How can two countries that aren’t fighting have a ceasefire? The news of a “permanent ceasefire” in Ukraine has buoyed the market, but as the Russian side pointed out, how can they agree to a ceasefire when they were never in Ukraine to begin with? I would wait to have the ceasefire independently verified before jumping on the peace trade, however that was not the way the market saw it and assets affected by the Ukraine tensions saw significant moves yesterday. Russian stocks were up 3.5% and RUB gained 1.6% while PLN gained even after central bank governor Marek Belka said that rate cuts were “very probable,” with the first coming as soon as next months. Oil also rose on hopes of faster economic activity in Europe. Yet gold gained.21

I would say that the adage “don’t count your chickens before they hatch” is applicable here. NATO is discussing what to do, and EU ambassadors are meeting to discuss EU proposals for sanctions on Russia. If they decide to go ahead with sanctions anyway, then Russia may decide not to honor the ceasefire. Ukraine PM Poroshenko noted that Russia has ignored or violated all previous agreements.

Hopes for an end to the Ukraine crisis sent the dollar lower against most currencies as the “flight to safety” bid evaporated. This was not justified by the US economic news; factory orders had a record mom rise in July, auto sales hit the highest level in nine years, and the Beige Book showed increasing evidence of rising wages. Yet Fed funds futures were largely unchanged and investors preferred to go into the commodity currencies (perhaps helped by the higher oil prices) than to stay in the dollar.

Two movements in the currency markets stand out: one, the euro made only modest gains despite the events in its backyard. This continues the pattern of EUR not being particularly affected by the Ukrainian problems and may also indicate weak enthusiasm to the EUR, in my view. Secondly, JPY was the second-best-performing currency, which is not what one would expect when the dominant trend is an easing of tensions and an increase in “risk on” sentiment. That probably had to do with the fall in the Tokyo stock market today and expectations that BoJ Gov. will stick to his optimistic outlook when he presents the results of today’s Policy Board meeting later. It doesn’t change my expectations of a weaker yen over time.

Today’s events: We have a very busy day as three more of the G10 Central Banks hold policy meetings today. Sweden’s Riksbank is the first to meet during the European day. Following its unexpected 50bps rate cut in early July and given that the country’s economics haven’t really improved much since then, we might see additional action from the Nordic central bank. That could be negative for SEK.

In UK, the BoE is unlikely to change policy and therefore the impact on the market should be minimal, as usual. However, after the two dissenting votes at last month’s meeting, the likelihood of a rate rise in the coming months has increased. The minutes of the meeting should therefore make interesting reading when they are released on 17th of September.

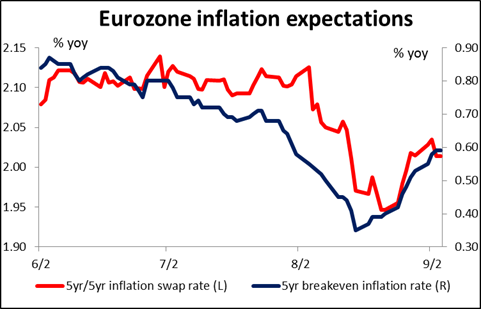

Last is the most important: the ECB. After the recent poor economic data from Euro area along with President Draghi’s comments on inflation expectations at Jackson Hole event have raised expectations that they may take some further action. Given that the Bank has hired an outside advisor to advice on a possible ABS program, I expect at least further clarification at the press conference about the likelihood of ABS purchases, in line with Draghi’s comments that the committee will “acknowledge” the change in inflation expectations. However, the situation has been complicated a bit by the fact that inflation expectations as measured by his favorite guage – the 5yr/5yr inflation swap -- have rebounded back above 2% since he spoke, which means that the Council does have some wiggle room if they need it.

As for the indicators, German factory orders for July are expected to rebound from June.

In the US, the ADP employment report one day ahead of the NFP release is expected to show that the private sector gained 220k jobs in August, slightly more than it did last month. This is in line with the market forecast of 215k private-sector jobs in the NFP figure (230k jobs total, including government). The country’s trade deficit for July is anticipated to widen a bit. The final Markit service sector PMI and the ISM non-manufacturing index both for August are also coming out. We also get the initial jobless claims for the week ended 30th of August. The ADP figure is likely to be the dominant one; a number in line with expectations or higher would suggest robust growth in jobs, which should be USD-positive.

As for the speakers, besides the ECB President Draghi press conference after the decision, Riksbank Governor Stefan Ingves also speaks after the repo rate decision. Cleveland Fed President Loretta Mester also speaks.