The European Central Bank surprisingly cut all its interest rates by 10bps and announced that the governing council decided to start purchasing non-financial private sector assets. The two new programs announced, include purchasing of asset-backed securities (ABS) and a broad portfolio of euro-denominated covered bonds. Interventions under these programs will be launched next month in an attempt to prevent stagnation and has taken into account the overall subdued outlook for inflation. At the press conference after the rate decision, President Draghi said that the decisions to cut interest rates and announce an ABS programme was not unanimous and he also added that “today’s rate cuts are the last ones”. The ECB has also cut its growth forecasts for this year and next year by 0.1 percentage point each. It now expects the bloc’s growth of 0.9% this year and 1.6% next.

With these moves, the ECB has clearly shown its concern about the economic situation, but we worry that it may be “too little, too late.” ECB data shows that a similar cut in rates in June did have a sizeable impact on borrowing costs for small and medium sized enterprises: rates for SMEs dropped by 25bp in Germany, 15bp in Italy and France and a whopping 40bp in Spain. So yesterday’s rate cut is likely to help further.

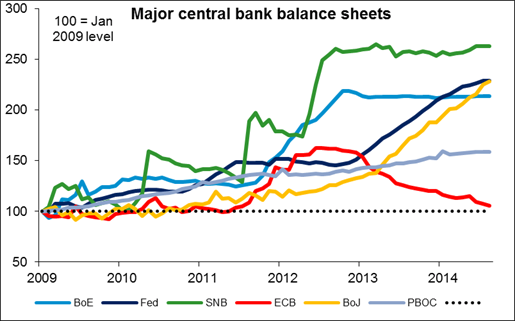

But with rates now up against the zero bound, the ECB only has quantitative easing to fall back for the next step, but that’s difficult in the EU because of the lack of a Europe-wide sovereign bond. Adding the covered bond market to the widely discussed ABS market shows that they are quite serious about this, but they have a long way to go. The ECB’s balance sheet has actually shrunk by about EUR 1tn or 35% since peaking in mid-2012. Over that time, the Fed’s balance sheet expanded by USD 1.5tn or 54% and the Bank of Japan by JPY 129tn or 90%. The ECB’s balance sheet is now the smallest of the major central banks in terms of percent of GDP. Given the limited size of the debt markets in the Eurozone, it will be difficult if not impossible for the ECB to catch up with these other central banks’ efforts. Draghi suggests that the ECB did discuss sovereign bond purchases and that some Council members were in favor of them, but it’s clearly a last-ditch effort because of the legal problems involved. They will want to save that for last.

Moreover, there are clear signs that the ECB Council itself is reaching the limits of what it’s willing to do. Draghi said the decision was not unanimous but was “comfortable,” indicating that there was sizeable opposition. In that case, the hurdle for sovereign bond purchases is likely to be high.

In any case, the implications for the FX market are clear. Draghi himself said that the euro was likely to depreciate against the dollar because of the divergence of monetary policy in the Eurozone and the US. That divergence is now clear as day. The ECB is embarking on new extreme measures to loosen policy at the same time as the FOMC is debating the timing of the first rate hike. I agree with Draghi that EUR/USD is likely to fall further.

The Bank of England on the other hand, left its interest rates on hold as was widely expected. The minutes of the meeting should make for interesting reading when released on Sept. 17, especially after two of the nine MPC members dissenting votes at last month’s meeting.

Today’s events: The main event today will be the US nonfarm payrolls for August. The market consensus is for payrolls to rise by 230k vs 209k in July. If the forecast is met, this will be the seventh straight reading above the 200k level. A strong NFP reading, along with an anticipated decline to a near six-year low unemployment rate of 6.1%, should add to the recent solid US data and boost USD further. Average hourly earnings for August are anticipated to accelerate 2.1% yoy from 2.0% yoy last month. Given the forecast of 2.0% yoy CPI rate for August, this would rise real wages by 0.1% yoy, adding to the positive employment figures.

During the European day, we get industrial production figures for July from Germany, Sweden and Norway. German and Sweden’s figures are expected to accelerate a bit, while no forecast is available from Norway. Eurozone’s final Q2 GDP is coming out and the forecast is for the pace to drop to 0.0% qoq, unchanged from the preliminary reading.

Canada’s unemployment rate for August is expected to remain at 7.0%, while the net change in employment is forecast to decrease to 10.0k from 41.7k.

We have one speaker on Friday’s agenda, Boston Fed President Eric Rosengren speaks at the annual Bankers associations’ conference.