Gone too far Investors yesterday realized that they had indeed gone too far, as I thought, and reversed much of Friday’s action. The Fed funds futures, which had knocked 9 bps off of tightening expectation in the long end, regained half of that, while 10-year yields rose 6 bps, a little more than half of what they lost on Friday. Yet the stock market managed to eke out a small gain after closing unchanged on Friday, indicating that the rise in yields was due to expectations of stronger growth. Under such circumstances the dollar rallied against almost all the currencies we track, exactly the reverse of Friday’s action. (The similarity extended even to RUB, which this time was almost the only gainer vs USD after central-bank Governor Elvira Nabiullina said policy makers will temporarily limit ruble liquidity, as it is partly being used “for games on the currency markets.”).

There doesn’t seem to have been any specific trigger for the reversal, just a general sense – which I shared – that Friday’s moves were overdone in relation to the payroll data. At the same time, the dollar did move up sharply about 15 minutes before the release of the new Labor Market Conditions Index, which rose to 4.0 from 2.5, thus confirming the improvement in the labor market. Was the timing of the rally purely a coincidence? We report, you decide. In any event the index is basically a summary of previously released indices and so contains little new information. My view remains that investors should pay more attention to the FOMC’s forecasts for interest rates, which are substantially more aggressive than the market’s, and that the gradual repricing of market expectations upwards is likely to offer continued support for USD.

One possible point of concern, though: once again, it looks like there is some extreme weather headed towards the US. A “polar vortex” is forecast to descend on the US this week, with only eight of the 50 states expected to avoid the blast of arctic air. Like last year, we may once again have to mentally adjust the economic data for unseasonably cold weather. The earlier-than-usual cold could also damage crops, thereby pushing up commodity prices, and could also cause at least a temporary reversal in the oil price.

Today’s calendar On Tuesday, we have a relatively light economic calendar. Japan’s current account surplus for September unexpectedly rose sharply due to a larger-than-expected rise in income. The trade deficit also narrowed slightly. Oddly enough, the news only seemed to send USD/JPY higher. Explanations were hard to come by: the headlines read “Yen Drops as Japan Stocks Rise” and “Japanese Stocks Rebound as Yen Falls.”

We have no major indicators coming out from the Eurozone nor the UK, while the US government is closed for Veteran’s Day (although exchanges are open).

In Sweden, Riksbank releases the minutes of its October policy meeting, when it cut its key repo rate to zero. The minutes will reveal if the members discussed the possibility of using unconventional measures if prices don’t pick up. As for the indicators, we get the country’s CPI and PES unemployment rate both for October. The first is expected to show that Sweden remains in deflationary territory, while the latter is anticipated to decline somewhat. Since this is not the official unemployment rate, I believe the market will focus mainly on the CPI reading and SEK could weaken amid these releases.

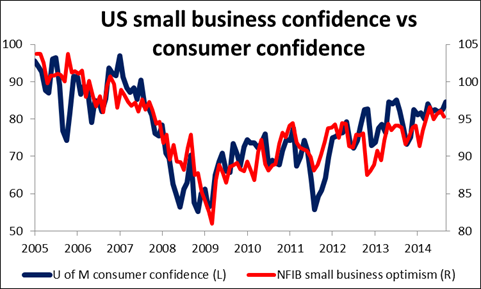

The only indicator coming out from the US is the NFIB small business optimism for October, which is expected to have increased fractionally and to remain near its highest level since October 2007. This indicator is not particularly market-affecting.

During the late US session, Reserve Bank of New Zealand releases its Financial Stability report. The Bank is expected to provide more insights on its view of inflation, which recently reached the lower boundary of the Bank’s target range. Another key point will be any hint from the RBNZ Governor Graeme Wheeler over the timeframe they are expected to remain on hold. In their last meeting they gave no indication when they might start to raise rates again. If they keep this stance and attempt to talk down NZD, NZD/USD could fall back to the key support line of 0.7700.

Besides the RBNZ Governor, Boston Fed President Eric Rosengren speaks on Tuesday. Rosengren is an extreme dove, but he doesn’t vote at FOMC meetings.