.