- Powell gives no hints about possible action to stem selloff in Treasuries

- Dollar soars to 3-month high, shares on Wall Street tank for third straight day

- OPEC+ extends output cuts in surprise move, oil scales early 2020 highs

Treasury yields resume rally after Powell stays course

Investors hoping for fresh clues from the Fed about how it plans to ride through the storm in bond markets were left disappointed on Thursday after Chair Jerome Powell offered no new insight. Speaking at a Wall Street Journal-hosted event, Powell mostly stuck to the current script, reaffirming the Fed’s commitment to not take its foot off the gas pedal until there’s been “substantial further progress” towards its goals, which would take “some time”.

However, Powell was notably more explicit when clarifying the Fed’s guidance, saying there’s “a lot of ground to cover” before inflation rises sustainably above 2% and that lift-off would only take place once the economy has “all but fully recovered”.

But as the US Senate readies to pass a humongous $1.9 trillion stimulus package, vaccinations gather pace across the country and business surveys continue to point to a build up in inflationary pressures, investors increasingly see this lift-off point moving forward. Hence, the panic in bond markets.

Powell’s only attempt to address the steepening yield curve was when he said he would be “concerned by disorderly conditions in markets or persistent tightening in financial conditions”. However, this didn’t appear to go far enough in calming jittery markets and the selloff in Treasuries resumed, pushing the 10-year yields back above 1.50%, with the 5-year yield also gaining some traction to climb to 0.80%.

Nasdaq in correction territory, futures down again

As expected, shares on Wall Street took a dive as yields began to surge. The tech-dominated Nasdaq Composite (-2.1%) was again the biggest casualty on Thursday followed by the S&P 500 (-1.3%). E-mini futures were trading 0.3% lower at the European open today, indicating that worries about overvaluations continue to weigh on equity markets.

After yesterday’s losses, the Nasdaq Composite is now flirting with correction territory, having dropped more than 10% at one point from its all-time high above 14,000 in February. The relentless rise in government bond yields, which bring about tighter financial conditions for businesses, seems to be accelerating the rotation out of the tech sector that began when traditional stocks started to look more attractive as vaccines brought a full reopening of the economy within sight.

With so many tech favourites looking extremely pricey still, an environment of higher yields does not bode well for them.

Dollar powers ahead, yen sinks

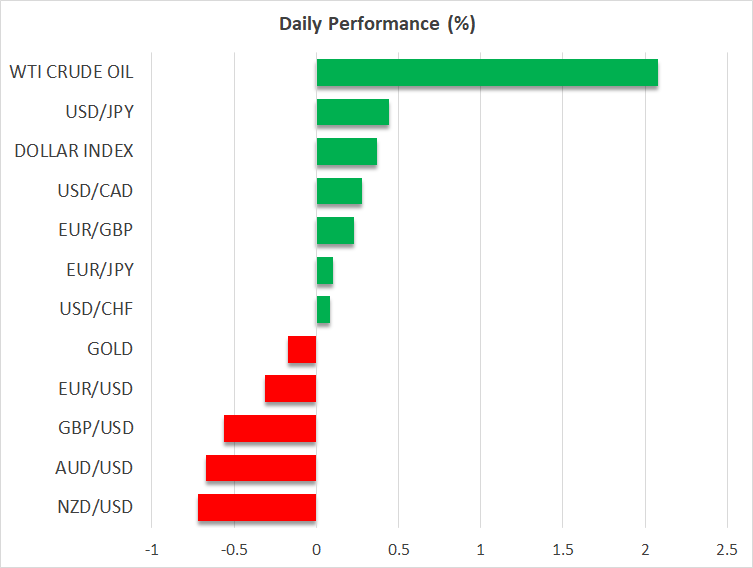

But it can only be a good thing for the US dollar, which has soared to three-month highs against a basket of currencies today. The rally in the dollar index is being driven by the greenback’s advance against the Japanese yen as the pair races towards the 109 level, having just breached 108.50, bringing the year-to-date gains to more than 5%.

The safe-haven yen has been steadily falling throughout this bout of volatility in bond and equity markets as the currency is being pressured by the widening yield spread of Japanese government bonds (JGB) with other major sovereign bonds.

