Nonfarm payrolls send USD sharply higher The DXY dollar index, a gauge of the greenback’s value against six major currencies, surged to a four year high after the strong employment report data. Nonfarm payrolls rose a higher-than-expected 248k in September, up from a revised 180k in August and returning to above 200k readings again. The average of July, August and September was around 224k, not far off the 228k pace in the first half of the year. Year to date, the average is 227k a month, the best since 1999. The unemployment rate fell to its lowest level since June 2008, which suggests that the US recovery is on a strong track. The only weak point was the small growth in average hourly earnings and the moderate decline in the participation rate.

The overall robust labor report adds to the growing body of evidence that the US recovery is gaining momentum and should sustain the case for the Fed to raise interest rates next year. It is not a game-changer, however. The market’s implied forecast for Fed funds in 2017 rose only 3.5 bps in reaction to the data. The implied interest rates on the 2017 Fed funds futures contracts are still on average 11 bps below where they were at the recent peak of Sep. 19th. That may be because the doves on the FOMC can still find evidence in the data to back up their concerns about “significant underutilization” of labor resources. The unemployment rate is still well above the FOMC's longer run estimate of 5.2% to 5.5%, while wages are growing far below the assumed neutral rate of 3.5% (based on productivity growing 1.5% and inflation of 2%). The slow growth in wages also suggests little inflationary pressure.

Nonetheless, the DXY index has risen 2.3% over that period, suggesting that more than just Fed expectations are at work here. One aspect is probably the widening divergence between the US monetary policy outlook and that of other countries. Yet GBP/USD hit a low for the year on Friday (as did AUD/USD), demonstrating that USD is gaining even against the one other country that’s also expected to tighten rates in the not-too-distant future. It seems that there is simply strong demand for dollars.

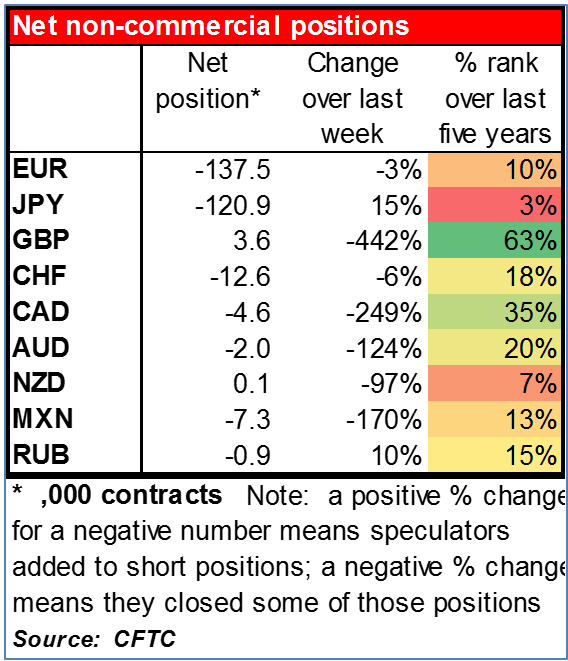

We can get a hint of where that demand is coming from by looking at the weekly Commitment of Traders (COT) report. Net non-commercial EUR shorts remained steady, as they have been since early September. Investors went long GBP ahead of the Scottish referendum and cut those positions afterwards. JPY shorts expanded notably, while shorts in other currencies, including CAD and AUD, expanded modestly. Short positions in CHF were closed back. The relatively modest increase in speculative short positions in non-dollar currencies is at variance with the large rise in the dollar. This suggests that real money investors and corporate hedging has been leading the dollar’s move upwards, which would mean it likely has much further to go.

Platinum and palladium, which fell sharply on Thursday, continued to fall on Friday. This is adding to the pressure on gold coming from the stronger dollar and thoughts of higher interest rates.

Today’s indicators: During the European day, the only indicator worth mentioning is German factory orders for August. The market consensus is for the figure to drop, a turnaround from the previous month, adding to the batch of weak data coming Germany. We have one speaker on Monday’s agenda, Riksbank Deputy Governor Per Jansson.

Rest of the week: central bank meetings As for the rest of the week, there will be three G10 central bank policy meetings: two on Tuesday and one on Thursday. Tuesday, the Reserve Bank of Australia is unanimously expected to keep rates steady. It will be interesting to see if Gov. Stevens makes any new attempts to talk down the currency. The Bank of Japan is also expected to keep policy steady and to maintain its view of the economy. The recent slowdown in Japan’s inflation could eventually trigger more action by the BoJ, and the statement from the policy meeting should give us more insights into their next action. On Wednesday, the key event will the release of the minutes from the FOMC’s Sept. 16-17 meeting. At that meeting, the FOMC kept its “considerable period” statement, but the key point was the rise in the Fed funds forecasts. On Thursday, the spotlight will be on the Bank of England policy meeting. The Bank is unlikely to change policy and therefore the impact on the market as usual should be minimal. The minutes of the meeting though should make interesting reading when they are released on 22nd of October, especially after the continued deterioration of the UK’s economy.

Other indicators: On Tuesday, we get industrial production for August from Germany and the UK. Wednesday, from Japan we get the current account balance for August and from China the HSBC service-sector PMI is due out. Thursday, in Japan, machinery orders for August are expected to decelerate and from Australia, we get the unemployment rate for September. During the European day, in Germany, trade surplus is projected to decline a bit. Finally on Friday, Bank of Japan releases the minutes of its Sept. 3-4 policy meeting and from Canada, we get the unemployment rate for September.