Bond market goes wild The action yesterday was all in US interest rates. It’s hard to say what “caused” the wild gyrations, because such moves are a sign of panic rather than a calibrated response to a certain input. The range on the 10-year bond yesterday was an incredible 36 bps, which is particularly amazing when you consider that the bond was only yielding 2.20% at the beginning of the day. The low yield of 1.86% only held for a moment though and if you just look at the open and close, you wouldn’t think much had happened: Bloomberg records a closing yield of 2.14%, down a mere 6 bps (trading at the European opening Thursday at 2.09%).

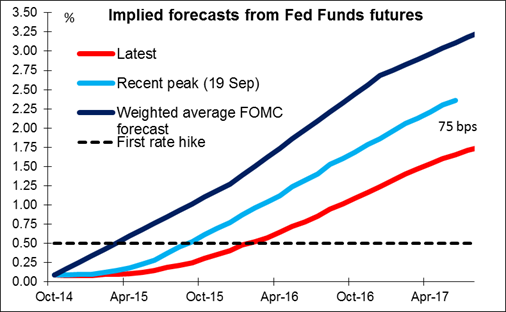

The action in the Fed funds futures left more traces. The shorter-dated contracts out to May 2015 were unchanged, and from then until Oct. 2015 were little changed. But the implied interest rate on the longer-dated futures fell 18.5 bps, or nearly one whole rate hike. In other words, the market is pricing in that the Fed starts tightening on schedule, but proceeds at a slower pace than was previously expected.

While the disappointing US retail sales may have triggered the move, the underlying reasons are fears that the global economy is slowing, deflation is gaining hold, and most importantly, the possibility that central banks can no longer do anything about it. Quantitative easing was the great hope, but that’s exhausted in the US, going full blast to seemingly no effect in Japan, and probably not possible in Europe. If the global economy slows and deflation gets hold, what can the central banks do now? The myth of central banker omnipotence is being torn down basis point by basis point. With that, the possibility arises that the Fed will not be able to start tightening on schedule or, even if it does, it may have to tighten at a slower pace than had been thought. Hence the movement in the Fed funds futures.

Nonetheless, I do see several good points to yesterday’s market action. First off, the stock market didn’t react anywhere nearly as violently. The S & P 500 had a 2.75% range, which, while large, was nothing like the 10-sigma event we saw in the bond market. Secondly, the markets are now prepared for higher volatility. Months and months of low ranges have lulled people into complacency. Now people are probably more prepared for volatility, which paradoxically means that a repeat event is less likely.

My personal view is that the fears are overblown and that the dollar should come back. While it is true that if Europe slips back into recession, the Fed may not be able to tighten as rapidly as they would otherwise have done, nonetheless I still expect them to begin tightening on schedule. The FOMC makes policy very slowly, basing its moves on a wide consensus. It therefore also changes policy only very slowly. It would take a lot to dislodge its current plans. Indeed that’s what the Fed funds futures are telling us. Nonetheless, that is still quite different from other countries and other currencies, where there is no discussion at all about normalizing rates. It seems to me that the policy divergence driving USD strength still exists, although the pace of divergence may be slowed. That means the pace of dollar appreciation may slow too, but it shouldn’t mean the direction changes.

Today’s indicators: Given that the market is concerned about the pace of Fed tightening, the focus today will be on the speeches by four Fed officials, ranging from the dovish (Minneapolis Fed President Narayana Kocherlakota) to the hawkish (Philadelphia Fed President Charles Plosser). Kocherlakota rated a “1” on Reuters’ dove/hawk scale of one to five, while Plosser rated a 5. Atlanta Fed President Dennis Lockhart and and St. Louis Fed President James Bullard are both centrists who rated “3,” so their views may be more typical of the FOMC as a whole.

During the European day, we get Eurozone’s final CPI for September and as usual the forecast is the same as the initial estimate.

In the US, industrial production for September is forecast to have rebounded, after declining a month earlier. The country’s Philadelphia Fed business activity index for October and the National Association of Home Builders (NAHB) market index for the same month are also due out (latter is expected to be unchanged). Initial jobless claims for the week ended Oct. 4 expected at relatively low 290k. If the data comes out as expected, it should help USD to recover.

From Canada, manufacturing sales for August are anticipated to drop, a turnaround from July.

In addition to the four Fed officials, ECB Governing Council member Luc Coene will speak.