- Spiraling infections and tightening US election inject caution into markets

- Stocks tank alongside crude oil, but trim losses after stimulus comments

- FX market was in a sour mood too, but moves were much smaller

- Question is, how is the euro standing so well even as growth risks escalate?

Risk aversion deepens, but does not overwhelm

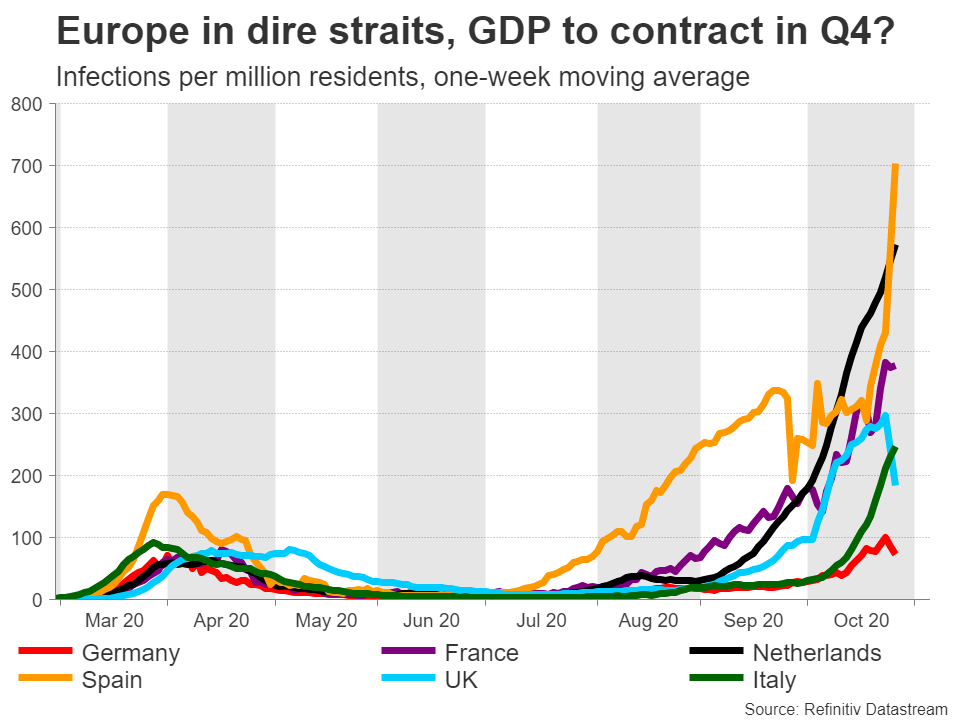

One week to go until the US election and markets are starting to wake up to the storm of risks that is threatening to send the economic recovery into reverse, as another wave of infections rampages through Europe and America. The onslaught of new cases has forced many European governments to adopt curfews, with speculation mounting for a full lockdown of major French cities soon, while the US is being ravaged by a resurgence in the West and Midwest.

Meanwhile, the US election is becoming an increasingly competitive race. The contest for the Senate in particular is almost too close to call, dimming the prospect of a sweeping Democratic victory that could deliver gigantic stimulus packages. A split Congress would imply a continuation of political gridlock, with the greatest fear being that ‘fiscal discipline’ could return as a theme next year.

While President Trump is still far behind overall, he has closed the gap enough in some battleground states to have an outside shot. Investors haven’t forgotten the shock of 2016, so any hint that he could still make a comeback is taken very seriously this time.

All this was enough for markets to push the risk-off button on Monday, with the S&P 500 sinking by 1.9% as investors reduced their risk exposure, rotating into the safety of bonds instead. Many investors are likely raising cash too, not just to de-risk, but also to capitalize on any buying opportunities that may arise around Election Day.

