A new trading week in the forex market 24-28 September 2018 is staring today with the most important event being the Fed monetary policy decision. Key economic data include: US final Q2 GDP growth, personal spending and income, PCE prices, durable goods orders and new home sales and for UK the final Q2 GDP growth. For the Euro any developments about Italy which may or may not adhere to EU’s budgetary rules and for the British Pound any further news on Brexit will probably influence their trend and values relative to other major currencies. Today the economic calendar is relative light in economic news, with a focus on the German Ifo readings, which should add some volatility and increased price action to the Euro.

These are the main economic events in the forex market today, time is GMT:

European Session

Switzerland: Current Account, Germany: Ifo Business Climate, Ifo Current Expectations, Ifo Expectations, Bundesbank Wuermeling Speech, UK: CBI Industrial Trends Orders

Time: 07:00, 08:00, 10:00, 15:00

The Current Account is the amount of exports minus imports of goods and services alongside a net factor interest and dividend income and a net transfer of payments, such as foreign aid. For the economy of Switzerland, a trade surplus is positive for the Swiss Franc reflecting capital inflows and a high demand for goods and services denominated in the local currency which may result in the appreciation of the Swiss Franc versus other currencies.

The IFO readings for Germany are expected to move the Euro reflecting expectations about the current conditions and business expectations for the next six months, and the level of optimism of firms about the economic outlook. Higher than expected figures are positive and supportive for Germany, the largest economy in the Eurozone and the Euro as well anticipating future positive economic growth.

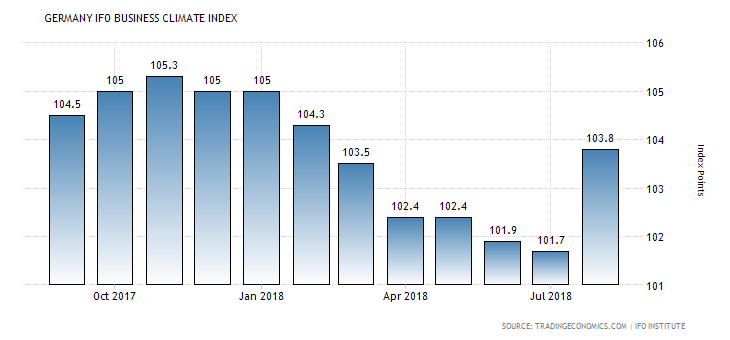

“The IFO Business Climate Index for Germany rose 2.1 points from a month earlier to 103.8 in August 2018, easily beating market expectations of 101.9. It was the highest reading since February, as the gauge of future expectations climbed 3 points to 101.2 and the current business conditions sub-index moved up 1 point to 106.4. Sentiment improved among manufacturers (up 1.8 points to 24.3), service providers (up 5.6 points to 32.3), wholesalers & retailers (up 0.1 points to 10.6), and constructors (up 2.6 points to a record 30.0).”, Source: Trading Economics.

From the above chart we note that the Ifo Business Climate Index for Germany had a downtrend from January 2018 until June 2018, and a strong rebound and increase in July 2018. The forecasts are for decreases for all three Ifo readings for the German economy. The IFO Current Conditions, IFO Business Climate and IFO Expectations are expected to decline to 106.1, 103.2 and 100.2 respectively from 106.4, 103.8 and 101.2 accordingly. As higher than expected business expectations can influence positively the economy stimulating the level of employment and capital spending, these lower figures may weigh negatively on the Euro.

The CBI Industrial Trends Orders in UK provide important opinions from senior manufacturing executives, on past and expected trends in economic indicators such as output, exports, prices, costs, investment intentions, business confidence and capacity utilization. In general, if those opinions show an optimistic outlook in the manufacturing sector, this is positive for the British Pound. A decline to 5 from 7 is expected.

American Session

US: Chicago Fed National Activity Index, Dallas Fed Manufacturing Index

Time: 12:30, 14:30

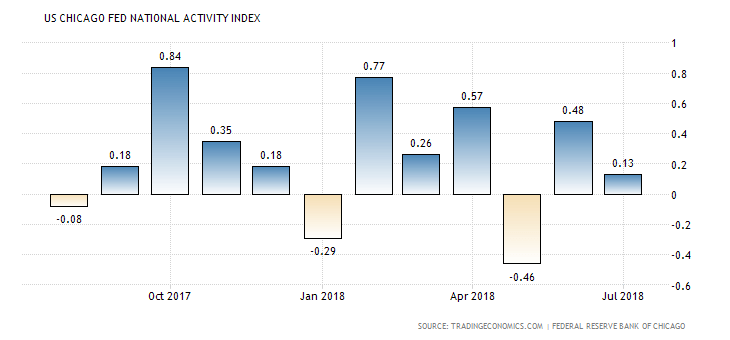

The Chicago Fed National Activity Index (CFNAI) is a monthly index designed to measure the overall economic activity and any related inflationary pressures. A higher than expected figure is positive for the US Dollar reflecting higher economic growth and increased economic activity in the broader Chicago Area.

“The Chicago Fed National Activity Index fell to 0.13 in July 2018 from an upwardly revised 0.48 in June and matching market expectations. Production-related indicators contributed +0.05 to the index (vs +0.45 in June), as industrial production edged up 0.1 percent after jumping 1 percent in June. Also, the sales, orders, and inventories category contributed of +0.03, down slightly from +0.06 in June; and the contribution of the personal consumption and housing category ticked down to –0.07 from –0.06, mainly due to a deterioration in consumption indicators. On the other hand, employment-related indicators contributed +0.12, higher than +0.03 in June. The index’s three-month moving average moved down to +0.05 in July from +0.20 in June.”, Source: Trading Economics.

The US Chicago Fed National Activity Index as seen from the above chart shows increased volatility. The forecast is for a decline to 0.02 from 0.13.

The Dallas Fed Manufacturing Index provides an assessment of the state factory activity based on economic indicators such as output, employment, orders, and prices. A higher than expected reading is positive for the US Dollar reflecting increased economic and business conditions. A marginal increase to 31.0 from 30.9 is expected for the Dallas Fed Manufacturing Index.

Asian Session

Japan: BoJ Monetary Policy Meetings

Time: 23:50

The Bank of Japan Monetary Policy Meetings review economic developments inside and outside of Japan. In general, if the BoJ minutes show a hawkish or optimistic outlook, it is considered positive for the Japanese Yen. Also, economic projections about the interest rate path and the inflation rate can move the Japanese Yen.

Trade Forex Here