- US dollar retreats after soft consumer sentiment survey

- Chinese data disappoints too, hitting risk sentiment in Asia

- Gold comes back to life, oil ignores Afghanistan tensions

Dollar grapples with consumer uncertainty

Currency markets closed with a bang last week after an American survey showed consumer sentiment cratering in August to reach its lowest level in a decade. The stunning loss in consumer confidence raised questions about the economy’s fortunes, and consequently about whether the Fed will be able to take its foot off the accelerator soon.

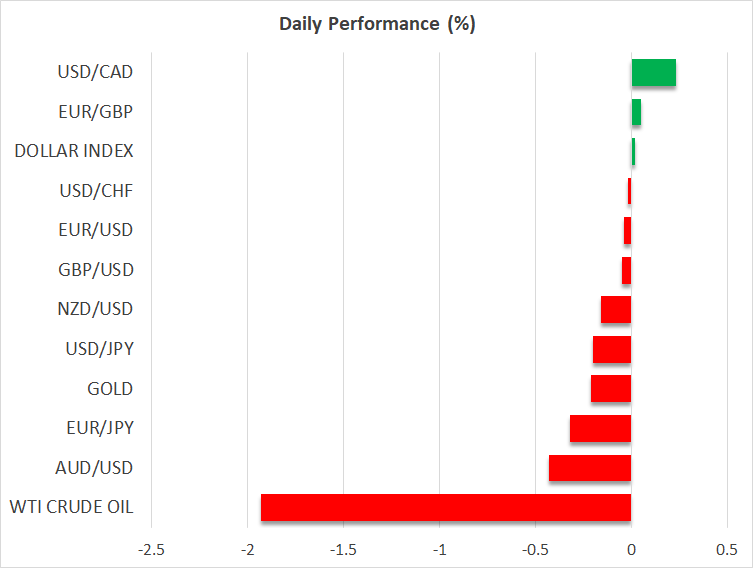

That dealt a heavy blow to the greenback, which fell in tandem with US Treasury yields. Capitalizing the most on the dollar’s troubles was the Japanese yen, which is very sensitive to changes in interest rate differentials and shines whenever foreign yields fall.

The question now is whether this foreshadows a sharp cooldown in consumer spending that hammers growth, or whether it is just survey ‘noise’ that won't really translate into hard data. As such, this elevates the importance of tomorrow’s edition of US retail sales, which will provide the next clue in this debate.

For now, this isn’t enough to derail the grand narrative that the Fed will dial back its asset purchases soon. The US economy is firing on most cylinders and Congress is working on another multi-trillion spending package. Whether tapering is announced in September or November ultimately doesn’t matter much. What matters for the dollar is that the Fed is years ahead of the ECB and the BoJ in the normalization game.

China slows down, sapping sentiment

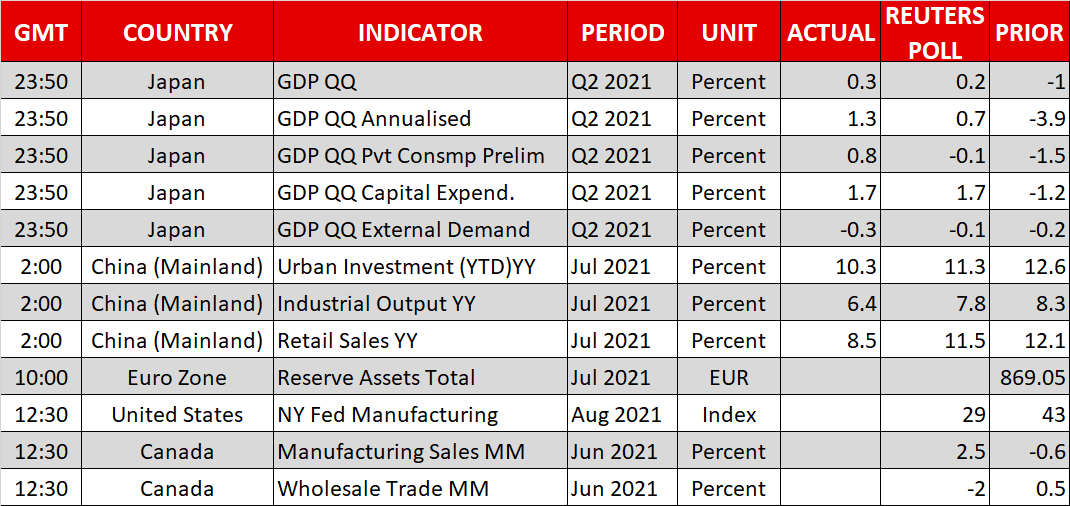

The Chinese economy is losing momentum. Industrial production, retail sales, and fixed asset investment all slowed very sharply in July as fresh virus restrictions and extreme weather events came together to suppress growth.

The disappointing report took the wind out of riskier assets early on Monday. Stock markets in Asia and Europe were a sea of red, although the losses were not very dramatic and there wasn’t any sense of panic. Wall Street didn’t escape unscathed either, with futures pointing to a slightly negative open today.

In the FX arena, it was the Australian dollar that got hit the hardest. The past few weeks have been a perfect storm for the aussie, which had to suffer strict domestic lockdowns to battle the Delta variant as iron ore prices crumbled and China started to slow down.

Oil focuses on China, gold breathes again

The debacle in Afghanistan has attracted a lot of attention lately but there has been no visible market impact. Oil prices are instead trading lower on Monday as fears around a slowdown in Asian demand overpowered hopes for supply disruptions in case the instability in Afghanistan spreads beyond its borders.

It’s not just China either. Japanese growth data just showed that the world’s third-largest economy had a solid second quarter and avoided a double-dip recession, but that optimism was quickly tempered by soaring covid infections. This wave has been Japan’s biggest by far, raising the chances for even tighter social restrictions.

Meanwhile, gold prices have staged a heroic comeback lately. The yellow metal erased the ‘mini flash crash’ to close higher overall last week, drawing power from the sudden retreat in the dollar and real yields. That’s quite impressive as it shows that dip buyers are still there, just waiting for more attractive prices.

The bull case for gold is that Congress is about to unleash more fiscal firepower and the Delta outbreak could delay the Fed from normalizing. That said, the bear case looks even stronger. Real rates are just a shade away from record lows and yet gold hasn’t been able to shine much. If real yields recover alongside the dollar as the Fed moves to taper, emboldened by more fiscal spending, it could get ugly for bullion.