US outperformance means higher USD The US economy continues to outperform other major economies. The ISM index for August was expected to fall marginally, but instead powered higher to the highest level in over three years. Moreover, the headline number was supported by solid figures from new orders, production and export orders. The figures were a sharp contrast with most other countries – 15 of the 26 countries that reported on Monday saw a decline in their PMIs, including China, the UK and most of the major European countries, and only nine reported an increase (two were unchanged). The good results send Fed funds rate expectations up 6 bps in the long end and the dollar firmed against most of the currencies we track.

With interest rate expectations higher and the dollar firmer, it’s no surprise that gold was lower. With the technical looking poor too, gold seems headed lower for now. At the same time, the indications of strong US manufacturing were not enough to outweigh the indications of a slowdown elsewhere and oil prices fell sharply to the lowest in over a year. The fundamentals for oil seem poor but the technical are more mixed, making it a difficult call (see below).

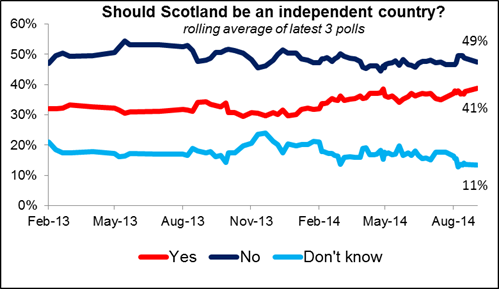

GBP was the main loser after a survey by Yougov, a British opinion research firm, showed support for Scottish independence had risen to 47% vs 53% opposed. The 6 ppt gap between the two sides is down sharply from this poll’s 14 ppt gap just two weeks ago, suggesting that as the Sep. 18th referendum draws near, more of the undecided people are making up their mind to vote “yes.” Other polls do not show quite as narrow a gap nor as high a level of support for independence, but they do indicate the same trend. Since there was no risk premium for this event at all priced into GBP, it would be reasonable to expect the market to discount the possibility a little bit and for GBP to decline further. (I wrote about this likelihood for CNBC back in July; you can see the article at https://www.cnbc.com/id/101870529 ).

Australia’s GDP rose slightly more than the market expected in Q2. It caused only a momentary spike in the currency however.

Today’s events: The main event will be the Bank of Canada policy meeting. In their last meeting, the Bank kept a neutral stance with respect to the timing and direction of the next change in the policy rate and revised their GDP growth forecast down for 2014 and 2015. We expect them to repeat themselves and remain on hold. The statement accompanying the release is most likely to reflect a dovish tone, which could weaken CAD somewhat.

As for the indicators, we get the final service-sector PMIs for August from the countries we got the manufacturing data for on Monday. As usual, the final forecasts from France, Germany and Eurozone are the same as the initial estimates, while the UK service-sector PMI is expected to have decreased slightly. Eurozone’s retail sales for July are also coming out and the forecast is for the monthly figure to drop, adding to the recent weak data coming from the bloc.

In the US, factory orders for July are forecast to have surged 11.0% mom from +1.1% mom in June. The MBA mortgage approvals for the week ended on August 29 are also coming out. Moreover, the Fed releases the Beige book report.