The Bank of Japan’s yield curve control policy is keeping the 10-year JGB yield anchored around 0%, intervening when yields deviate more than 0.20% in either direction. However, the Bank did not need to intervene today as comments from Governor Haruhiko Kuroda that there are no plans to widen the yield band, dashing speculation it would do so at the March meeting, were enough to pull the 10-year yield sharply lower.

But it’s not just the yen that’s on the slide as the dollar is crushing all of its rivals following Powell’s remarks. The euro has plummeted below the $1.20 level and even the bull-charged pound and Australian dollar are plunging, falling below $1.3850 and $0.7700 respectively.

Resurfacing Brexit tensions between the UK and EU are adding to the pound’s woes after Britain decided to unilaterally extend the grace period for border checks for trade across the Irish sea amid fears of disruption to supplies to Northern Ireland. The EU is threatening legal action.

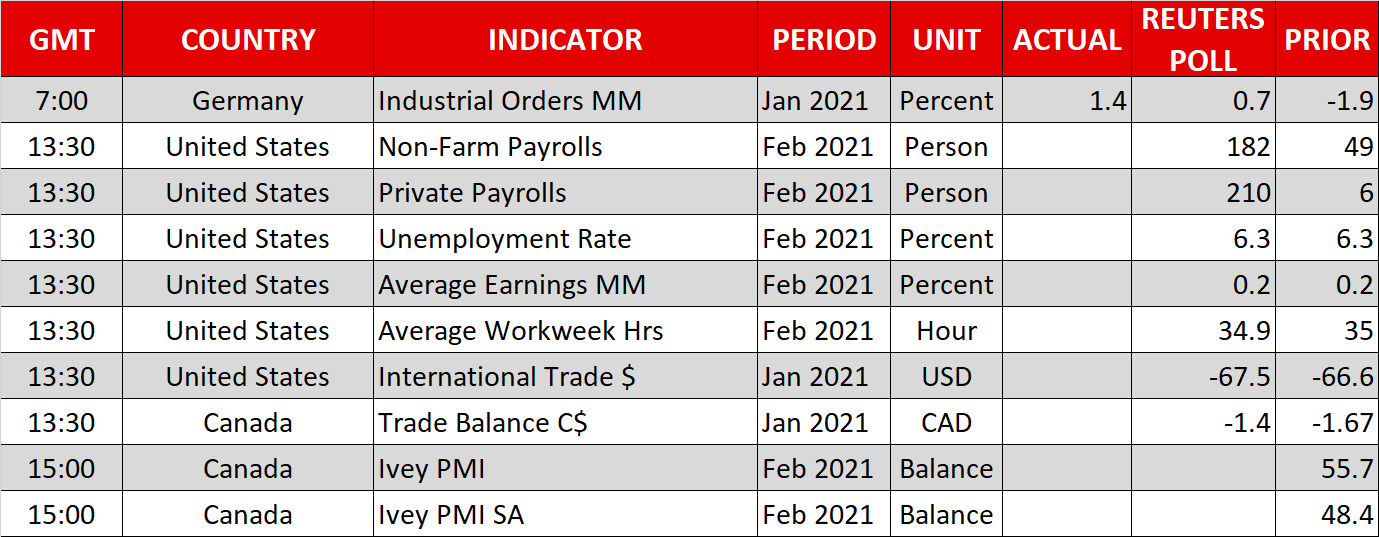

The only thing that can stand in the way of the mighty dollar right now is probably a bad jobs report. The latest nonfarm payrolls print is due at 13:30 GMT.

OPEC+ decision refuels oil rally

In commodities, gold licked its wounds near 9-month lows as the precious metal slipped below $1,700/oz on the back of the latest jump in the dollar and bond yields. However, oil prices were in a bullish mood after OPEC and its Russian-led allies decided to keep output unchanged for another month.

The decision took many by surprise as there were strong expectations that the oil alliance would raise output by 500,000 bpd. Not only there were no clear signals that an increase is imminent at the next meeting, but Saudi Arabia kept the door open to extending its voluntary cuts of 1 million barrels per day beyond April.

WTI and Brent crude were both trading about 2% higher to reach levels last seen in January 2020.