ECB Day The European PMIs were lower, as new orders contracted for the first time in a year and even Germany slipped into contractionary territory. Meanwhile the US ADP report once again indicated job growth over 200k. But the US ISM index disappointed (although it remains the highest in the world) and US auto sales slowed in September, following the unusually high figure for August. For some reason the markets took these fluctuations unusually hard: the S & P 500 was down 1.3%, 10-year bond yields plunged 10 bps, the long end of the Fed funds futures contracts collapsed 10 bps (13.5 bps for the September ’17 contract) and the dollar weakened against most currencies. The reaction seems extreme to me and I would expect to see it reverse at some point, particularly if tomorrow’s nonfarm payrolls beat the 215k forecast.

What is the ECB likely to do? The focus today will be the ECB Governing Council meeting. At its last meeting on Sep. 4th, the ECB announced that it would start buying asset-backed securities (ABS) and covered bonds starting in October, and that it would announce the details of these programs after its meeting today. Everyone is waiting to see those details. The three main questions are: what credit ratings will it require, what kind of underlying collateral will it accept, and how much it will buy (although Vice President Constancio has said that they will not reveal a precise figure).

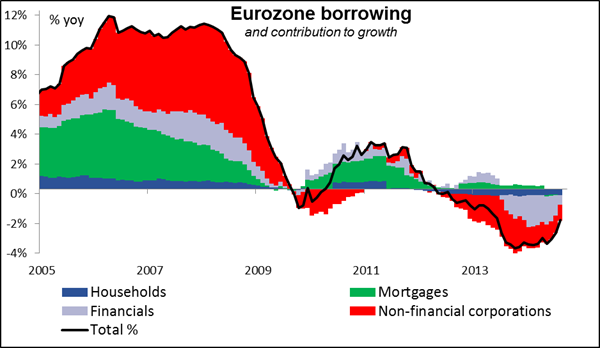

The purpose of the ECB’s intervention is to get lending going again. Bank loans account for nearly 80% of corporate loans in the Eurozone, as compared to about 50% in the US. Companies in Europe are therefore hostage to the health of the banks – which are not particularly healthy right now. Lending to non-financial companies has fallen by about EUR 600bn or 12% since peaking in Jan. 2009. Draghi and his colleagues hope to enable banks to get some of their existing loans off their books and thereby allow them to start lending again.

One obstacle is that the ECB wants to buy some of the riskier kinds of ABS, but only with a government guarantee. It’s particularly important that the ECB buy these loans to get lending to small- and medium-sized enterprises going again. However, Germany and France reportedly object to guaranteeing them as they believe it would undermine investor responsibility. There will be particular interest in whether the ECB will be able to buy Greek ABS, which are rated below investment grade. If they manage to push through such a plan, that could have a big impact on businesses in the Eurozone periphery and signal the Bank’s determination to rid the region of deflation (prices have been falling in Greece since March 2013).

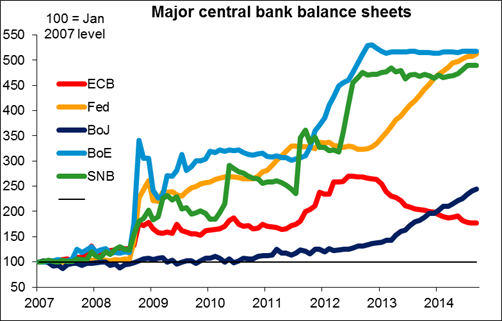

One other benefit of the program is that by buying the ABS, the ECB will be launching a kind of “private sector quantitative easing.” Draghi has said that he wants to rebuild the ECB’s balance sheet back to its 2012 levels, when it was approximately EUR 1trn larger. But if the ECB is too restricted in what it can buy, it will not be able to find enough paper to meet that target. Furthermore, the signs from the recent first round of direct long-term lending to the banks was discouragingly small. The market will be looking for signs that the ECB will eventually have to resort to a broad-based QE using sovereign bonds – definitely a negative for the euro.

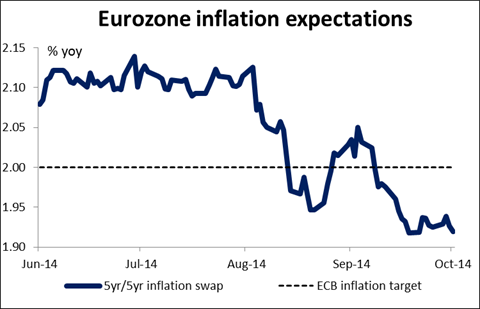

Recent news has made the search for some solution even more pressing. Since the ECB’s last meeting, the Eurozone’s inflation rate has fallen further below the ECB’s target and Draghi’s favorite gauge of expected inflation, the 5yr/5yr inflation swap rate, has declined as well. Draghi has previously said that a worsening of the medium-term inflation outlook or the unhinging of inflation expectations “would be the context for a more broad-based asset purchase program.” It’s possible therefore that even if the details of the plan remain vague, Draghi will once again drop hints about more loosening to come in an effort to raise expectations and talk the euro lower. In a recent interview he said that the ECB remains ready to “alter the size or composition of our unconventional interventions should it become necessary…” The market will be looking for some confirmation that if the ECB can’t meet its balance sheet target through ABS purchases, it will be willing to buy sovereign bonds. A specific date, perhaps the December targeted long-term refinancing operation, would make such a commitment even more powerful.

On the other hand, if he were to dismiss the recent weak data and fall in inflationary expectations as insignificant, that would be considered hawkish and would be EUR-positive. I do not expect him to do so, however.

Other events today: Separately, the Eurozone PPI for August is also due out.

From the UK, construction PMI for September is expected to decline.

In the US, we get factory orders for August and initial jobless claims for the week ended 27th of September.

Besides ECB President Draghi, we have three speakers scheduled on Thursday: Norges Bank Governor Oeystein Olsen, New York Fed President William Dudley and Atlanta Fed President Dennis Lockhart.