USD/JPY moves still higher Yesterday we briefly discussed why USD/JPY was rising and pointed to the circular explanation on the wires: USD/JPY was higher because stocks were higher, and stocks were higher because USD/JPY was higher. Digging a bit deeper, it seems that both are being pushed up by talk that the government may postpone its planned increase in the consumption tax by 1½ years and call a snap election as a referendum on the tax hike. An election could cement PM Abe's grip on power, because no matter how unpopular he and his party are, the opposition parties are even weaker and more disunited. He is therefore likely to come out in a stronger position and with a pseudo-mandate to raise the consumption tax. Meanwhile, the delay in hiking the tax is perceived as positive for growth. That pushed Japanese stocks to a seven-year high, and as usual, Japanese stocks are positively correlated with USD/JPY. (Chief Cabinet Secretary Suga today denied that an early election is in the works, which took some of the steam out of USD/JPY.)

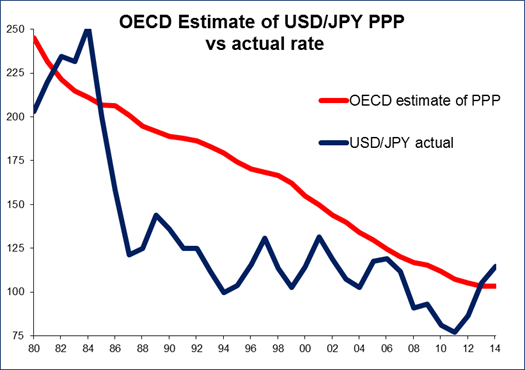

How high can USD/JPY go? The falling current account surplus and increased outflow from investors should continue to push the pair higher, in my view. Fundamental value for a currency is set by purchasing power parity. The Organization for Economic Co-Operation and Development (OECD) calculates that purchasing power parity for USD/JPY is now around ¥103.50. That means the yen is currently about 11% undervalued. Historically, this is unusual. Using the OECD’s calculations, USD/JPY was overvalued from November 1985 until August of this year, or around 29 years. It’s averaged 37% overvalued during that time on this methodology. But just because the yen has been overvalued for a long time doesn’t mean that it can’t be undervalued. Often currencies fluctuate between over- and under-valued according to economic fundamentals and market sentiment. In fact, the market usually overshoots fair value, because people tend to move together, like a herd of sheep. If the yen was 37% overvalued on average before, why couldn’t it now be 37% undervalued under these conditions? That would take USD/JPY to around ¥140. I think at least ¥130 is entirely possible.

Meanwhile, the dollar fell against most currencies Tuesday with the US market thinned out for Veteran’s Day. NZD made the biggest gains even though the Reserve Bank of New Zealand (RBNZ) financial stability report said the NZD is still above sustainable and justifiable levels and could drop further. The reason was probably that they also said interest rates may need to rise again in “coming years” as there is a risk of a resurgence in house price inflation. While I think both NZD and AUD are liable to suffer from reduced Chinese demand in coming months, I prefer NZD over AUD because a) I expect demand for agricultural commodities to be stronger than demand for industrial commodities, and b) I think the RBNZ is likely to hike rates again before the RBA starts on its hiking cycle.

Today’s indicators: During the European day, the UK will take center stage. The nation’s unemployment rate for September is expected to decline to 5.9% from 6.0%, suggesting less slack in the labor market. Average weekly earnings are anticipated to rise, adding to the positive employment report. Besides the employment data, we get the Bank of England inflation report with new forecasts for growth and inflation. These should give us more insights over the recent data that are consistent with a slowing pace of growth. Labor market data remain crucial since if wage growth remains muted then the market is likely to remain convinced that the first rate hike won’t come until after the general election in May, leaving GBP vulnerable.

Eurozone’s industrial production for September is forecast to rebound on a monthly basis. After the recent poor data, a rebound probably will not be enough to reverse the negative sentiment towards EUR, in our view.

In the US, wholesale inventories for September are expected to decelerate.

During the late US session, New Zealand’s BusinessNZ manufacturing PMI for October is to be released.

We have no speakers on Wednesday’s agenda besides the inflation report presentation by BoE Governor Mark Carney.