FX market stays composed

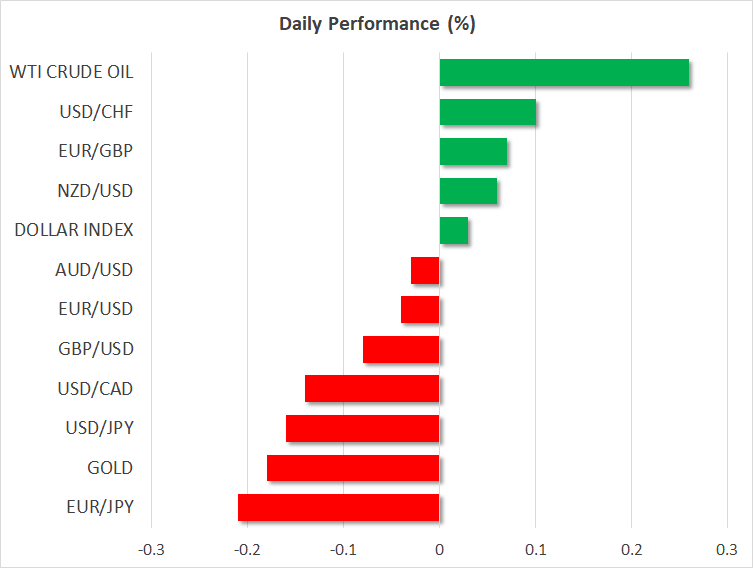

The risk aversion was felt in the currency arena as well. The dollar and the Japanese yen climbed as the mood soured, whereas the commodity-linked currencies were hit the hardest, though none of these moves was especially large.

The risk trade was helped a little by House Speaker Pelosi, who said she remains optimistic a stimulus deal can still be reached before the election. Stocks trimmed some of their losses while the dollar pushed on the brakes afterwards. While nobody expects a deal this week, as it would be politically disadvantageous for the Democrats to risk that at this stage, investors remain hopeful that an agreement has only been delayed until after the election, not entirely derailed.

How is the euro still standing?

One of the biggest oddities lately is how well the euro has held up, even as the outlook for the euro area grows darker by the day. Curfews and partial lockdowns mean that many businesses are operating at reduced capacity, consumers are turning defensive as confirmed by Google mobility data, and there is a very real risk that the economy falls back into contraction in Q4.

Meanwhile, the bloc’s core inflation rate hit a record low in September, well before infections exploded, amplifying the threat of outright deflation and putting even greater pressure on the ECB to increase its liquidity offerings soon. Despite all this, the euro has barely retreated and speculative positioning on the currency remains near record-long levels.

So what gives? One explanation is that there is no real alternative for the euro to depreciate against. The dollar is being plagued both by election and stimulus risks, the pound must deal with all the Brexit turbulence, the SNB is constantly intervening to weaken the franc, and emerging markets are riskier than ever. The yen is perhaps the only option that remains.

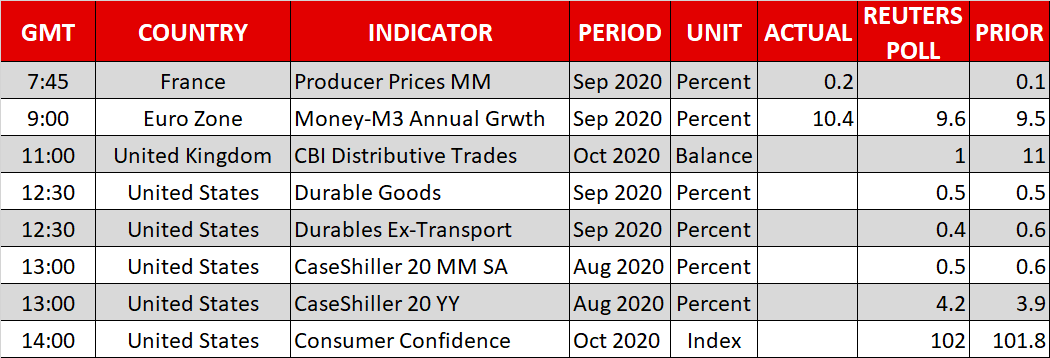

As for today, the highlight on the calendar is the US durable goods data, though markets will likely pay more attention to covid numbers and incoming polls. Meanwhile, the earnings season fires up with Microsoft and AMD reporting after Wall Street’s closing bell.