By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Early in another October week, EUR/USD is consolidating at 1.0983, but may yet continue growing.

Former European Central bankers have published a memorandum on the ECB monetary policy where they attacked it and said it was “based on the wrong diagnosis and risks eroding its independence”. Former policymakers believe that in case of the Euro Area economy and the ECB, the interest rates, as a control and management tool, have become more irrelevant recently, while the risks have grown a lot. In their opinion, the longer the regulator continues its ultra-loose rates policy, the higher the probability that it will fail.

Of course, this opinion pretty much has the right to exist. It appears that the ECB was too late to respond to the inflation decline and missed the right moment to do avoid it. At the same time, it’s difficult to agree that the low rates policy won’t work, because in this case, the banking system will “reboot” itself.

Last Friday, the USA published several reports on the labor market. The Unemployment Rate wasn’t expected to change, but it dropped significantly in September, from 3.7% to 3.5%, the lowest level over the last 50 years. The Average Hourly Earnings remained unchanged, although it was expected to add 0.3% m/m, and that put the pressure on the USD. The Non-Farm Employment Change was 136K in September against the expected reading of 145K. By the way, the August number was revised upwards, up to 168K.

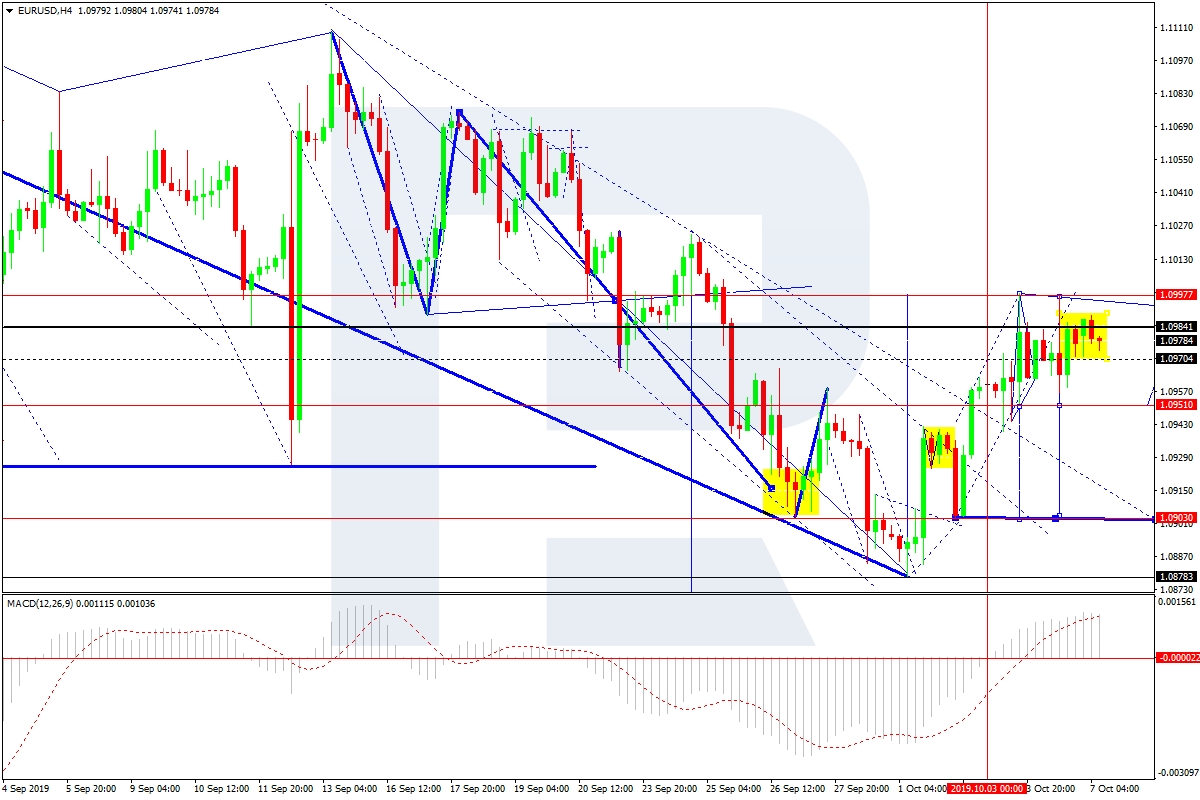

In the H4 chart, EUR/USD has completed the ascending wave, which may be considered as a correction of the previous descending wave; right now, it is trading to rebound from 1.0997 to the downside. One can see the first descending impulse along with the correction. At the moment, the pair is forming the second impulse with the target at 1.0950. after breaking this level, the price may continue trading inside the downtrend with the first target at 1.0903. However, this scenario may no longer be valid if the price steadily grows to break 1.0998. In this case, the pair may choose an alternative scenario to extend the correction towards 1.1004. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving high above 0. Basically, the line is expected to fall towards 0. Later, it may break this level and boost the decline.

