Yellen goes (mildly) hawkish While Fed Chair Janet Yellen’s press conference yesterday didn’t contain any new information, her style of presentation was somewhat more hawkish than before. She seemed to be warning the market that it was being too dovish on rates, much like Bank of England Gov. Carney did recently – and we all know how the pound reacted to his warnings. I believe something similar should happen to the dollar in the not-too-distant future as Yellen’s (and the FOMC’s) vision gradually comes to pass.

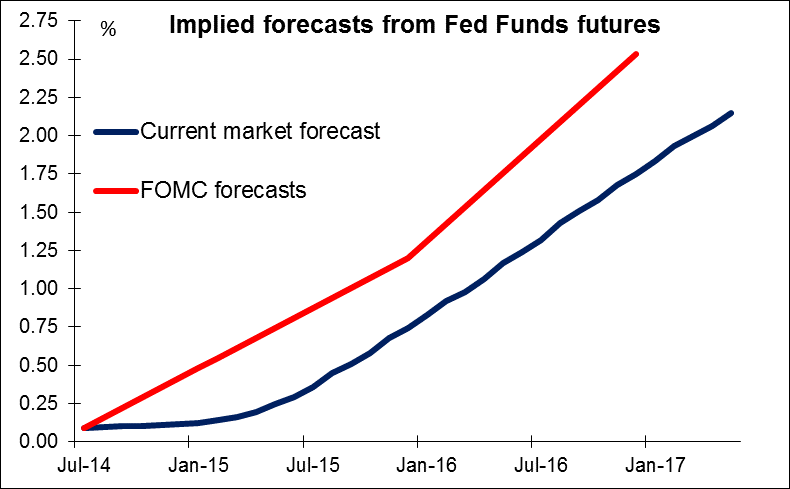

Asked about the timing of the first rate hike, Yellen pointed to the FOMC’s Summary of Economic Projections, in which all the members of the FOMC make their economic forecasts, including the “dots” for the Fed Funds rate, and say when they expect rates to rise. This reference was quite significant, because she had dismissed these dots at her first press conference in March and played them down in May. ““I think that one should not look to the dot plot, so to speak, as the primary way in which the Committee wants to or is speaking about policies to the public at large,” she said back in March. Thus it was a change that she now did point to these forecasts as the main indicator of Fed policy. Also it was a big change from May, when she responded to a similar question by noting simply that "most members believe that in 2015 or 2016 normalization would begin under their baseline outlook." The reason this change is so significant is that the dot plot remains much more aggressive than the market’s forecasts. Even after yesterday, when Fed Funds futures implied interest rates rose 5 bps or so from 2016 outwards, the FOMC forecasts were still 45 bps (= 2 rate hikes) higher than the market for end-2016 and 78 bps (= 3 rate hikes) higher for end-2017. Thus her language this time seemed to be a warning to the market that it was too dovish with regards to rates. To make the point perfectly clear, she also stated that if the labor market continues to improve at its current pace, “then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned.”

In any case, the market did not miss the implications and the dollar was up against virtually all currencies yesterday, both G10 and EM. The only exception was the pound, which gained on the dollar after Tuesday’s announcement that UK inflation suddenly jumped in June, making a rate hike seem all the more likely.

Overnight, China announced some better-than-expected data: 2Q GDP rose 7.5% vs estimates of 7.4%, while June industrial production and first-half fixed asset investment both exceeded projections. Nonetheless AUD and NZD both declined. Part of that may have been due to a statement by China’s National Bureau of Statistics that a downturn in the property market creates short-term pressure on economic growth, a forward-looking statement that may have outweighed the significance of the backward-looking indicators. For NZD, the biggest loser on the day, the decline was due to domestic factors: inflation rose less than expected in Q2 (+1.6% yoy vs expected +1.8%; previous +1.5%) and dairy prices fell further at the latest auction. Both of those facts take some pressure off the Reserve Bank of New Zealand to raise rates. Given the recent slump in agricultural commodity prices, I may have to reassess my bullish stance on the kiwi. I remain bearish AUD.

Today: During the European day, the Riksbank releases the minutes from its latest policy meeting, when it shocked the markets by cutting rates more than expected. SEK has recovered a bit since the meeting, so there’s a chance the details could shock the market again and cause the currency to weaken once again.

From the UK, nation’s unemployment rate for May is forecast to decline to 6.5% from 6.6%. On top of Tuesday’s strong inflation rate for June, and the recent indications of a booming housing market, this figure should work towards lifting UK rate expectations. However, the focus will be probably on average weekly earnings --which are expected to slow in May to +0.5% yoy (three month average) from +0.7% yoy. If wage increases are slowing, the Monetary Policy Committee is likely to conclude that there is still sufficient slack in the economy and there’s no urgent need to tighten.

It’s a busy day in the US. Industrial production and PPI data for June are due out, as well as the National Association of Home Builders (NAHB) market index for July. The Fed releases the Beige book. We also get the MBA mortgage applications for the week ended on the 11th of July. We also have Fed Chair Janet Yellen’s second day testimony to the House on monetary policy. Dallas Fed President Richard Fisher also speaks.

In Canada, the Bank of Canada meets to decide on its interest rates. CAD has been firming on expectations that they will move from a neutral to a tightening bias, but we disagree, especially after last Friday’s higher-than-expected unemployment rate for June. The nation’s manufacturing sales are also coming out.

EU leaders meet in Brussels to consider expanded sanctions against Russia over Ukraine.