The hawk goes dovish In Fedspeak, as in ice skating, usually you discard the views of the people at the extremes and listen to what the people in the middle are saying. Yesterday was an exception however, because the views of the hawkish St. Louis Fed President James Bullard proved so radical. A week ago (Oct. 10th), Bullard said that “the markets are making a mistake” and that rates would rise earlier than people think, probably at the end of Q1 2015. Yesterday he said the Fed should consider continuing with its bond-buying program, which is scheduled to end this month. “Inflation expectations are declining in the US,” he explained, adding, “we are willing to do things to defend our inflation target.” This is the first such suggestion we have had from any Fed official. Paradoxically, he also said he continues to see the first rate hike at the end of Q1, based on the expectation that the current global market turmoil won’t affect US prospects. Nonetheless, his suggestion opens up the possibility of delaying a rate hike if things don’t work out as hoped. Bullard is not currently a voting member of the FOMC.

Despite Bullard’s comments, the implied interest rate on Fed fund futures actually rose 4 bps in the long end. This may have been because of the generally good US economic data: initial jobless claims were the lowest since April 2000, industrial production in September was better than expected, with manufacturing production reversing its August decline, and the Philadelphia Fed index was also better than expected. Only the NAHB index was down, although it remains in positive territory. So the picture in the US is of a generally strong economy and a central bank concerned about even the appearance of not hitting its targets.

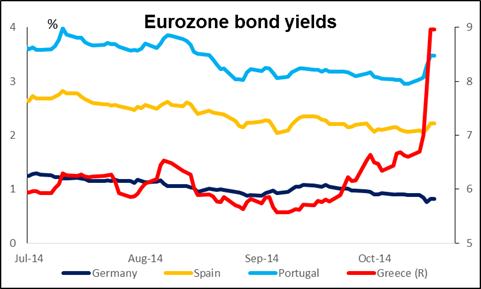

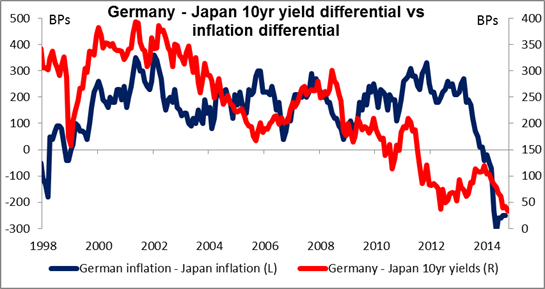

Europe and the ECB present a striking contrast to the US and the Fed. ECB Governing Council member Ewald Nowotny said the Eurozone economy “isn’t in deflation yet, but it shows clear signs of a weakening.” Nonetheless he said expectations of large-scale asset-backed security purchases were “exaggerated” and that the purchases wouldn’t start until December at the earliest. The phrase “fiddling while Rome burns” comes to mind. While the Eurozone economy slips closer to deflation, Eurozone bond yields are jumping: France was up 13 bps yesterday, Italy 16, Portugal 19, and Greece 111! Greek bond yields are up 233 bps over the last week. Rising bond yields against a background of low inflation mean future fiscal disaster. Meanwhile, the spread between German and Japanese 10-year bonds has narrowed to a mere 33 bps, meaning the market thinks Europe is turning Japanese. The market is clearly demanding that the ECB do something, and yet some members of the ECB apparently see no urgency. The burden of rescuing the global economy therefore depends largely on the Fed.

Money is not only flooding out of Eurozone bond markets – yesterday there was an outflow of USD 1.3bn from US-based European equity funds, the biggest outflow on record. Such capital flows are likely to be one of the main factors driving EUR/USD lower, in my view, as investors get increasingly fed up with the Eurozone’s inability to manage their monetary union.

Oil bounced back after falling below USD 80/bbl on speculation that OPEC will restrict supply in order to shore up prices. Given the fact that several OPEC members are virtually at war with each other, I think the idea that they are going to cooperate on this is nearly laughable. I believe this was simply a bit of profit-taking on technical factors after a sharp decline and I see oil prices falling further.

Today’s indicators: We have a relatively light day today. There are no major indicators from the Eurozone nor the UK.

In the US, housing starts and building permits for September are forecast to increase. Last time, both missed expectations and disappointed the market. It remains to be seen whether the weak pace continues in September. If the forecasts are met, it would suggest that the US economy is on a strong track and this could strengthen further USD. The preliminary University of Michigan consumer confidence sentiment for October is also coming out. The big event in the US however will be a speech by Fed Chair Janet Yellen at a Boston Fed conference on inequality.

From Canada, the inflation rate for September should shed some light on the country’s current situation. The forecast is for the rate to fall, which could prove CAD-negative and offset the impact from the recent decline in the unemployment rate.

There are several ECB speakers scheduled today: ECB Vice President Constancio, Bundesbank President Weidmann, and ECB Governing Council members Coeure and once again, Mr. Nowotny.