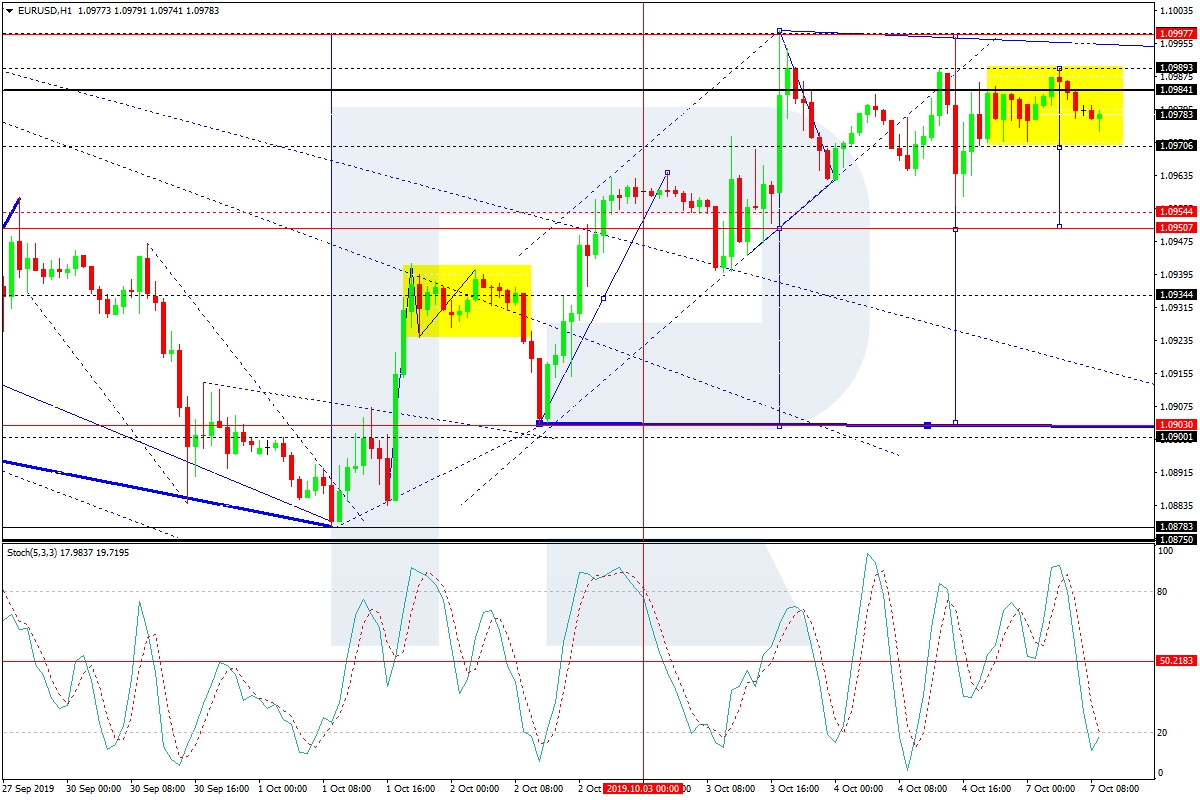

As we can see in the H1 chart, EUR/USD is consolidating above 1.0970. According to the main scenario, the price is expected to trade inside the downtrend. After breaking 1.0970, the pair may continue falling towards 1.0950. And that’s just a half of this descending wave. After a slight consolidation, the instrument may resume falling to reach 1.0903. However, this scenario may no longer be valid if the price steadily grows to break 1.0998. In this case, the instrument may choose an alternative scenario, which implies extending the ascending wave towards 1.1000. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving inside the “oversold area”, thus indicating further consolidation and growth towards 50. Still, if later the line rebounds from 50, the current downtrend may get faster.

Disclaimer

Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.