A day to remember Some days I come into work wondering “what am I going to write about today?” Not today. This is one of the biggest days I can remember ever knowing about in advance in my career. Let’s take the three main points in chronological order:

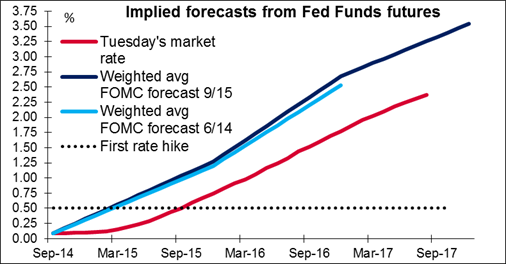

FOMC decision The FOMC kept its “considerable period” statement, but the key point was a sharp rise in the Fed funds forecasts: the median rose 25 bps to 1.375% for 2015, 2.875 (+37.5 bps) for 2016, and 3.75% for 2017. The likelihood of higher short-term rates pushed the dollar higher against every currency that we track, even though Fed Chair Yellen’s comments were not so hawkish – she said that there had been relatively little change in the outlook since June. Significantly, Yellen also signaled her approval of the ECB’s attempts to jump-start the Eurozone economy (see below) even though that is likely to weaken the euro. “We certainly hope they will be successful in seeing the pace of growth and inflation pick up and I think that will be good for the global economy and the US,” she said. The Committee also confirmed some technical changes in how it would implement monetary policy when the time to start raising rates does arrive.

TLTRO: The ECB today will hold the first of eight planned loans of cheap, long-term money. Today’s targeted long-term refinancing operation (TLTRO) will allow banks to borrow up to EUR 400bn for four years at 10 bps over the Bank’s main refinancing rate, currently 0.05%. The loans are called targeted LTROs because banks will only be able to keep the money for the whole time if they use it to increase their lending to companies and households, as opposed to buying government bonds as they did with previous LTROs.

These loans plus purchases of asset-backed securities are intended to reflate the ECB’s balance sheet, which has shrunk by around EUR 1.1tn or 35% since peaking in 2012. By contrast the Fed’s balance sheet has expanded by USD 1.5tn or 54% over the same time. The ECB hopes to reverse that contraction and thereby convince the market that it is determined to prevent deflation. ECB officials have also noted that with the Fed and Bank of England already discussing when to raise rates, the divergence in monetary policy is likely to drive the euro lower. This too should help to raise inflation and boost exports. Analyst expect banks to bid for EUR 174bn of loans today; the bigger the take-up, the greater the impact on the euro, in theory. However, it’s questionable how much immediate effect the loans will have on the currency market, because there are other, more momentous things going on, namely:

The Scottish referendum All the latest polls have all shown the anti-independence “no” side winning, although the gap was within the margin of error for the polls and there are still a lot of undecided voters. Nonetheless, The Guardian newspaper noted that in 50 votes on independence that have been held in various countries since 1846, the people voted for independence 88% of the time.

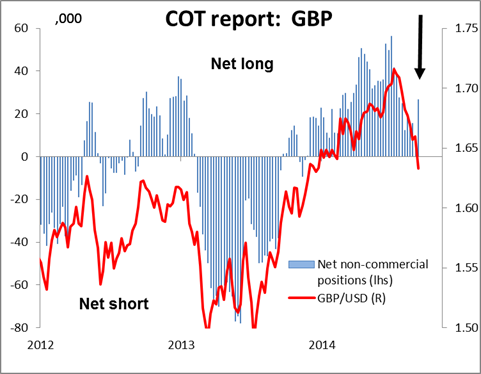

Although the polls are extremely close, the betting isn’t. British bookies are making 2-to-9 for “no,” indicating that bettors strongly believe that the results will be a vote against independence (a winning bet would earn only GBP 2 for every GBP 9 wagered) while the odds of a “yes” vote are put at 15-to-4. Apparently, while voters are sharply divided on how they will vote, they generally agree on how they think their neighbors will vote. Market positioning is also heavily in favor of a “no.” This means the market reaction to a “no” would be much less than the reaction to a “yes,” which would probably be dramatic.

The polls are open from 0700 to 2200 local time. The first exit polls will start appearing after they close. Recent elections in Scotland have been formally declared around 0630 to 0730 the following day. It may be difficult to get a definitive result much before then, because the cities of Edinburgh and Glasgow will be among the last areas to announce their results and together they account for around 20% of the votes.

Implications of a “no” vote: I would expect to see an immediate relief rally in cable and all GBP crosses (see technical section for more details). The response is not likely to be euphoric however as much of the rally has already occurred since the stunning rise in the “yes” vote stalled a week or so ago. GBP/USD bottomed on 10 Sep at 1.6050 and hit 1.6350 last night, an excellent performance against a generally stronger USD.

Implications of a “yes” vote: If the vote is yes, there is no clear roadmap for what would happen. According to the geopolitical strategy firm Stratfor, the Scottish government says there would be a short transitional period and the country would become independent by March 26, 2016. But the existing agreements between the governments do not mention a date for independence, and Westminster is not obliged to follow Scotland's timetable. Additionally, if the independence camp wins, the British Parliament would have to pass several laws transferring prerogatives to Scotland. This means that a potential "yes" vote would mark only the beginning of a long and complex period of negotiations, without a rigid end date. Uncertainty would reign and the pound would probably fall sharply, in my view. EUR could also be hit due to the implications for Spain and the likelihood that the UK leaves the EU.

Other events today: In Norway, Norges Bank meets to decide on its key policy rate and the market consensus is for the Bank to keep policy steady and to maintain its view of the economy. A press conference will follow the rate decision.

In the US, we get housing starts and building permits both for August and the forecast is for the figures to decline marginally. The country’s Philadelphia Fed business activity index for September and initial jobless claims for the week ended September 13 are also due out.

Besides Norge’s Bank press conference, we have three speakers on Thursday’s agenda. Bank of Japan Governor Haruhiko Kuroda and Riksbank Deputy Governor Kerstin af Jochnick speaks. Fed Chair Janet Yellen also speaks via prerecorded video.